Mortgages

Tighter rules for mortgages and lending continue to hinder the growth of new home construction, and keep some segments of the population out of the housing market. While it can be harder to get approved for a mortgage, it is also more worthwhile than at most points in history, as mortgage rates remain near historic lows. Rates for 30-year fixed-rate mortgages have dropped to 3.8 percent in recent weeks, while 15-year fixed rate mortgages are down to 3.09 percent, according to Freddie Mac’s Primary Mortgage Market Survey.

“Even in a scenario in which interest rates are rising, we’re going to see stronger employment growth and wage gains that are roughly in line with house price appreciation,” Neal says. “That should bode well for a healthy and stable housing market.”

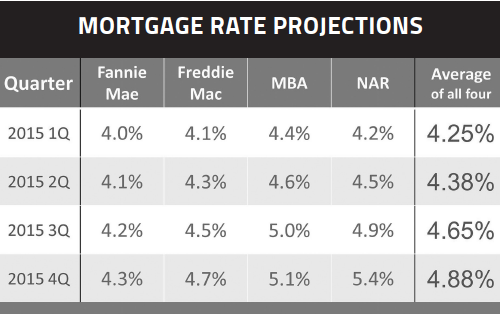

While the Federal Reserve has indicated its intention to move cautiously when it comes to raising interest rates, a higher cost of borrowing also may bump mortgage rates upward. Mortgage rates tend to rise when inflation increases, and a move toward the Fed’s 2 percent target inflation rate could have that effect in the coming months.

Still, rates remain near historic lows and will likely continue to do so for some time. However, in many cases, banks have tightened their lending guidelines, and would-be homebuyers are finding it harder to get a mortgage. New policies implemented by Fannie Mae and Freddie Mac have aimed to loosen credit by reducing the minimum down payment from 5 percent to 3 percent for people who Federal Housing Finance Agency Director Melvin Watt calls “creditworthy borrowers who can afford a mortgage, but lack the resources to pay a substantial down payment plus housing costs.”

Broude sees the continued low interest rates as a positive for homebuyers, but does not believe they are having a big impact on peoples’ decisions to purchase a house sooner rather than later.

“The buying decision hasn’t become urgent as a result of the low interest rates,” Broude says. “I just think it’s a very healthy sign; it allows home sellers to appeal to a bigger pool of homebuyers. It helps homebuyers leverage housing affordability and take advantage by buying a home. But it hasn’t had an impact on the homebuying decision.”

Looking forward to a early Spring market; a lot of pent up demand!