The frenzied rush to market from historically low interest rates is over. Long-term mortgage loans hover in the 6% range, signaling a return to more ordinary times for lenders, agents and buyers. Rate buydown products and ARMs, which may not have come up much the past few years, are once again part of the mortgage conversation.

The option to refinance later has kept buyers in the market, and those buyers can now focus on choosing homes that speak to their hopes and dreams. So, as the market recalibrates, lenders are sharing the most effective ways to bring buyers back to the transaction table and prepare them to sign on the dotted line.

Lenders and agents work in tandem

Every week, Andrew Tisler, a senior home lending advisor with Chase Bank, sends his agent partners a newsletter containing current rates so they are fully educated and up to speed for clients. He also co-hosts regular homebuyer seminars with agents.

“We have a partnership in terms of helping the buyer figure out what their budget is and what options they have from a price standpoint,” Tisler said. “It’s important to work closely together to help determine the right sweet spot for buyers.”

That sweet spot can be found using different product offerings. A popular one is the rate buydown. A seller-paid credit to incentivize buyers to purchase a home, a rate buydown allows for a lower rate the first couple of years without an adjustable rate, explained John Moony, senior vice president, mortgage lending, at Guaranteed Rate Affinity. For example, if today’s rate is 6.5%, using a 2-1 buydown, you start year one at 4.5%, year two at 5.5% and year three and beyond at 6.5%.

“It’s a credit the seller offers that pays the difference of that lower rate in the first couple of years,” said Moony, noting developers used it 20-plus years ago to entice buyers to purchase the few remaining homes in a development. “As long as the seller nets what they want on the house, they can build it into the price. We’re actually seeing a lot of really sharp real estate agents put ‘the seller is willing to negotiate a buydown for the buyer’ in their listings.”

For those looking to stay in their home for more than five years, Tisler says the rate buydown is a great option. In many cases, buyers will recoup the costs much sooner. Certainly, he believes it has been an important vehicle to help buyers into a more affordable payment and bring them back to the transaction table.

Tisler is also seeing a lot of sellers willing to pay closing costs and provide incentives to buyers, increasing the popularity of the rate buydown product. “For me, it’s important to help clients calculate what the break-even points are, why it’s a good idea to do a rate buydown and what the client is thinking about the home in the long term,” he said.

Moony also highlights the potential savings with specific types of adjustable-rate mortgages (ARMs): a fixed rate for a set period of time before it becomes a variable rate. However, ARMs are still somewhat stigmatized based on the market corrections of 2008. “It’s unfortunate, because in the right circumstance, the ARMS are a very useful product,” he said. Market indications seem to show that rates will come down in the next 12 to 18 months, Moony said. For clients who will want to refinance at some point anyway, he suggests setting up an ARM for the next five to seven years.

Still, Tisler emphasizes that many buyers understand that they can buy now and refinance when rates drop. It’s a welcome change to see rates hold steady, he says, even if it’s a higher range. One exercise he does with clients is to compare the cost of renting to buying. Regardless of higher interest rates, he’s able to prove that it’s still a lot cheaper to buy, and buy now.

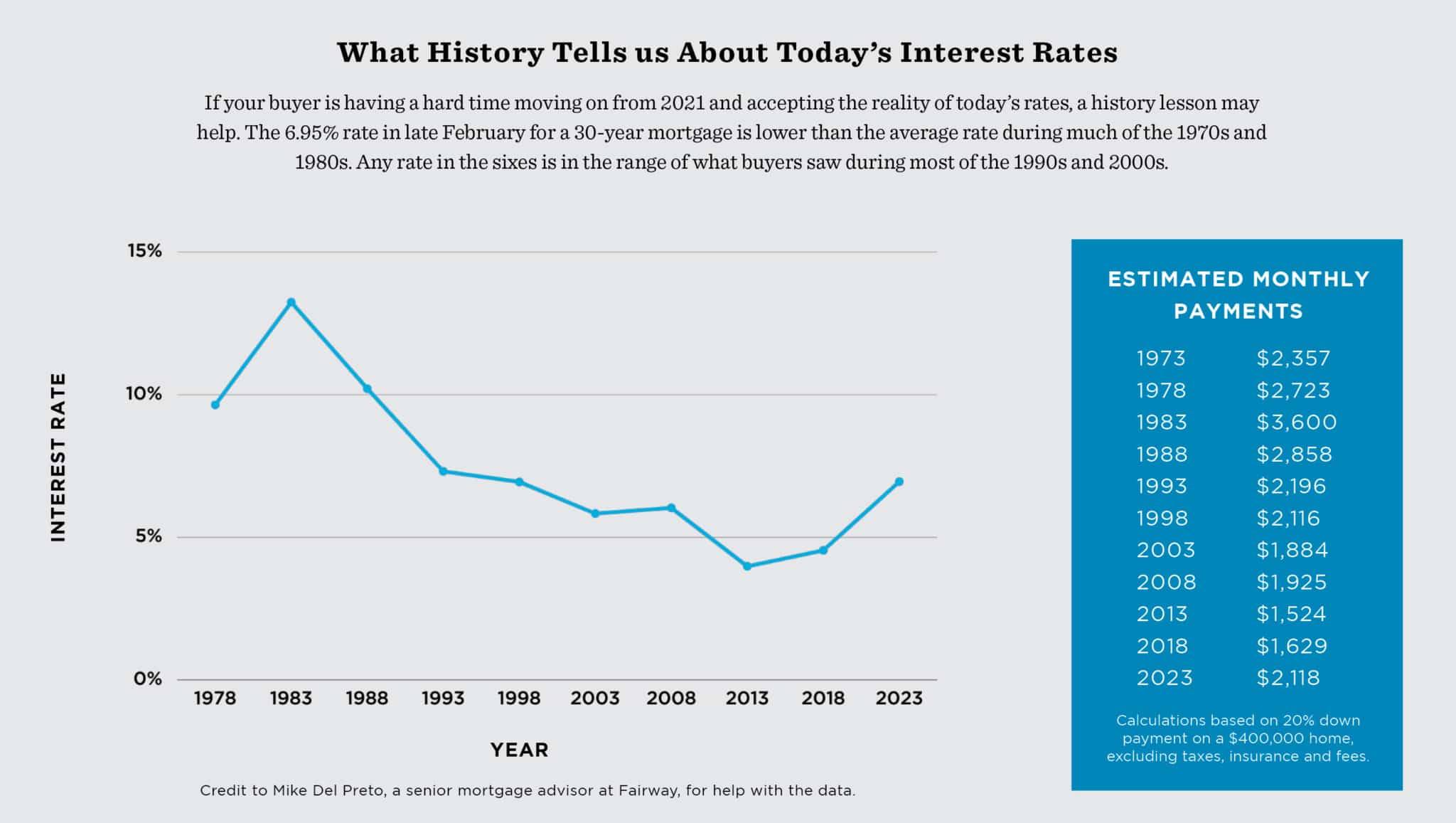

A look back in history

The return of first-time homebuyers

Moony has watched first-time homebuyers take a bigger slice of the market in 2023 than they did at the end of last year. “I think the sticker shock of rising rates in 2022 is over, and buyers understand rates are higher now but on a downward slope going into 2023,” he said. “Every 1% difference in interest rate makes a 10% impact on affordability. As an example, the monthly payment at 7% for $500,000 is nearly identical to a payment at 6% for $550,000.” This can mean an additional bedroom or otherwise larger home, especially for first-time buyers. Tisler is also seeing more first-time buyer loan programs with lower rates enter the market.

Kelly J. Price, senior mortgage consultant with Wintrust Mortgage, said first-time buyers can also benefit from grants through the Illinois Housing Development Authority. “Interest rates paired with grant programs are beating the market now,” she said. “The homebuyer is able to secure a 30-year fixed debt without paying points at interest rates in the fives and receive a grant for $6,000 to $10,000 toward down payment or closing costs assistance.”

Although first-time homebuyers are interest-rate-sensitive, Price said they need to consider other factors that go into the overall cost of a home: property taxes and, if it’s a condo, assessments and special assessments like deferred maintenance.

“Take any main street that runs through multiple towns and take your price point — the same houses are going to vary a lot based on what you pay for your property taxes,” Price said. Nonetheless, buyers are more financially savvy now than they were during the pandemic. “They’re not asking me what’s the maximum I can do for them; they’re asking me, ‘What is the maximum I can get for the money? This is my limit and budget.’ By and large, people are being more cautious and taking their time.”

Tips to get to closing faster

To get to closing faster, Tisler advises agents to send buyers to meet with lenders early in the process. “The earlier we can help them determine their budget and get them preapproved, the more prepared they’ll be as a buyer. The more successful the transaction, the more quickly they can close,” he said.

Price said that to avoid delays at closing, agents should update lenders on any contract changes, such as those related to contingencies, closing date, second earnest money payments or seller closing cost credits. Even though the Realtor is considered an advisor, she suggests they have clients contact lenders directly to help them understand the shifting interest rates and answer related questions.

“Make sure they understand there’s going to be fluctuation in rates. Focus on the price and what they’re going to buy and whether or not they can afford the worst-case scenario rate,” Price said. “What goes up hard and fast will come back down. If they make a decision based on the property and not on the rate, they’ll be happier in the long run, and there will be a lot less people with buyer’s remorse.”

A changing suburban and city landscape

While many homeowners have locked in low rates for the long term and don’t plan to move anytime soon, low inventory continues to plague the suburbs. The city, on the other hand, boasts more supply because urban dwellers tend to move more frequently. Even so, the attributes of a hot market remain the same in both places: good schools, neighborhood feel, easy access to trains and ample space for spending more time at home — working, exercising and entertaining.

Tisler offered some of the most popular suburban options that meet these criteria: Wilmette, Winnetka and Glencoe on the North Shore; Arlington Heights, Des Plaines and Mount Prospect in the northwestern suburbs; and Hinsdale, Clarendon Hills and Naperville in the western suburbs, among others.

In the city, embracing affordable options is increasingly necessary. Price is hopeful Realtors will help buyers see the value in buying $700,000-to-$1 million town homes in the same community where condos are priced from $200,000 to $300,000. She believes agents can help change the mindset of some buyers from “Why should I buy this $1 million town home if I live next to Section 8 housing?” to understanding that it’s key for those who work in the neighborhood to also live there. Too often, teachers, police officers and other public servants we rely on each day are priced out.

Moony said the Lincoln Park, Lakeview, Roscoe Village and North Center neighborhoods are still hot, though other areas present fresh housing options. He pointed out single-family new construction in Avondale and Old Irving Park, plus new multifamily buildings in Pilsen and the West Loop. “We’re seeing the appreciation values there as a result,” Moony said.

Expert sources

John Moony

Senior Vice President, Mortgage Lending

Guaranteed Rate Affinity

Kelly J. Price

Senior Mortgage Consultant

Wintrust Mortgage

Andrew Tisler

Senior Home Lending Advisor

Chase