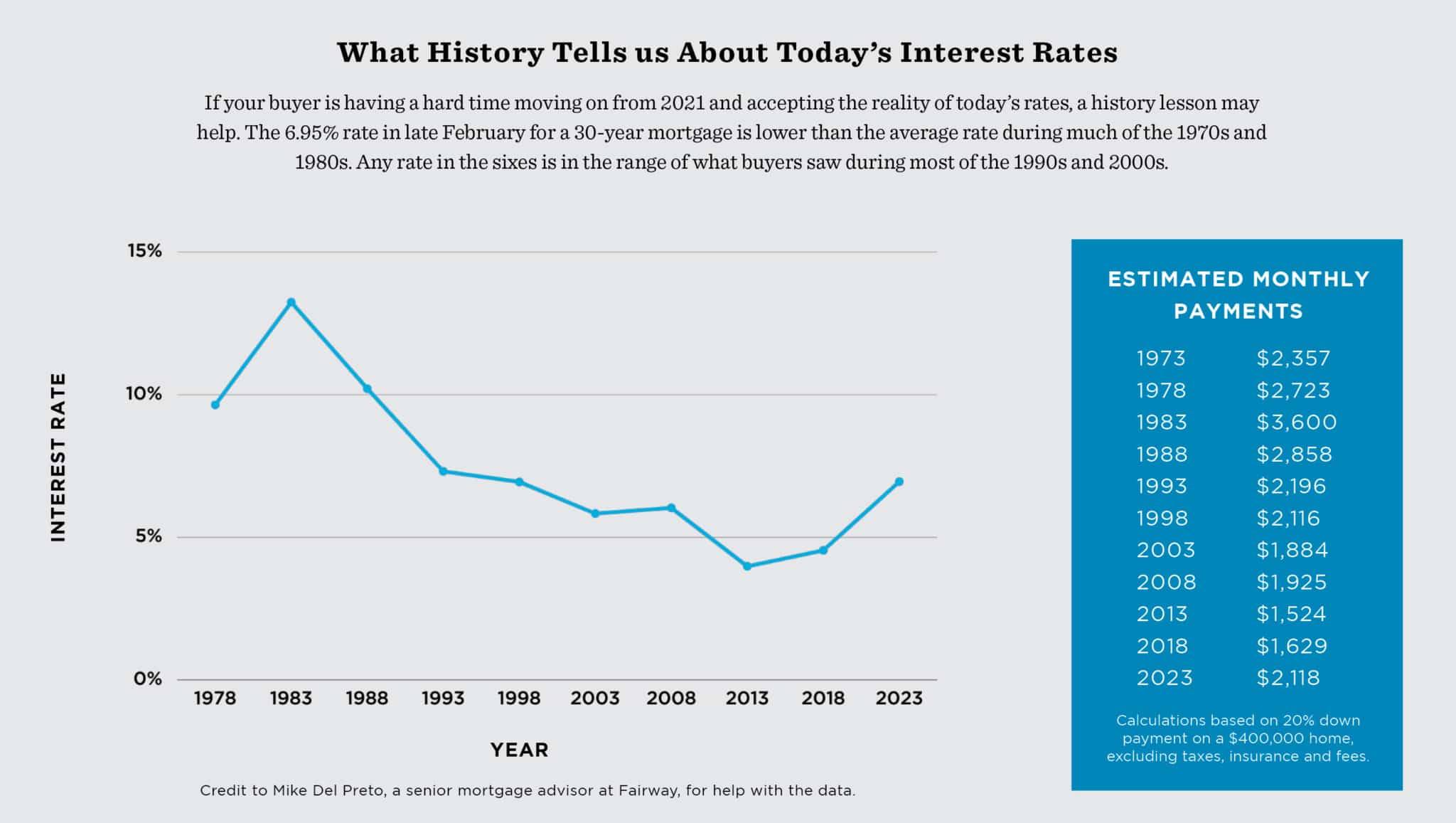

Keeping things in historical perspective can be tough when mortgage rates have roughly doubled in the last year. Any rate in the sixes, though, is right in the range of what buyers got during most of the 1990s and 2000s.

Mike Del Preto, a senior mortgage advisor at Fairway Independent Mortgage Corporation in Chicago, noted there are tools to find interest rate solutions for most buyers. He said one popular option is the temporary rate buydown, allowing buyers to pay a fee and drop their interest rate for one or two years.

After those years are done, the homeowner’s rate will return to today’s full percentage, or they can refinance if rates have dropped. As many lenders have noted in recent months, rate buydowns allow buyers to “marry the house and date the rate.”

Del Preto also said there can be a cost to sitting out of the market and waiting for rates to change. He cited a cost-of-waiting analysis that showed waiting to buy a property for one, two or three years can cost the buyer the value of home appreciation, offsetting any savings from a lower interest rate. Depending on the property appreciation, waiting can cost a homebuyer tens of thousands of dollars in the long run.

The most critical component in this article is in fine print under the chart of monthly payments by years – Calculations based on 20% down payment on a $400K home, excluding taxes, insurance, and fees. When I bought my first home in Miami, FL in 1990, insurance was $400/year. That home was destroyed in Hurricane Andrew and I replaced it with a townhome of similar value. The insurance remained the same in 1993. By 2019, I was paying $4,800/year. Thank God Florida has Homestead exemption that caps the increase in taxable value you to no more than 3% yearly. But that is just Florida, and when a new buyer closes on the property, the tax basis goes all the way up to market value. When I sold my townhome in 2019, the new owners were hit with taxes triple what I have been paying. The chart in this article is wonderful until you understand that it is a combination of all of PITI that matters. The recent reduction in MIP/PMI, there is a tiny bit of relief. But that does not even begin to counter the 25% increase in insurance premiums in a year.