Chicago will likely increase its property taxes on homeowners – how will it impact real estate?

Chicago Mayor Rahm Emanuel has made a $544 million property tax hike the cornerstone of his proposed 2016 budget, with the bulk of the increase going towards the city’s chronically underfunded public pensions.

Since Emanuel’s announcement of the tax plan, opinions have been divided sharply along two viewpoints: one argues that the city’s economy is strong enough to withstand the tax increase, which is necessary for the city’s financial solvency; in contrast, the other warns that such increases will create unsustainable burdens on homeowners and businesses alike, and that Chicago will inevitably follow Detroit’s unfortunate path.

Amidst the political debate, World Business Chicago – a public-private partnership between the city and the business community that guides Chicago’s business climate – commissioned a detailed analysis of Emanuel’s tax plan from the the audit, tax and advisory firm KPMG LLP, and the results of the analysis are quite intriguing.

Just How Bad are Chicago’s Taxes?

KPMG’s report assumed that Chicago’s property tax rates would increase to 7.98 percent, the necessary hike to generate an additional $500 million in revenue. Here were its main findings:

•For a hypothetical single person making $50,000 a year, the increase would bring a property tax bill of $2,146. That is higher than New York’s $1,724 and Los Angeles’ $1,743, but still behind Dallas’ $3,292 and Milwaukee’s $4,308.

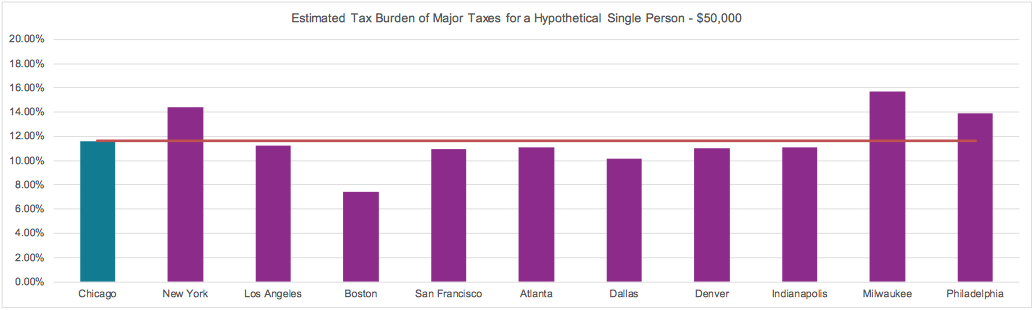

•Furthermore, even with the the higher property tax bill, Chicago’s overall tax burden on that hypothetical person would be less than New York’s, Milwaukee’s and Philadelphia’s; furthermore, with the exception of Boston, the burden would be only marginally higher than such areas as Atlanta, Denver, and Indianapolis. Here is a graph KPMG included of that breakdown (click on the image for a larger version):

•Other major cities notwithstanding, Chicago’s tax burden would still be substantially lower than its surrounding suburbs. For instance, in Evanston, Glen Ellyn, Highland Park, Naperville, Orland Park, Rosemont and Schaumburg, property taxes are at least $1,000 higher for that same hypothetical person, while in Aurora and Joliet, property taxes are at least $2,300 higher. Similarly, as this graph demonstrates, the overall tax burden would also be higher:

•KPMG ran the numbers for a number of different scenarios, including different income levels for individuals, couples and even households. Across each spectrum, the end result was basically the same – New York, Milwaukee, and Philadelphia had higher overall tax burdens, with Los Angeles, Atlanta and San Francisco not far behind. Similarly, suburban tax burdens all remained higher than in the city.

Complicating Developments in Chicago Taxes

The overall takeaway from KPMG’s report is clear. Although Emanuel’s budget would place Chicago’s property tax burden above several other large metro areas, the city’s overall tax burden would be largely in line with national averages – and compared with the largest suburbs in Cook and the collar counties, the city’s tax burden is still markedly lower.

Chicago’s budget process, however, is anything but static, and new developments have suggested that KPMG’s report is hardly the final word. Greg Hinz of Crain’s Chicago Business recently reported that while Emanuel has proposed a $544 million property tax hike, he is also advocating an expansion of the Illinois homeowners exemption that would effectively lower property taxes for city homeowners with properties valued at $250,000 or less (nearly 290,000 homeowners total).

On one hand, such an exemption appears to be good for real estate. After all, if homeowners along Chicago’s active Bungalow Belt see their property tax bills decline, Chicago’s working class will have more disposable income and more savings; the mass exodus that naysayers fear, therefore, will not materialize, and the city’s housing market will continue to progress. But on the other hand is Hinz’ argument – if 290,000 homeowners see their property taxes decline, that means that the remaining 194,000 homes in the city (and all of the roughly 95,000 commercial properties) will see their property taxes rise, and will account for the mayor’s increase.

Below, we’ve included a map from KIG Analytics that maps out what sections of the city will see property tax increases (click on the image for full size):

In the meantime, a vote is not expected on the budget until Oct. 28, so expect more developments and analyses until then.

Creative Commons 3.0: Silverstone1, http://commons.wikimedia.org/wiki/File:Summer_2006_0882.jpg