Lending

“MBA expects solid growth in purchase activity this year, as demographic drivers and the strong economy support housing demand. However, the strength in growth will be dependent on housing inventory growing more rapidly to meet demand.” — Mortgage Bankers Association Associate Vice President of Economic and Industry Forecasting Joel Kan

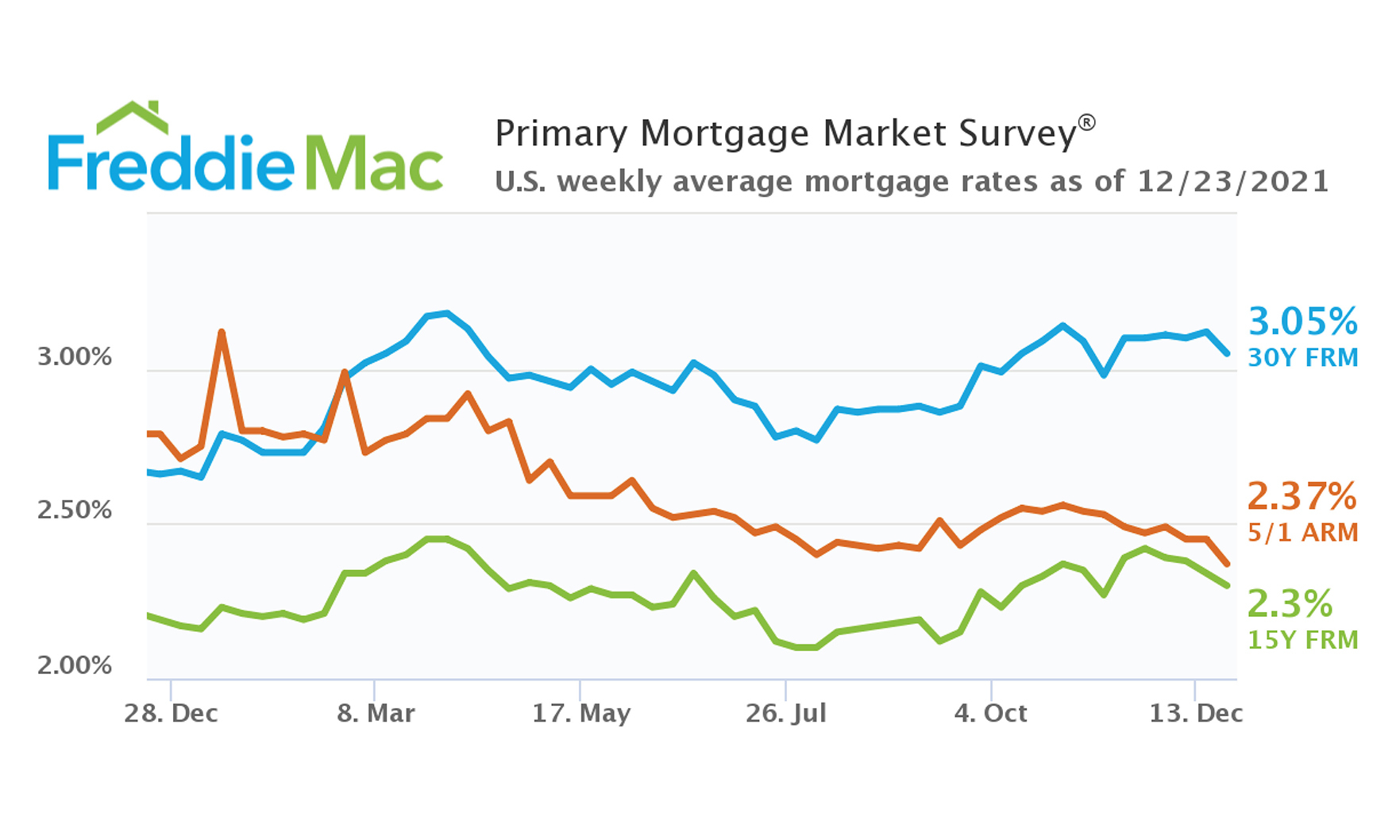

At the same time, the average 30-year fixed-rate mortgage rose to 3.33%, its highest level since April 2021, the Mortgage Bankers Association said.

Fears of an economic fallout are causing long-term U.S. mortgage rates to fall as the newest COVID-19 strain reignites worry among Americans.

LoanSnap said it used its innovative AI technology, affectionately called Nell, to close the loan in the record-breaking amount of time.

The decline in mortgage rates prompted an uptick in refinancing, with government refinances increasing more than 20% over the week, MBA associate vice president of economic and industry forecasting Joel Kan said in a press release.

The Federal Housing Finance Agency (FHFA) recently announced its 2022 conforming loan limits (CLL) for conventional loans acquired by Fannie Mae and Freddie Mac.

“Despite higher mortgage rates, purchase applications had a strong week, mostly driven by a 6% increase in conventional loan applications.” — MBA associate vice president of economic and industry forecasting Joel Kan

Banosian has funded $2 billion in total loan volume this year, becoming the company’s first loan originator to reach that milestone.

Company officials say the organizational changes will support the company’s record-setting growth.

“Mortgage rates decreased for the first time since August, as concerns about supply-chain bottlenecks, waning consumer confidence, weaker economic growth and rising inflation pushed Treasury yields lower.” — MBA associate vice president of economic and industry forecasting Joel Kan

At the same time, the increase in interest rates drove fewer borrowers to refinance their loans, according to the Mortgage Bankers Association.

The Low-Income First Time Homebuyers Act (LIFT) establishes a program to sponsor 20-year mortgages that would build equity at twice the rate of a conventional 30-year mortgage.

“The net result for housing is that these low and stable rates allow consumers more time to find the homes they are looking to purchase,” Freddie Mac Chief Economist Sam Khater said.

Two of the largest leaders in the real estate market are joining forces to form a new mortgage origination company.

On a year-over-year basis, new-home mortgage applications were down 5.9% in May, the Mortgage Bankers Association reported, citing its Builder Application Survey.

Homebuyers lucky enough to win a bidding war for a property are increasingly running headlong into appraisals that don’t match — or even come close to — the agreed sales price, leaving them with limited ways to close the sale.