Lost in Translation

As if geographical and transactional translations were not enough for relocation agents to grapple with, there are also cultural, linguistic and financial issues, as well, and the bevy of peculiarities and challenges that such situations can inspire.

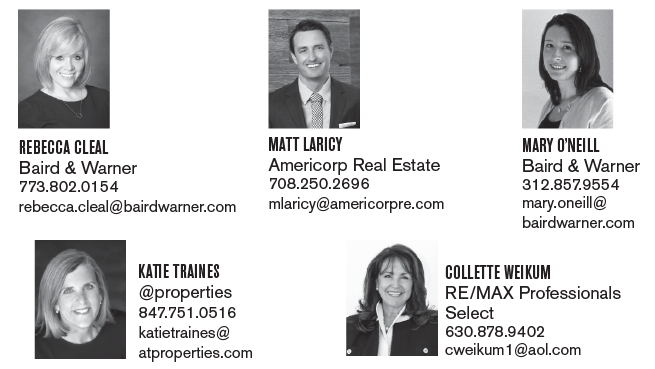

The solution, Laricy says, is to relate to international clients culturally, and to build rapport with them through knowledge of the economic trends in their home country.

“If I’m able to relate and talk about their home country, I’m able to make them feel at home outside of home,” Laricy says. “Picking up on their local lingo, and knowing little tidbits about their culture, also resonates. Knowing how real estate works in China, for instance, I know that eight is a lucky number, so if I go to a showing, and the unit is ‘808,’ I’ll point that out to the client. It makes them respect you more.”

And that emotional resonance, Cleal says, is paramount to her overall approach when working with relocation clients, which prioritizes empathy and the acknowledgement of how transformative moves often are.

“It’s such a scary thing, to come to a completely new city and know only what you’ve read or heard about it,” she says. “In such a short time, they are selling their home, moving and setting up a whole new life with their family. So me helping them with that process is essential.”

Financing Issues

For clients relocating within the United States, financing is relatively easy. But what about an international client who does not have any conventional financial assets? What about, say, a newly graduated medical doctor from the University of Illinois at Chicago who wants to purchase a home, but is originally from India and is here on a work visa? It’s one of the biggest challenges, Laricy says, that his international relocation clients face – how am I going to finance my home purchase?

“You’ve got to make sure you have somebody who can read the transcripts, read the tax returns and understand all the visas, if you want to have financing done appropriately,” Laricy says.

For instance, how do funds transfer to the U.S.? What are the current exchange rates between the U.S. dollar and their foreign currency? Has that currency been gaining value on the dollar in recent weeks? Or perhaps its been losing value, and you should expedite the process so that your client does not lose money in the transfer? But what about the stipulations of the client’s specific bank? Are there limits to how much money they can send? How many installments can they send? Will it take days, weeks or months to have the funds in place? There are a myriad number of factors to consider, and it’s crucial that, as the real estate agent quarterbacking the process, you have those considerations in mind.

“There are many moving parts,” Laricy says, “so you have to know all the pitfalls ahead of time … Financing is the main pitfall for any international deal.”

Overall, specializing in the relo market can be challenging, rewarding and interesting, but agents need to commit to the training and continuously follow the markets, cultures and issues regarding rules, laws and financing. CA