In a report released today, Cook County Assessor Fritz Kaegi announced his office would begin making property value reductions to real estate in the south and west suburbs as a result of the economic implications of the coronavirus pandemic.

The report noted that unemployment and property values do not move up and down in tandem, but they are closely correlated. “These economic and market effects can have corresponding effects on real property values,” the report noted. “The assessor determined that property values for 2020 should, to the extent reasonable and practicable, reflect the real estate market effects of COVID-19.”

Part of the reason for the action was because the assessor anticipated that many owners would likely appeal their property value assessments anyway, but that waiting for them to do so would create an uneven playing field.

“Relying on the appeal system to correct for COVID-19’s effects could create an inequitable tax burden borne by property owners who do not have the resources or access to file an appeal, particularly during a health-related pandemic,” the report noted. Instead, the assessor will be “treating all property owners as if they formally appealed their 2020 assessments based on COVID-19’s impact on their property value.”

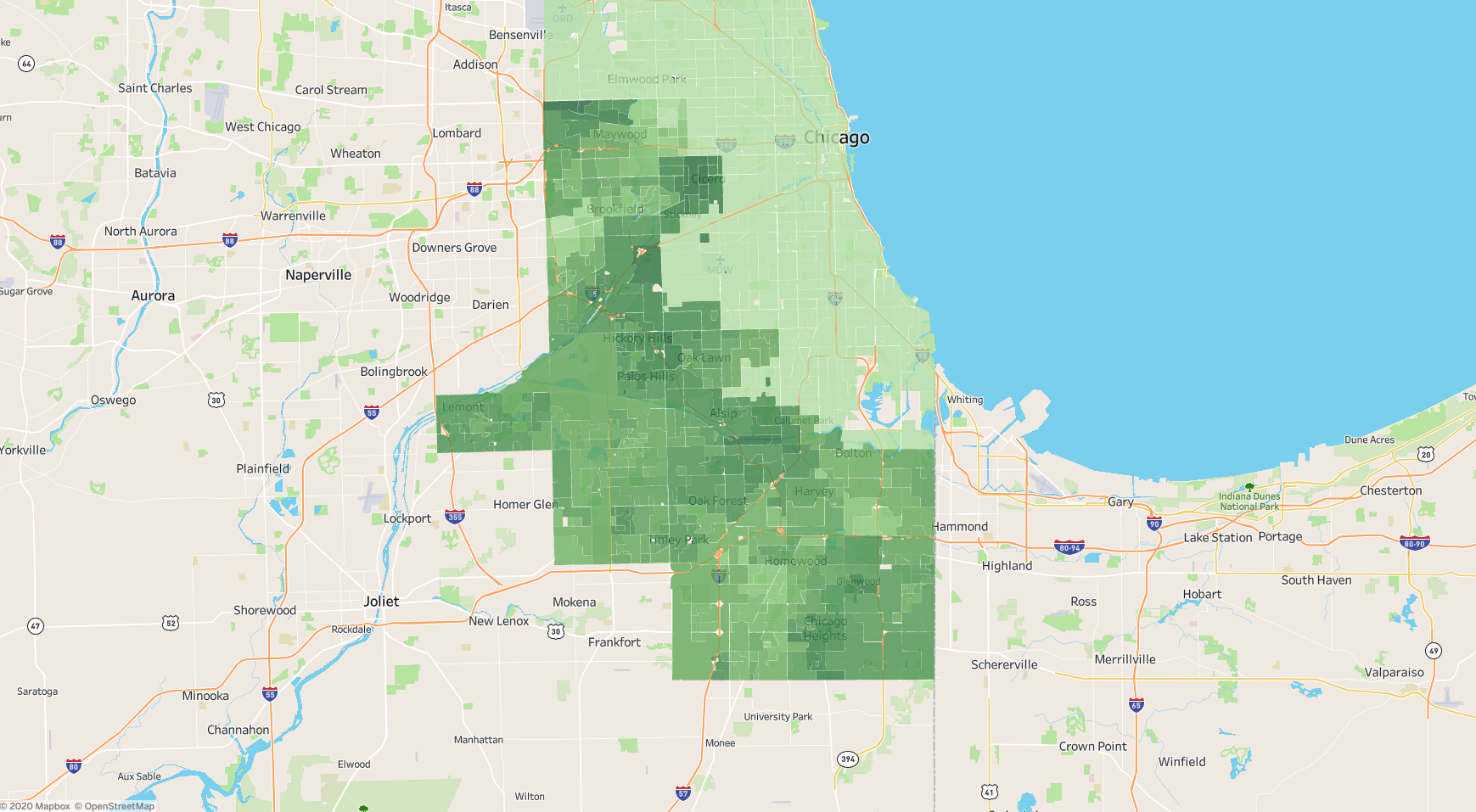

The changes won’t all be determined at once, however. The reason the reassessment will begin in the communities at the southern and western edges of the city is because the office was already in the midst of reassessing values there when the pandemic was declared (see below for interactive map of the adjustments announced today).

Due to the mid-stream nature of the interruption, different property owners will see different communications from the office. Pre-COVID-19 initial values had already been mailed to homeowners in Calumet, Oak Park, Palos, River Forest and Riverside, but they’ll be getting updates with adjusted values. For those in other townships — including Berwyn, Bloom, Bremen, Cicero, Lemont, Lyons, Orland, Proviso, Rich, Stickney, Thornton and Worth — mailed reassessment notices will reflect the COVID-19 adjusted values. They’ll also be posted on the assessor’s website.

The report noted that the office will release a similar roundup dedicated to the north suburbs and city of Chicago, though it did not offer any specific timeframe.

The assessor’s office also made different reductions in estimated values depending upon the type of property. For residential properties, the assumption is that “areas with the largest increases in unemployment will experience the largest declines in home values.”

Single-family homes and condos will receive reductions between 8% and 12.2%. For multifamily buildings, that reduction will run between 10% and 15.2%. Because the impact on commercial buildings varies so much, the office created a range of adjustments to capitalization rates ranging from 0 (for grocery stores, for example) to 200 (for restaurants).

These reductions will be applied to the 2020 tax year. For Cook County taxpayers, the new 2020 property values will impact their second installment property tax bills issued in the summer of 2021.

The office used data from the Case-Shiller Home Price Index during the last recession as well as changes in the price of real estate investment trusts over the last three months to get an idea of how the unemployment rate will impact home values. They also interviewed analysts at the The Institute for Housing Studies at DePaul University. More about the methodology behind the reductions can be found in the report. In a bid to live up to Kaegi’s consistent pledge for more transparency in the assessor’s office, the report also includes a link to a repository of data, code, and technical documentation used in the analysis.