Lending

At Chicago Agent’s recent Accelerate Summit, some of Chicago’s top lenders sat down to talk about ways they partner with agents to help generate business.

Almost everyone agrees that it’s time to do something about the federal conservatorship of mortgage giants Fannie Mae and Freddie Mac, and that lawmakers and regulators should handle the transition with care. But what will reform look like, when will it get done and what will it mean for lenders, real estate brokers and home buyers?

While most of the predictions about interest rates in 2019 were off by a long shot, one crucial element of the housing market in 2020 remains true: The cost of borrowing is very low, by both modern and historic measures.

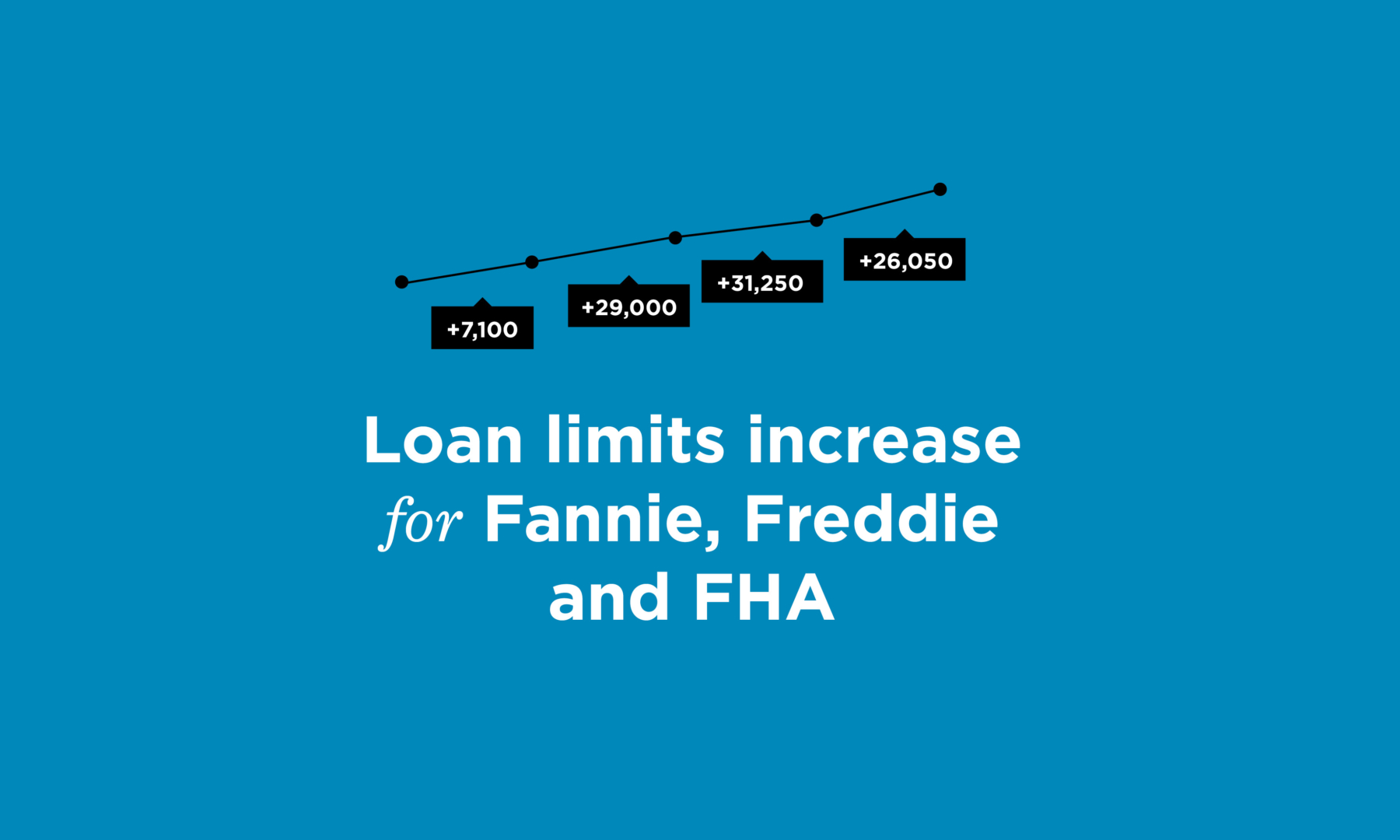

It stands to reason that, as home prices rise faster than income, buyers are going to need larger loan amounts. And for the fourth straight year, the Federal Housing Finance Agency has increased the conforming loan limits for Fannie Mae, Freddie Mac and Federal Housing Administration loans.

While there’s no guarantee that Congress or the administration will tackle GSE reform in 2020, the FHFA did announce that it will re-propose regulations on capital requirements for Fannie Mae and Freddie Mac sometime in the next year as a clear move toward the end of conservatorship.

It’s important for real estate professionals to understand how unique the lending picture is in America because of Fannie Mae and Freddie Mac and how regulators and lawmakers are proposing to change the situation.

Cash-strapped Generation Z and millennial veterans are taking advantage of VA loans that allow them to purchase with $0 down payment, no mortgage insurance, flexible credit guidelines and the industry’s lowest average interest rates.

But beware of the busy times: Customer satisfaction rates drop when loan volume increases.

HUD has loosened its rules regarding FHA loans for condos. Learn what that means for your clients.

Nontraditional couples have been going in on big purchases together forever. But unmarried duos going in on a property purchase together is a rapidly growing trend. What does this mean for agents?

There are many misconceptions about the simplicity of the process of separating out a home loan. Learn why executing a quitclaim deed may not be the only thing your clients need to do.

Brokers share tips for working with unmarried buyers, as well as their stories of going through the experience themselves — for better or for worse.

Whether it’s a group of friends investing in a multi-unit building or a couple that sees no need to tie the knot before buying a home together, agents and buyers have plenty of reason to understand the distinctions between different types of joint ownership structures.

Mortgage lenders and developers regularly find themselves working with a team of agents or brokers, which comes with its own advantages and common issues.

Two new policies in the works have the potential to reshape the way homebuyers access credit through programs backed by the U.S. government.

This summer, the mortgage industry has good news for veterans in high-cost real estate markets thanks to the Blue Water Navy Vietnam Veterans Act, recently signed into law. But the bill was nearly bad news for those interested in VA loans, as previous versions would have raised VA loan fees.