New Construction

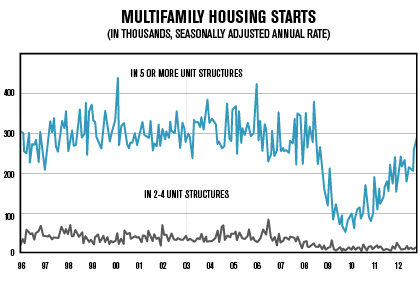

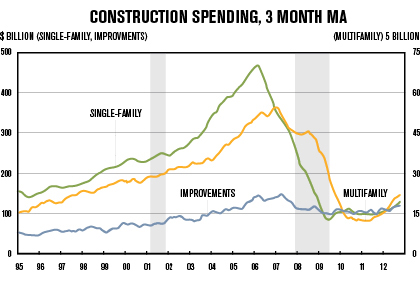

According to Bill Conerly, a reporter for Forbes.com, new construction units are being built slower than needed to meet demand. Last year, just over 600,000 new construction units were built in the U.S. Next year, Conerly’s prediction is about 750,000 units will be built. At the peak of construction in 2005, there were 2.5 million units built. We need about 1.5 million new units per year to accommodate population growth, the desire for vacation homes and demolition of old units.

In addition, Conerly also reports that it is still too soon for housing starts to get back to normal, but he estimates that 2013 will probably have about one million total housing starts. This will be a substantial percentage gain over 2012. According to Metrostudy, in Chicagoland’s counties, there were 2,628 housing starts tallied through the first nine months of this year, and new homebuilders continue to see improvement in the level of demand for their product. In the first nine months of 2011, there were 2,093 housing starts. The 535 unit improvement over the prior year-to-date total is the largest such increase (both nominally and percentage-wise) in over 10 years. Metrostudy expects the number of housing starts to reach 3,400 housing units by year’s end.

“We entered this year expecting new home demand in 2012 to be comparable with 2011,” Maria Wilhelm, vice president of sales with PulteGroup, says. PulteGroup is currently building new communities in Burr Ridge and Glenview. “Obviously, demand has been more robust, with industry-wide sales tracking roughly 25 percent above prior year levels. There are a host of reasons to support the housing market’s recovery: higher rents, low home prices, low interest rates, the rapid reduction of existing-home inventory and the limited supply of new homes on the market. I think you’ll see a sustained recovery in 2013.”

The challenge for many developers next year will be with absorption, according to Todd Condon, vice president of Ryland Homes. “Certain submarkets will continue to see challenges in sales absorption due to existing short sale and foreclosure listings that initially seem attractive to buyers,” he says. “However, Ryland has performed very well in these areas (in the suburbs) by staying competitive.”

The market saw a rise in the demand of new construction, leading to more housing starts and more new developments. Price points are not back to housing boom levels, but are approaching pre-boom levels. “It’s all about value,” David Wolf, president of sales for Related Midwest, says. “New construction or newly renovated properties are selling much faster and for more money than comparable resale properties.”

While the rental market was hot for some time, especially the last few years, the demand for rentals is now on the decline as the market starts to level. But there are a few companies that have rental developments in the works: Related Midwest, for example, is developing 500 rental residences at 500 N. Lake Shore Drive, which will open in April 2013, and another 500 at 111 W. Wacker Drive, opening in spring 2014. In fact, all the developers we spoke with for this story have several projects lined up for delivery in the next few years, like Belgravia’s third 40-unit phase of CA23 in the West Loop and its Lincoln Park townhome project Montana Row; Related Midwest’s redevelopment of three Museum Campus buildings in the South Loop; Ryland is opening communities in Crystal Lake, Huntley, Shorewood, Aurora and Elgin early next year; PulteGroup has a new community, Kensington Court, opening in January in Glenview; and Lexington Homes has new models opening at Lexington Square 2 in late December/early January, and two spec homes are under construction and opening at The Sanctuary Club in Kildeer next spring.

“Developers will continue to minimize risk and take baby steps with small projects,” Liz Brooks, vice president of sales and marketing at Belgravia, says. ”Financing larger projects is nearly out of the question. Developers that rented out unsold units during the downturn are now starting to put those units on the market.”