During buyer meetings, I always say, “Let’s work backwards” when we discuss a client’s target purchase price. Rather than fixating on a specific price point, it’s important for clients to understand all fees that come with buying a home. Together, we figure out a realistic monthly payment, and work backwards to determine the right price point. Especially in our market, with assessments and taxes varying so vastly for each property, I explain to clients everything to expect in their monthly payment including their mortgage, property taxes, assessments, mortgage insurance and all other costs.

I handwrite out all of the payments with my clients. I pull up a property in their desired neighborhood and do the calculations the old fashioned way. Most real estate agents say, “I have my clients call a lender.” Before my clients call a lender, I provide them with an overview of what to expect, so when the conversation occurs, they are familiar with the acronyms DTI, PMI and LTV. By the time that we finish our first meeting, the part of the process that can be the scariest for buyers is not a concern, because they fully understand it.

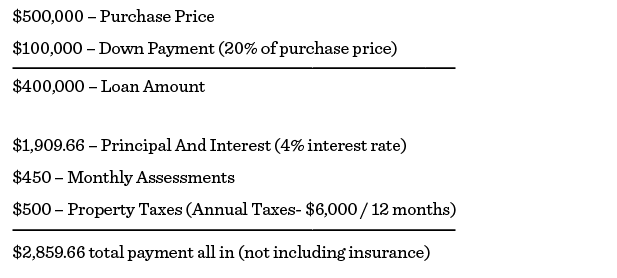

Here is how I write out payments with my clients:

After breaking down the payment, I explain the tax benefits of purchasing, because homeowners can reduce their taxable income by the amount they pay in annual interest and property taxes. Most first-time buyers are taking the standard deduction on their tax return, so I show them the amount that they will receive back at tax time. Many buyers are not aware of this, and when I show them that their tax return can cover their annual property tax bill, they realize the value in purchasing.

For instance, after the first 12 months of payments, the numbers may work out like this:

A client could reduce their taxable income by that amount, and assuming a 28 percent tax bracket, their approximate tax savings is $6,124. In this situation, their savings exceed the entire annual property tax bill.

I am not a loan officer or an accountant; however, being knowledgeable on those topics makes me more valuable to my clients. The pride of ownership, the upside of potential appreciation and building equity are all reasons to purchase. As I walk clients through their payments, they see even more benefits of homeownership. Learn this and your business will grow.

Josh Weinberg co-founded Weinberg Choi Realty in 2007 after working for PulteGroup, a Fortune 500 homebuilder. Weinberg Choi Realty has ranked in the Top 1 percent Top Producer Teams in 2013, 2014, and 2015 by The Chicago Association of Realtors and has been featured in Chicago Agent magazine’s ‘Who’s Who’ in 2013, 2014 and 2015. Outside of work, Josh teaches a real estate course at CAR’s Realtors Real Estate School. He has his Accredited Buyer’s Representative designation, and he has appeared on HGTV’s “House Hunters” and “House Hunters Renovation.” Josh is actively involved in his community through his company’s monthly donation and volunteering initiative called 365 Days of Giving which benefits organizations like Habitat for Humanity, the Ronald McDonald House, Lincoln Park Community Shelter and several other Chicago-based charities. Josh resides in the Lincoln Park neighborhood with his wife, son and dog, Yogi.

I’m very proud of your success and accomplishments.

$400,000x.04= $16,000 per Year divided by 12 months=$1333.33 PI

How dd you get $1909.66 what am I missing. please respond ASAP

Thank you

Maria Chavez-Real Estate Broker

Hi Maria, that is a great question! The $1333.33 amount that was calculated would be for an interest-only loan. The principal and interest payment is $1909.66.