JOBS

How do you think Chicagoland’s job markets will fare in 2017? How will that impact consumers’ ability to buy homes in the city and suburbs?

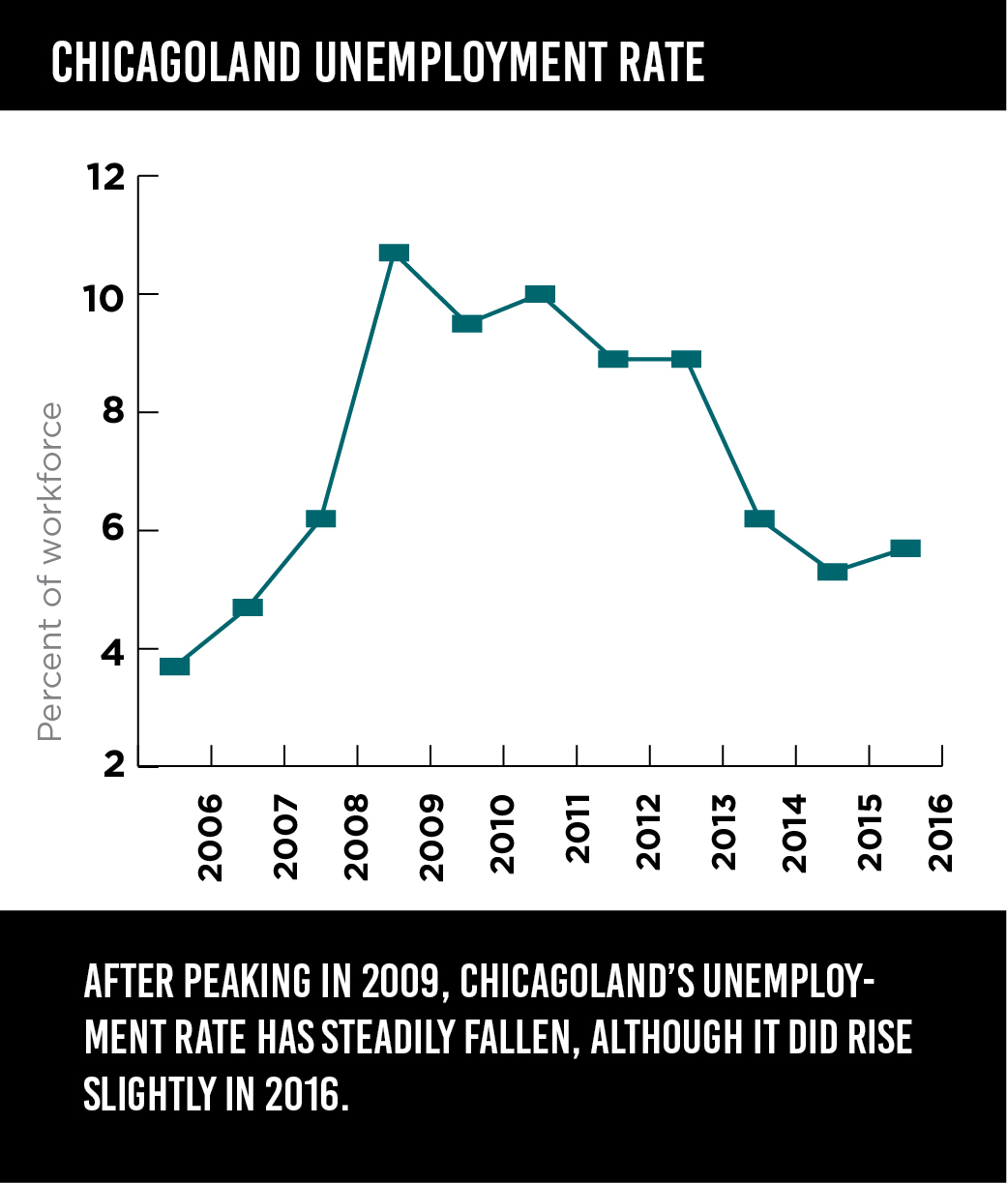

Dan Goodwin, The Inland Group: Chicago lags behind the country in job growth. In 2016, we were below a 2 percent wage growth, but we should see some movement to 3 percent in 2017. Job growth is lagging because of political and economic uncertainty, while the structural regulatory issues like tort reform and workers compensation make it harder for Illinois to compete for jobs. In addition, the public pension debt crisis is causing tax increases, which erode the capital for businesses to expand and can cause some businesses to leave our area completely.

Rebecca Thomson, @properties: Employment in the Chicago metro area continues to rise. We have a number of sectors performing strongly in Chicago, and I have a positive outlook on the local job market. Most of the Realtors I speak with do, too. Also, look at many of the people who are in a very strong employment position – a larger percentage of those people, relative to historical data, are renting. They certainly have the ability to buy, and ownership is an appealing and affordable alternative. I expect to see an increase in the number of buyers entering the market in 2017.

Tripti Kasal, Baird & Warner: The job market in the city is strong, and we expect it will continue to grow in 2017. Tech companies continue to move into the city and expand, which is bringing jobs and employees who want to live close to where they work. While not as strong as the city, the suburban job market should remain stable. The whole Chicago market is solid, and that’s both good and bad – we do not grow fast, but we also do not decline rapidly.

Patrick Ryan, Related Realty: Chicago is receiving much more global exposure, and that will continue to expand the Downtown Chicago market. Chicago’s technology industry is growing, more corporate headquarters are relocating downtown and building construction remains active. Our company, Related Midwest, will create 1,100 new jobs with the construction of One Bennett Park; each crane you see in the city represents 800-1,200 new jobs.

What immediate impact do you think President-elect Donald Trump will have on housing?

Catherine Terpstra, MORe: As a result of the election, I do not think we will see any significant immediate effects on the housing market. I was heartened to see the stock market rebound after its dip the day after the election, and hope that was an indicator of optimism in the market. At this point, we need to see how President-elect Trump’s actual policies will play out in the market and among consumer confidence.

Doug Carpenter, IR: All indications are that the new administration is serious about loosening business regulation and addressing student loan debt. Actions in those areas could provide a boost to the housing market, both in terms of easing lending restrictions and perhaps getting more first-time homebuyers into the market.

Paul Lueken, Draper and Kramer Mortgage Corp.: With Donald Trump winning the presidency and having both houses of Congress with a Republican majority, we can expect more of his agenda to be able to go through. He has indicated he will reduce government regulation, increase spending on infrastructure and make tax cuts across the board.

With his pro-growth agenda, it is likely that deficits will rise and inflation will finally start to creep in. We have already seen interest rates rise a bit in anticipation of that. I do not think rates will run away higher, so that should not be that much of a damper on the purchase market. There would be stronger negative pressure on the refinance market, however.

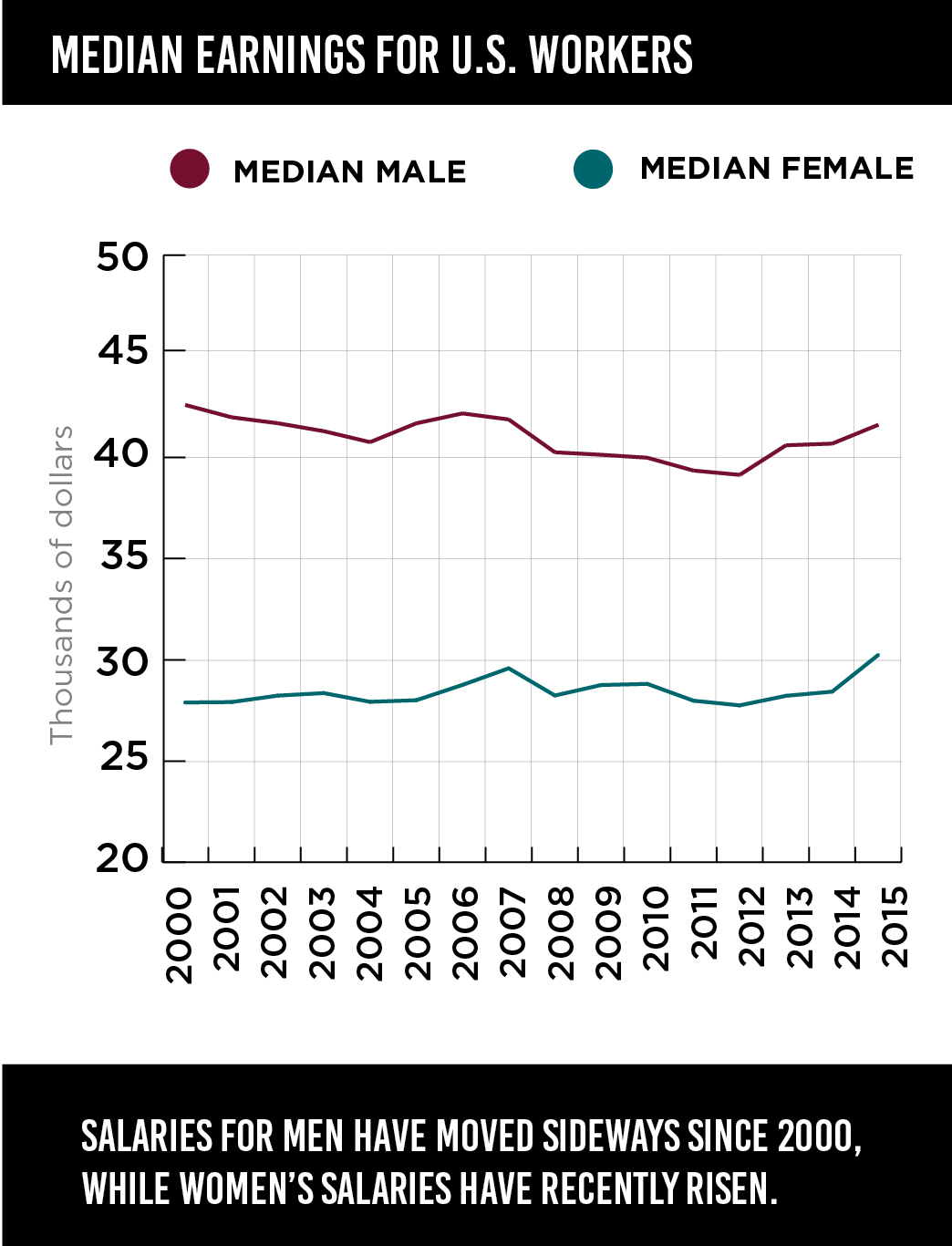

In 2016, wage growth did not keep up with home price increases in many places. How will that affect Chicagoland markets in 2017?

Alan Lev, Belgravia: I think this trend will continue leading to more luxury rentals and condos being built, and we will not be able to produce rentals or condos for the middle or high-middle-class market. This is all due to the increased cost of land and construction.

Sean Conlon, CONLON/Christie’s: This will affect the homebuying market by continuing the push toward renting until buyers have adjusted to the market. But with the mortgage market loosening up a little more lately, I think we will see an increased supply of buyers entering the real estate homebuying market over the rental market; the consumers’ ability and desire to buy is still dominant.

Matt Silver, CAR: Many families are dual-income families; therefore, wage increases are less influential in the decision-making process. The single wage earners are still seeing home prices and values increase. There is a high ceiling and there are plenty of entry points into homeownership. Chicago has a significant amount of property categories to choose from for all price points.