What does the new generation of homebuyers and sellers look like? How old are they and how are they doing business? Every year, the National Association of REALTORS® (NAR) gathers new answers with its annual Home Buyers and Sellers Generational Trends Report.

Compiled from a detailed survey of thousands recent homebuyers who purchased in the period between July 2021 and June 2022, this year’s report provides a by-the-numbers look at those evolving demographics — and some of the stats may surprise you.

Who is buying homes?

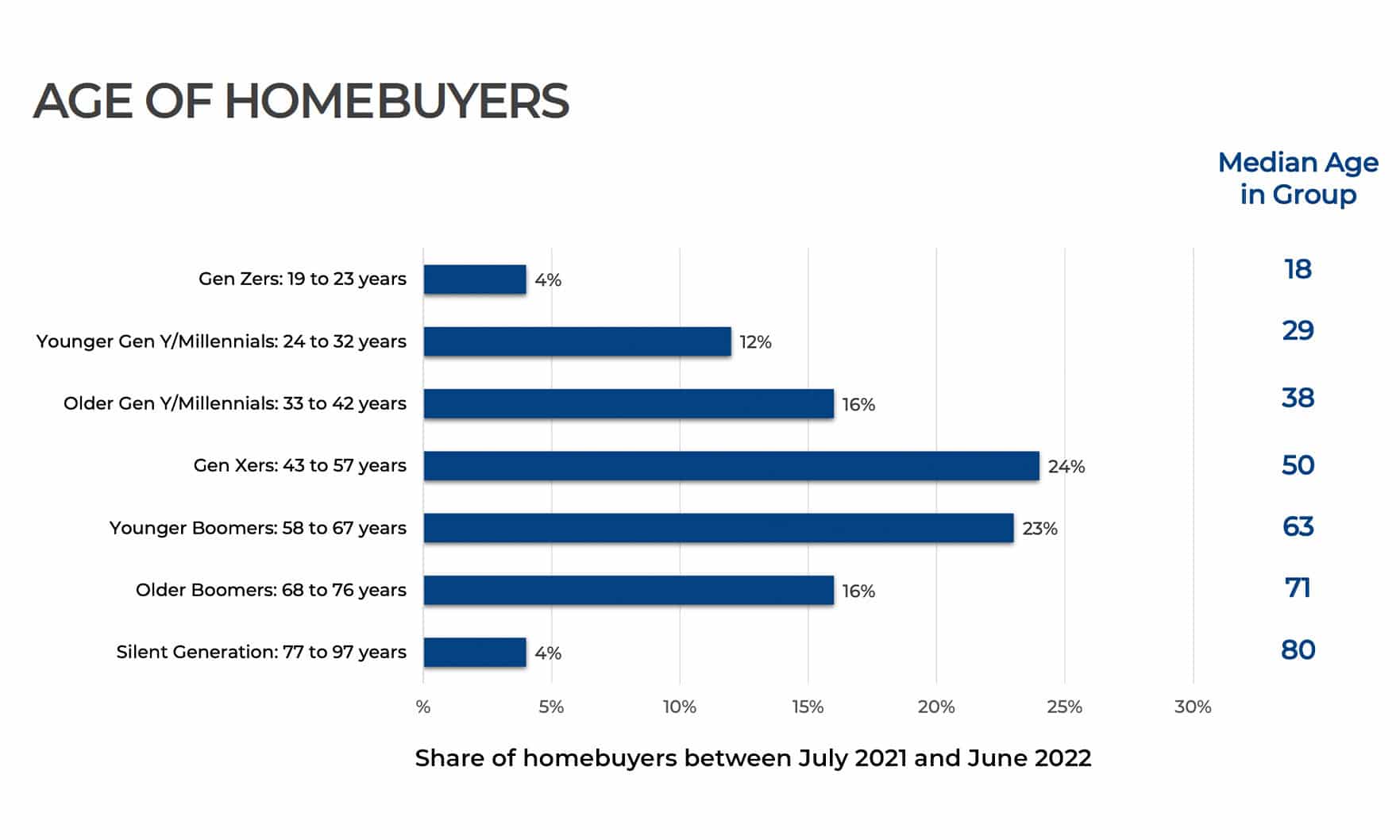

data via NAR

It was a big year for baby boomers. For the first time in eight years, millennials did not make up the greatest share of homebuyers, bumped by those aged 58 to 75 — otherwise known as boomers. The demographic accounted for 39% of home purchases during the period of study.

“Baby boomers have the upper hand in the homebuying market,” NAR Deputy Chief Economist Dr. Jessica Lautz said in a press release, commenting on the shifting tides. “The majority of them are repeat buyers who have housing equity to propel them into their dream home … They are living healthier and longer and making housing trades later in life.”

Meanwhile, the millennial share of homebuyers slipped a considerable 15% making up just 28% of all buyers this year. And in turn, there was a dip in first-time homebuyers. First-time buyers made up 26% of all homebuyers, a year-over-year decrease of 8%. That is the lowest number recorded by NAR since the organization began tracking this data.

Still, most millennial buyers were first-timers. Seventy percent of younger millennials and 46% of older millennials were first-time buyers. By NAR’s standards, all shoppers aged 24 to 42 are considered millennials with a further breakdown of younger millennials (24 to 32 year olds) and older millennials (33 to 42 year olds). Many of those younger millennials also relied on some form of down payment assistance from family and/or friends as affordability remains an issue for these new buyers.

In particular, the report noted how many buyers were delayed by student loan debt. Millennials are the most educated age group with 35% of younger millennials reporting student loan debt with a median loan balance of $30,000. Thirty percent of older millennials reported a median loan balance of $40,000.

Following millennials, Gen Xers — those aged 43 to 57 — made up the second-largest share of first-time homebuyers at 21%. Gen Xers also had the highest household incomes of any generation at median of $114,300. (They were followed by older Millennials with a median income of $102,900.) Additionally, Gen Xers remained the most racially diverse homebuyers this year with 23% identifying as non-white.

For the first time, the youngster Gen Z demographic made sharp homebuying progress. The demographic, which includes those aged 19 to 23, surged to 4%: a 100% increase from last year’s numbers. Gen Z is now equal with the Silent Generation — homebuyers aged 77 to 97 — in terms of their homebuying share.

“As the youngest generation of home buyers and sellers, it’s encouraging to see Gen Z entering the market,” Lautz said. “Their desire for homeownership is strong, and many are relying on family support systems to help make their first real estate purchase.”

It’s also worth noting that Gen Z contained highest percentage of single female buyers — 31% — during a year when 61% of buyers were married couples. Taking all age groups into account, just 17% of buyers were single females and 9% were single males. The highest share of unmarried couples occurred in younger millennials at 20%.

Who is selling homes?

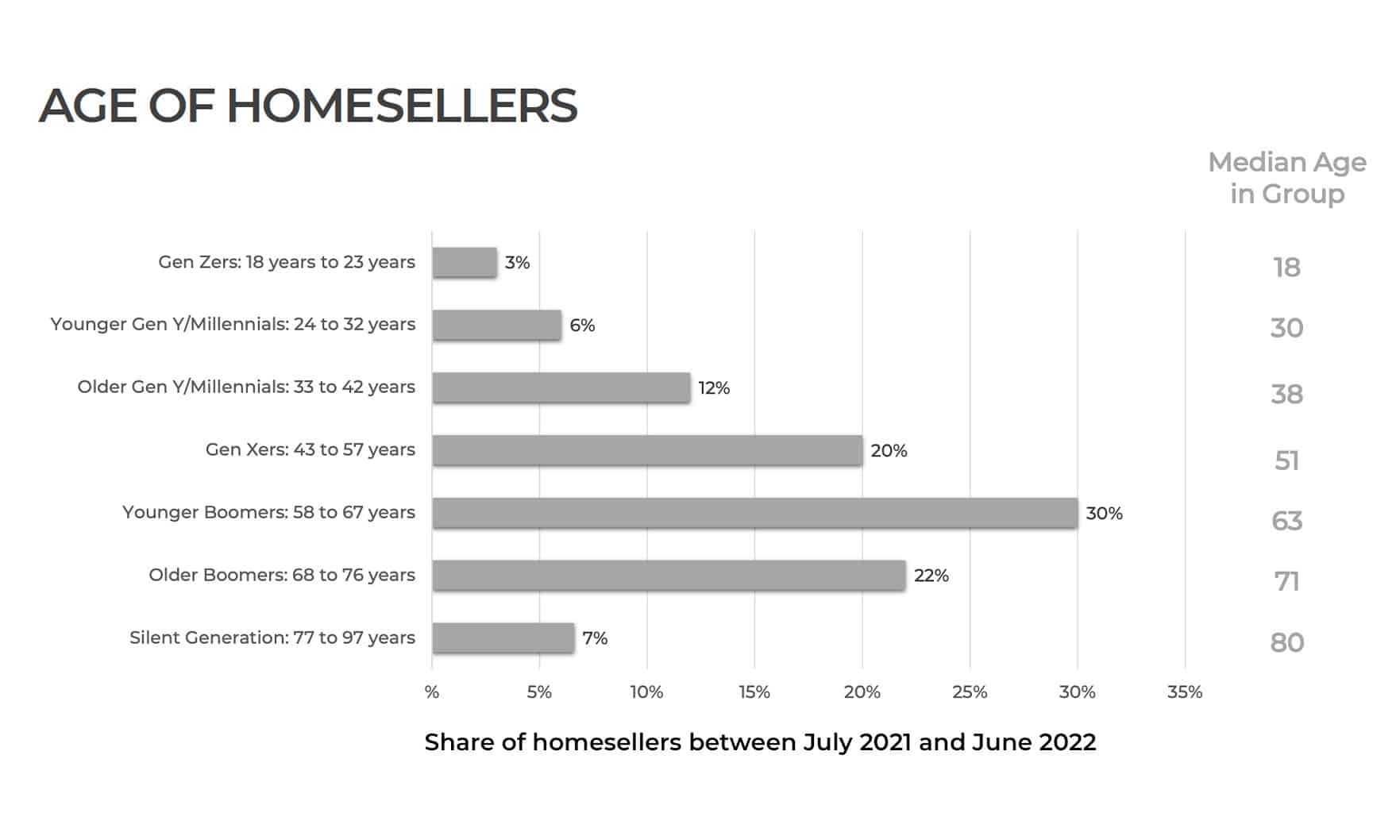

data via NAR

In addition to leading the way in homebuying, baby boomers remained the largest home seller generation, jumping from 42% to 52% in the past year. Broken down, younger baby boomers made up the highest age share with 30%, reporting a median income of $89,500. They were followed by older baby boomers (22%), Gen X (20%), older millennials (12%), the Silent Generation (7%), younger millennials (6%) and Gen Z (3%). 67% percent of sellers were married couples.

Sellers typically lived in their homes for 10 years before selling with younger millennials staying in their home for less time — a median just four years — compared to a median of 16 years for older baby boomers.

Wanting to move closer to be with friends and family was, overall, the most popular reason to make the move although small home size was a particular issue for millennial sellers.

Throughout the selling process, 20% of all sellers offered incentives to attract buyers 19% reduced the asking price of their homes at least once. More Silent Generation sellers reduced their price than any other age group (34%). In the end, though, the reported final sales price for sold homes across all demographics was a median of 100% of the final listing price.

Seventy- two percent of sellers reported being “very satisfied” with the selling process, up 2% from last year.

What’s hot on the market?

Given the wide spectrum of homebuyers, the core reasons for purchasing property vary — by a lot. For all homebuyers under age 58 years, the main reason for buying was the desire to own a home of one’s own. However, those older than 58 prioritized being closer to friends and family, followed by the need for a smaller home.

Fourteen percent of homebuyers purchased a multi-generational home to accommodate for aging parents or grown children moving home. Older baby boomers purchased the most multi-generational homes at 18%, followed closely by Gen Xers at 17%.

Naturally, all these reasons affect what type of homes buyers gravitate toward. Most recent buyers were looking to avoid renovations and repairs although 31% were prioritizing price. In the end, the most common type of home purchase continued to be the detached single-family home. It made up 79% of all homes purchased and was most popular among all generations.

The typical home had a median 1,800 square feet, with three bedrooms and two bathrooms and was built in 1986. Gen X homes were generally larger (at median 1,970 square feet) older Baby Boomers bought newest (with a median build year of 1996).

In a dramatic shift from the 2022 report, NAR recorded a median of 50 miles between a buyer’s old and new home: a year-over-year increase of 35 miles. The distance is even higher for older baby boomers at 90 miles.

Seven percent of buyers over the age of 60 opted for senior-related housing and, as per usual, the Silent Generation chose apartments/condos at the highest rates.

Overall, buyers expect to live in their new homes for a median of 15 years, up slightly from 12 years last year. They also report high satisfaction with the homebuying process, across age groups.

Agents in the mix

Most homebuyers worked with a real estate agent and their No. 1 goal, across age groups, was the same: to help them find the right home to purchase. That desire was increasingly strong among older buyers. All told, 86% percent of all buyers worked through an agent and that number was slightly higher for younger baby boomers (90%) and Gen X (88%).

An agent’s purchasing experience was extra beneficial to buyers, too. Thirteen percent reported wanting an agent to negotiate the terms of sale and 11% wanted an agent to negotiate the home price. Millennials were most likely to want an agent’s help with paperwork.

Sixty-seven percent of buyers said they interviewed just one real estate agent during their home search with referrals being the go-to source. Seventy-six percent of buyers also said that they would use their agent again or recommend their agent to others — a number that was consistent across generations.

Meanwhile, 86% of homesellers worked with an agent to do their business. Sixty-three percent worked with a referral or the same agent they had worked with in the past. That number was 76% for older millennial sellers. Thirty-nine percent of sellers used the same agent to buy and sell their homes.

When it came to choosing that representation, the most important factor for sellers as an agent’s reputation. Once they were hired, though, sellers wanted someone who could price the home competitively and help market it to potential buyers. The No. 1 listing source was the Multiple Listing Service (MLS), utilized by 86% of sellers, followed by yard signs.

Eighty-five percent said that they would definitely or probably recommend their agent for future services — and 64% say they already have.

Among all generations, the first step taken in the home search process was to look online for houses. Buyers typically searched for 10 weeks and saw a median of five places. Ninety-six percent used the internet to search, scheduling walk-throughs. Though the type of internet searches were split — 50% used a computer and 50% a mobile device — nine out 10 buyers agreed that photos were the key online feature.