As real estate professionals gathered at the International Interior Design Association’s downtown headquarters for the Chicago Association of Realtors’ CommercialForum Advocacy Breakfast this week, the weight of new laws being implemented, shifts in tax assessments and possible methods for filling government shortfalls was apparent.

At the event, lobbyists, brokers, lawyers and the county’s top tax man offered thoughts on what’s to come in 2020; here’s what it may mean for your business.

Marijuana as economic engine?

The fact that recreational marijuana will be legal across the state in less than two months was a big topic of discussion. Paul Stewart, cannabis coordinator for the City of Chicago, noted that while Springfield passed the law to fill a budget gap, the mayor’s office is taking more of a long-term economic development approach. “This was a revenue play for the state, obviously,” he said. In contrast, city officials expect to see ancillary businesses — such as smoking lounges and specialized restaurants — grow around the cannabis boom. “We see it as an opportunity for a new industry.”

Barrington Rutherford, senior vice president of real estate community integration at Cresco Labs, the second-largest cannabis company in the U.S., said his Chicago-based firm is a prime example of how the industry can bring new jobs to other parts of the economy. “We employ lawyers and engineers and graphic designers … those opportunities are really plentiful and very easy to integrate into any community,” Rutherford said, noting that the way the law was written will help economically disadvantaged people and communities. He also mentioned that there’s a great “need for real estate intelligence in terms of site selection” for businesses such as Cresco.

In terms of real estate needs that go beyond retail and entertainment, Rutherford said while most grow spaces in Illinois will be in rural areas, Chicagoland could see its share of buildings that are not just dispensaries but also production facilities, akin to the booming microbrewery industry in the city. “I think there will be cultivation in the city of Chicago,” he said. “If combined with a dispensary license, that could be a vertically integrated business model that works well.”

Assessing assessments in a changing regime

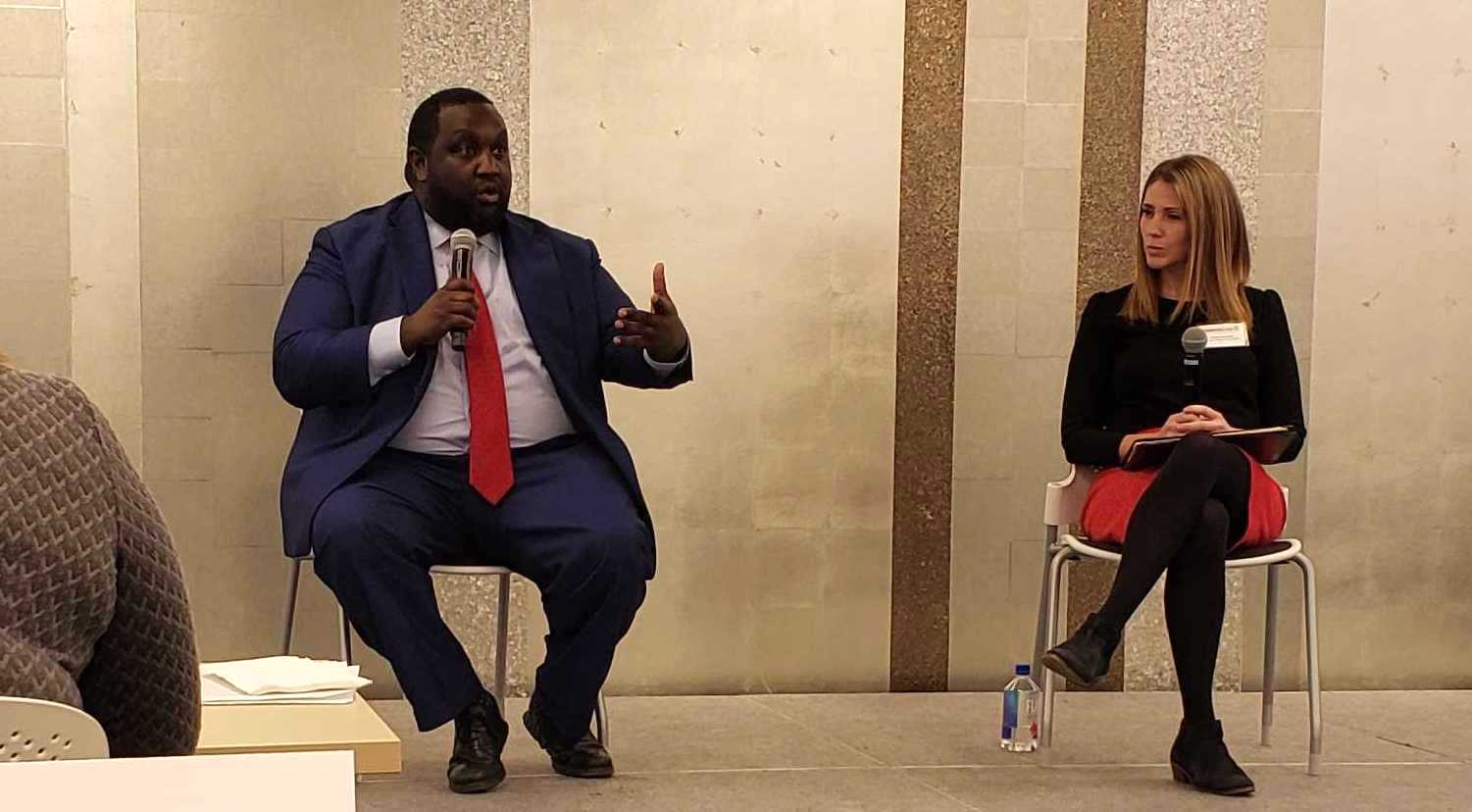

Fritz Kaegi, Cook County assessor, and Sarah Ware, principal and managing broker at Ware Realty Group

Cook County Assessor Fritz Kaegi returned to the CommercialForum this week, and one of the main items on his agenda was to lay out the potential benefits of his data modernization bill for the audience of commercial practitioners.

While residential sales are common and homogenous enough to use a regression model to predict values, commercial real estate is too varied and sales are too infrequent to rely on comps to tell the full story, Kaegi said. “The thing that the market needs is a better understanding of what data is going into our models,” he said. “That’s what the data modernization bill is aimed at doing.” The bill was sidelined this year, but Kaegi has vowed to reintroduce it next year.

Kaegi added that the “extremely sloppy, substandard work” by his predecessor may have led to some of the inequalities when it comes to how properties are treated in different parts of the city. “Where we don’t have a lot of data is Englewood or South Shore,” he said. “Good data will help us to serve those neighborhoods better.”

But the association isn’t yet convinced. “Illinois realtors did oppose his bill,” CAR’s director of government affairs, Adriann Murawski, noted during the forum. She said the association was concerned about the government collecting too much information about the income and expense data of commercial properties, but that they would continue to watch as the legislation evolves. “Know that, in 2020, this will be an issue that we will be working on. …I can’t tell you where our position will be at that point.”

Legislative action to watch out for in 2020

In another section of this week’s forum, two lobbyists for CAR laid out a number of their concerns for the next year at the city, county and state levels. One is a perennial favorite: rental control.

Kristopher J. Anderson, CAR director of government and external affairs and Adriann Murawski, CAR director of government affairs

“We know that is going to be an issue in 2020,” said Adriann Murawski, who heads up government affairs at the city level for the association. She said now that the Chicago Teachers Union has joined forces with the Lift the Ban coalition, she expects to see an even greater push to end the statewide prohibition against rent control. She added that while CAR does see a need to create affordability and “more housing for middle-income individuals,” she said the organization firmly believes rent control won’t do that and that officials need to find alternatives that will better “target the population in need.”

Kristopher J. Anderson, CAR’s director of government and external affairs, added that the local effort is part of a larger movement aimed at tackling affordability across the nation, noting recent gains for rent-control advocates in California, Oregon and New York City. “We’re not in a bubble here,” he told forum attendees. “This is a fight that we’re going to be in for quite a long while.”

Another measure to bring more housing to market for lower- and middle-income Chicagoans is the Affordable Requirements Ordinance, which Anderson noted might see some changes in 2020. Currently the law stipulates that developers building new residential structures that are 10 units or more and need to ask something of the city (zoning changes, buying city land, etc.) have to either price 10 percent of their units affordably for low- to moderate-income families or pay an in-lieu fee that can range between $100,000 and $225,000 for each unit not provided. But Anderson said that these requirements may soon become more stringent. “There are housing advocates who are looking to increase that fee, get rid of [the option to pay] that fee or increase the percentage of affordability,” he said. He added that the association has been lobbying hard for real estate professionals to be included on Chicago Mayor Lori Lightfoot’s recently announced ARO tax force, which will be considering such matters.

And then there are issues surrounding existing laws that are due to go into effect in 2020. Among those, Murawski warned landlords to get their ducks in a row when it comes to the Just Housing ordinance that’s set up to limit housing discrimination against those with criminal records, starting in January. In the screening process, landlords will need to consider an applicant before conducting a criminal background check. There will also be an opportunity for rejected applicants to dispute the landlord’s decision, which requires that the unit be held vacant for a certain period of time (likely to be around 10 days, though Murawski said this is still up in the air). “Illinois Realtors have asked for a sliding scale” in terms of the types of convictions governed by the law, she said. “We have been trying to approach this with sensitivity.”

Finally, the specter of a property tax increase still looms over budget talks. While Chicago’s mayor has stated that she hopes to avoid a property tax increase, her recent trip to Springfield may signal the need to dip into homeowners’ pockets. “Unfortunately, she came back hat in hand,” Anderson said of Lightfoot’s lobbying at the capital. “There are very limited options the mayor has at this point. … I think you will see her team start to talk about a property tax increase.”