Housing Prices

Home prices for the Chicago area continued to show modest growth through much of the year, according to Standard and Poor’s Case-Shiller Home Price Index. The index’s most recent data shows that prices dipped 0.2 percent from August to September and about 0.4 percent from July to August, but are up about 2.6 percent for the year. The drop was part of a general deceleration of price increases throughout many U.S. cities. Nationally, year-over-year gains for September stood at 4.8 percent, down from 5.5 percent year-over-year gains in August.

“In the Midwest, we don’t usually have the wild fluctuations, the highs and lows that they typically see or experience in the coastal communities,” says Fran Broude, Coldwell Banker Residential Brokerage’s president and COO for Chicagoland and Milwaukee. “We typically stay more modest with our upturns in pricing and our downturns. I really think 4 to 5 percent growth is very reasonable for us. Historically, our fourth quarter – it doesn’t really matter what year – doesn’t accelerate quite as quickly.”

Homes that have gone into foreclosure or are otherwise distressed continue to be a drag on the housing market. According to RealtyTrac, at press time, there are 17,994 homes in Chicago that are in some stage of the foreclosure process, though the rate has slowed somewhat. In November, the number of homes entering the foreclosure process fell 22 percent from October, and was 25 percent lower than Nov. 2013. Overall, home sales were down 2 percent from September to October, but increased by 43 percent from 2013. The median home price was $280,000 in October for a non-distressed home, and $105,000 for distressed properties.

Foreclosures continue to cast a pall over the Chicago housing market. Illinois’ status as a judicial state means that it can sometimes take several years for a foreclosure action to be completed. During that time, some of the homes in question may have been sitting vacant and neglected for quite some time.

Jim Roth, the regional vice president for Carrington Real Estate Services, sees the number of unimproved foreclosed homes on the market as a continuing weak point. “Improvement on those homes is where you see price increases happen,” he says. “It hasn’t happened. Most foreclosed homes aren’t getting any sort of improvements for months and months, and sometimes even years. When they go onto the market, they’re going to get a lower price.”

Supply and Demand

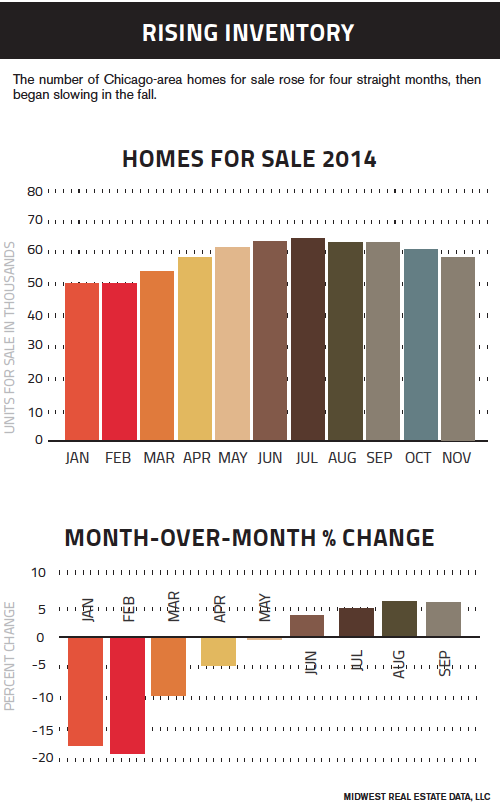

The supply and demand dynamic has remained skewed in many ways, with few homeowners willing to unload their properties for less than they paid and prospective buyers having trouble raising the money required for a down payment. Homes at the lowest and highest ends of the market are available, but the number of mid-range properties for sale remains small. There are indicators, however, that more people are planning to get into the housing market. The number of people intending to purchase a home rose to a five-year high, up to 5.8 percent in November, according to an analysis of Conference Board data provided by BMO Financial Group.

Michael Neal, an economist with the National Association of Home Builders, sees the improved employment numbers as a good sign for increasing demand in the housing market. “A stronger labor market, like 321,000, bodes well for homeownership,” Neal says. “But at the same time, we also hope that income continues to grow. The labor market’s growing, and we’re seeing some inroads as to income growth.”

Looking forward to a early Spring market; a lot of pent up demand!