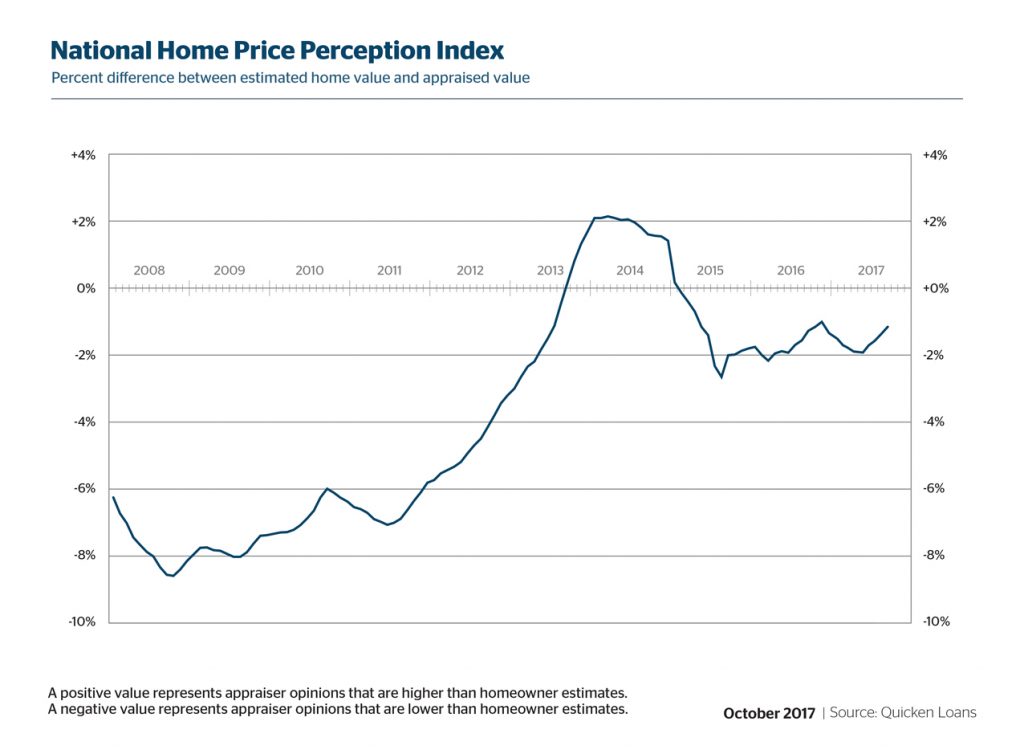

Although homeowners and appraisers don’t see exactly eye to eye on home values, the gap is narrowing, according to the latest National Quicken Loans Home Price Perception Index (HPPI).

According to the September update, appraisers’ valuations were 1.14 percent lower in September than what owners expected. September marks the fourth consecutive month that the gap narrowed.

The Quicken Loans Home Value Index (HVI), which is based on appraisal data, showed that home values have increased 0.44 percent from August and 3.38 percent since September 2016. All areas of the country saw home values increase on a year-over-year basis, although the South saw a 1.33 percent drop from last month.

“Home values are highly impacted by the balance of buyer’s interest and the volume of available homes. Currently this is highly tilted, with a lack of home inventory – leading to rising values,” said Bill Banfield, Quicken Loans Executive Vice President of Capital Markets. “One of the most impactful things that could be done to achieve stability is an increase in new home building. If move-up buyers move on to new construction, it will open up starter homes for first time buyers.”

Chicago has one of the largest gaps between appraisers and homeowners, with appraisers valuing homes 2.15 percent lower than homeowners. While this is closer than the 2.36 percent difference in August 2017, it is worse than the 2.08 percent difference in September 2016.

“An appraisal can vastly impact the mortgage process. This number alone can impact how much a buyer needs to bring to closing, or the current equity a homeowner has when refinancing,” Banfield said. “If homeowners are aware of local home values and how they are changing, it will assist with a smoother mortgage process.”