Mortgages and Appraisals

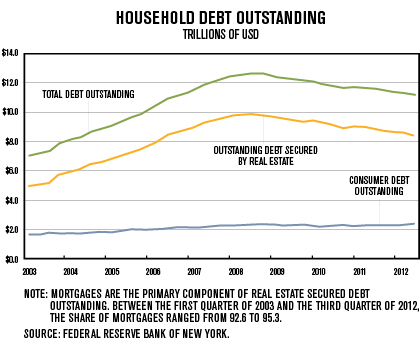

When it comes to mortgages, whether regulations will start becoming less stringent hinges on Basel III. Developed in response to the financial crisis, Basel III is a global regulatory standard on bank capital adequacy, stress testing and market liquidity risk agreed upon by the members of the Basel Committee on Banking Supervision last year, and scheduled to be introduced from 2013 until 2019. Whether the challenges loan officers have been having in years past – clients having trouble qualifying for financing due to down payment, credit or appraisal issues – all depends on Basel III’s capital requirements, which could have unintended effects on borrowing costs for buyers, Amir Syed, private mortgage banker with Perl Mortgage, says. “Basel III capital requirements are designed as an additional liquidity safety net for lending institutions during any financial downturns,” he says. “This would have a butterfly effect on homeowners (that could cause) higher rates, more costs and more red tape.”

Basel III will also increase requirements for banks next year, and if that’s the case, banks are going to act sparingly in giving homebuyers loans. G-fees will be passed onto loan officers, and with the record low interest rates, banks will see the ability to supply capital; but, according to some area lenders, the banks will most likely not want to give money to most buyers.

The other government program to watch? Dodd-Frank – now that Obama has been re-elected, it’s likely the program will be highly impactful on the industry. “Democrats already had a strong majority in the state House and Senate, and Dodd-Frank will be very impactful moving forward,” Dione Spiteri, president of US Appraisal Group, says.

“Obama has a lot of programs that he put into place. Now that he has a second term, he can execute these programs,” Tonya Corder, president of the Mainstreet Organization of Realtors, says. “The American voters re-elected him, now he has a chance to get the economy moving.”

At press time, the fate of the mortgage interest deduction, or MID, was still up in the air, as well. According to HouseLogic, having a tax deduction for mortgage interest makes owning a home more affordable because the deduction lowers the amount of tax you pay. U.S. Census data shows 37 percent of homeowners with mortgages spend more than 30 percent of their income for housing. Saving on these costs is critical for homeowners as it allows them to allot funds for savings and other expenses.

Therefore, while policy makers are considering eliminating the MID, Lawrence Yun, chief economist for the National Association of Realtors, believes that such a move would lower the homeownership rate in the U.S.

“While we must ensure that the conditions that led to the artificially inflated homeownership rate of the bubble years do not resurface, we also need to create the conditions for sustainable homeownership,” he explains.

While the Home Valuation Code of Conduct (HVCC), a document that stated that Freddie Mac Seller/Servicers must represent and warrant that the appraisal report is obtained in a manner consistent with the Code, expired in 2010, in most agents’ and loan officers’ opinions, it made appraisals more difficult.

“The basis of the HVCC stemmed from relationships between unscrupulous loan officers and appraisers inflating and manipulating home values,” Syed says. “The HVCC, in my opinion, was actually a good idea, however, it needed more refining in terms of the arbitrary appraiser selection process. Many homeowners are experiencing appraisers that do not have direct or recent knowledge in their neighborhood.”

“I think the HVCC had such a huge impact, which unfortunately led to a separation of lender and appraiser,” Lisa Trace with Griffith, Grant & Lackie in Lake Forest, says. “I had a property where the appraiser compared the property to a section of Lake Bluff that wasn’t even apples to apples. There is no comparison between the two areas, and the appraiser didn’t even know the area, which is the case with most appraisers (in my experience).”

Looking to next year, there should be an increase in sales, especially once the spring market hits. Interest rates should stay low through next year, and with more sales, recent comparable sales and appraisals will improve.

“I’m hoping that next year, there will be federal regulation of appraisal management companies as opposed to state regulation,” Spiteri says. “The variance of state laws and requirements are exhausting and prohibitive and counter-productive. As always, next year, bring data, a list of improvements, plat map/survey and any other available information to the appraisal inspection to ensure it goes smoothly.”

Regarding REO transactions and short sales pulling home values down and causing problems with appraisals into next year, the hope is that as more are sold and taken off the market, over time, this challenge will be solved. But as for next year, again, home values and the market are creeping back slowly, meaning while the challenge of having a home appraise out is getting better, it won’t be completely gone until REO properties are off the market, and short sales will continue to be challenging next year, as well, according to some agents.

“One of the biggest challenges in 2013 will be in the way short sales are handled,” Sinnott says. “Despite continued improvements to the process, it still can take excessive amounts of time, which often results in cancelled contracts because the buyer can’t wait that long to make a purchase.“

“I think collateral is getting better and appraisals are starting to come in line with expectations,” Syed says. “In the city, we’re starting to see values coming more in line with what people think their properties are worth. But as long as shadow inventory and low comps exist, some homes may appraise low.”

Additionally, everyone on our panel said their companies have all experienced some sort of growth. “We can’t seem to hire fast enough,” Spiteri says. “We want to streamline through technology and innovation in a way that is unparalleled in our industry.” We have a feeling we’ll see several companies keep growing and improving to provide impeccable services to clients as the market continues to improve.