Inventory

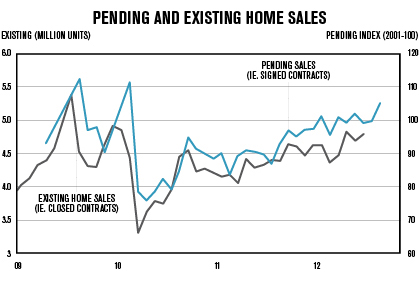

There might not be any earth-shattering data regarding home prices and home sales, but as small as the improvements are for both, at least they’re headed in a positive direction. Currently, the inventory has decreased, but once 2013’s spring market comes around and more people put their homes on the market, this should change.

“There will be two kinds of sellers – those who want to sell and those who have to sell,” Millie Rosenbloom, a top producer with Baird & Warner, says. “These will be made of people who have to relocate because of work, or people who are ‘empty nesters’ and want to move. Some of these sellers will be moving from larger homes in the suburbs to smaller places in the city, or possibly from condos to larger homes to make room for a growing family.”

There might be a shortage of quality inventory, and distressed properties are still a drag on the pricing side of the equation, but once they are off the market, it will be a major step towards housing recovery. Ginny Stewart, an agent with Adams & Myers in Hinsdale, says that while REOs are in high demand in her market – many can still be a “steal” for buyers as the market slowly turns away from being a buyer’s market and lowball offers – it still can take what feels like ages to move them.

“I’m extremely frustrated with the lenders. They have to be more proactive,” she says. “They are listing with brokers who are not from the area. And, more importantly, (to sell them), please, clean up the REOs! What would it take to get someone, or a cleaning crew, to help take care of the upkeep on an REO listing? I was at one REO and it looked like someone didn’t rake the leaves in six years.”

“The REO inventory in Chicago will remain above most of the rest of the nation for the next 12 to 24 months,” Zeke Morris, president of the Chicago Association of Realtors, says. “Because of our state’s extremely high number of homes in foreclosure and the backlog of paperwork that’s accumulated in the state’s judicial system, we still have a while to go before the numbers start to clear.”

Thankfully, however, should Governor Quinn sign the Illinois Foreclosure Bill, the foreclosure timeline for vacant properties would decrease from 500 days to 100 days, and the bill will provide housing counseling to homeowners while raising $28 million to clean up vacant houses and lots and providing $13 million in grants to housing counselors. This should help kick-start clearing the REOs from the market next year.

Sales have increased but prices have not, therefore, there is demand for housing, “but sellers have not bought into that sentiment,” Russ Bergeron, CEO of Midwest Real Estate Data, says. “A few months of increased prices, no matter how small, will spur some sellers to get off the fence and test the waters (next year).”

We entered this year expecting new home demand in 2012 to be comparable with 2011…(but) demand has been more robust.”

Maria Wilhelm, PulteGroup

“If you look at the nation overall, statistics indicate that the delinquency and shadow inventory numbers are improving. However, the foreclosure trends are different for each state,” Joan Sinnott, senior vice president of Century 21 Lullo, says. “Since Illinois is among the states that require foreclosures to go through a judicial review (which significantly delays the process), the Chicago area is projected to be a year or two behind any national recovery. Clearing up our inventory could take quite a few years yet. Reports I’ve read indicate that foreclosures may decline a bit more this year, but both foreclosures and short sales will dramatically accelerate in our area in 2013 and also into 2014. So the turnaround may not happen until 2015.”