Current Market Data

Brutalist style and sensory gardens may seem at odds — but they are both hot home design trends that will rule 2024. At least, according to new predictions from Zillow.

A 15% rise in applications for adjustable-rate mortgages drove overall mortgage applications higher in the most recent weekly survey.

New home listings are still on the rise, despite mortgage rates hitting the highest level in more than 20 years. And those high mortgage rates are pushing monthly housing payments higher than they’ve ever been.

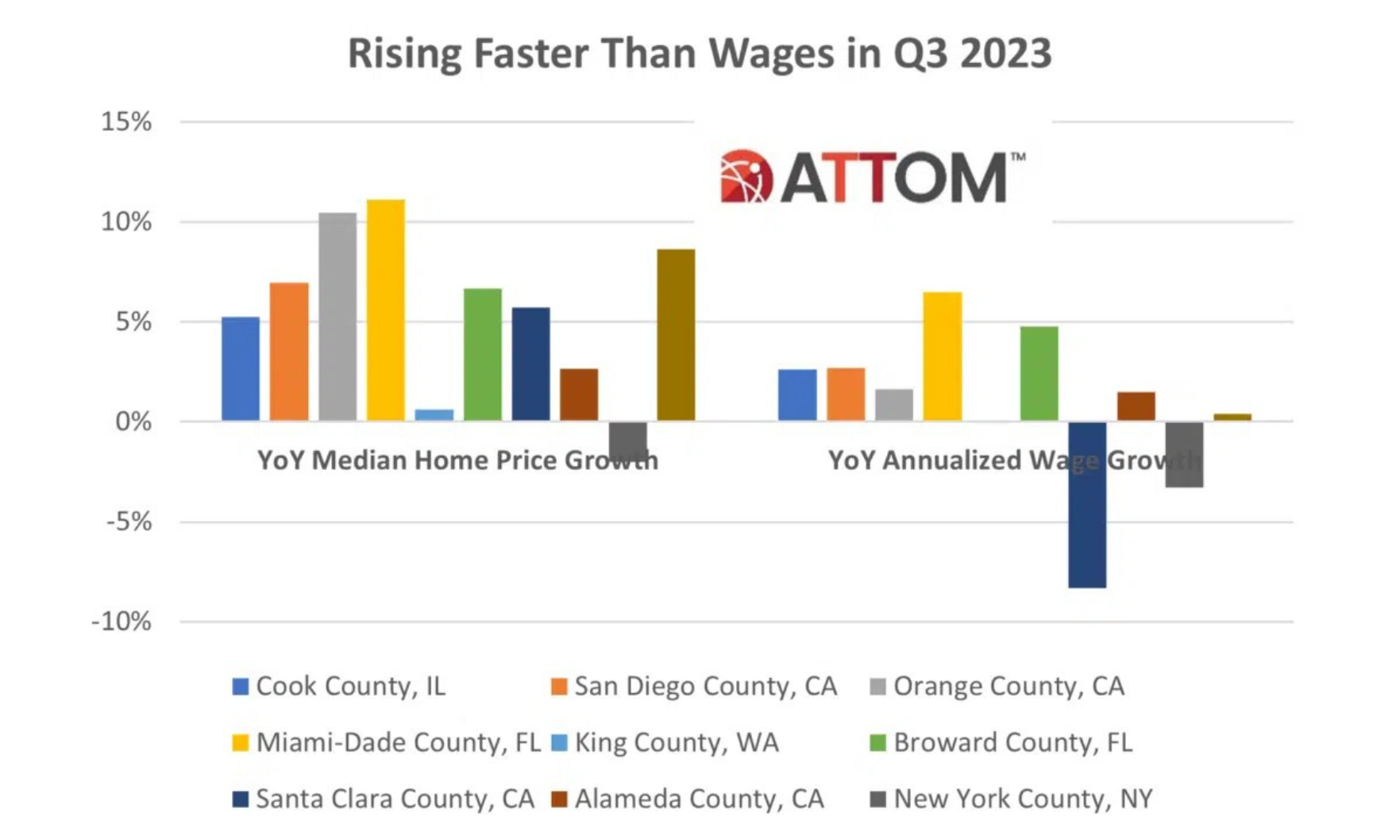

Housing affordability has worsened in many parts of the country as wages fail to grow at the same pace as home prices.

Regionally, pending sales were down across the board on both a monthly and an annual basis, the National Association of REALTORS® said.

Among the top upgrades: large showers.

Total housing inventory at the end of August was 1.11 million units, up 3.7% from July but down 14.6% on a year-over-year basis, the National Association of REALTORS® said.

Canceled home-sales contracts hit their highest rate in almost a year as skittish homebuyers blanche at mortgage rates that are the highest they’ve been in more than 20 years.

A rise in new listings is finally giving potential homebuyers options as the summer market winds down.

Sidelined homebuyers can breathe a sigh of relief. According to Realtor.com, the best week of the year to buy a home is still ahead of us.

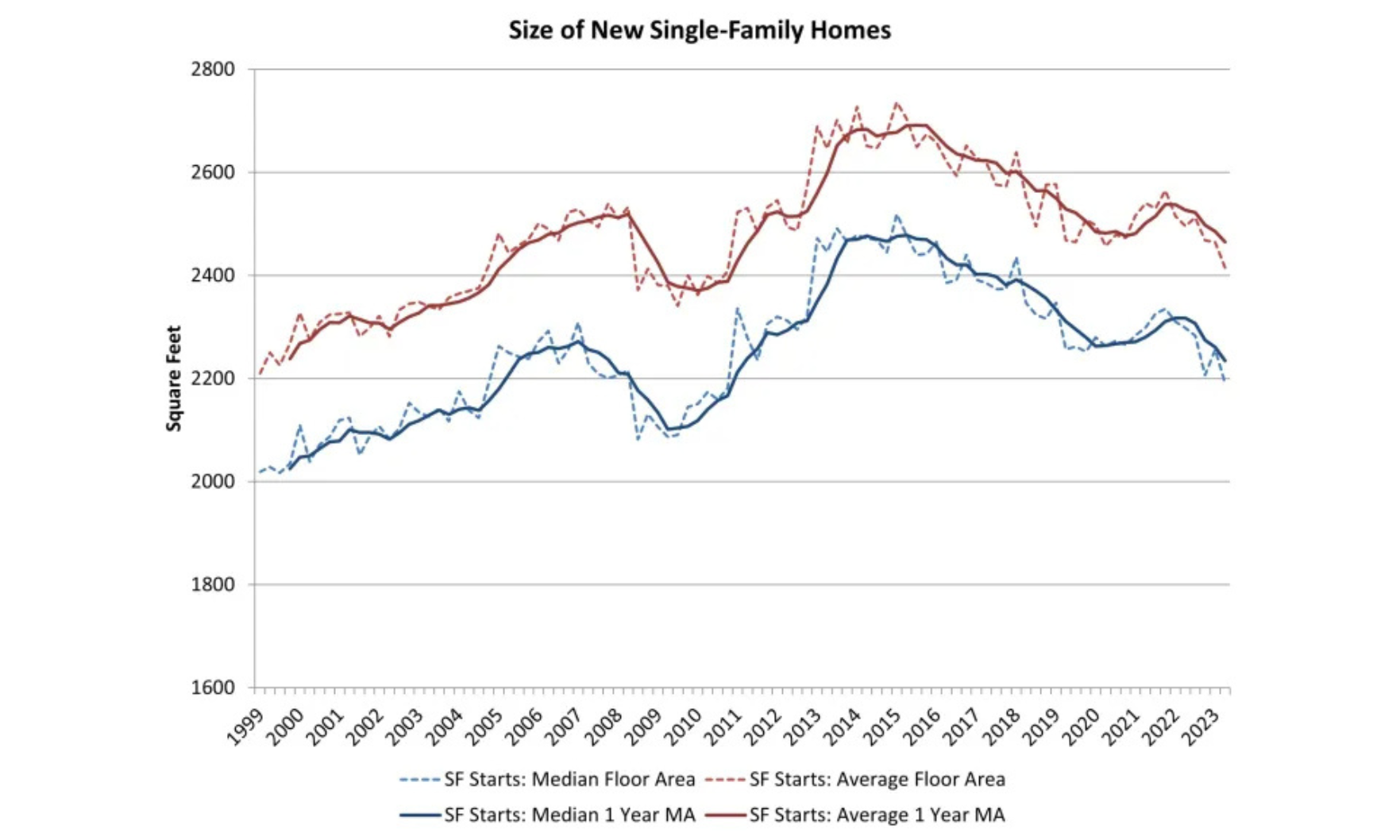

The median area for a new single-family home fell to 2,191 square feet in the second quarter — the lowest recorded size since 2010.

CoreLogic expects prices to continue to grow through next year, albeit at a more traditional pace than in the height of the pandemic.

Those looking to buy a house will be paying a premium as inventory continues to be an issue.

Eighteen percent of millennials — approximately one in five — believe they will never become a homeowner, according to a recent survey from Redfin.

Pending transactions were in negative territory for most of this year, so the recent increases could bode well for future activity.

A fifth consecutive month of increases in the S&P CoreLogic Case-Shiller U.S. National Home Price Index suggests the housing market recovery that began earlier this year is likely to continue.