Two roads, both long

The reality, as Watt once alluded, is that the future of Fannie and Freddie – much like the future of the country’s housing market, economy and everything in between – is unclear. The only thing we know to be true is that whether the conservatorship ends and Fannie and Freddie take their place back among the echelons of private enterprise, or they transition into an explicitly government-backed role, the road to either outcome will be more of a trudge than a stroll. That’s contrary to Mnuchin’s promise of an expedited government-control schism, but a reality most in the industry have already accepted.

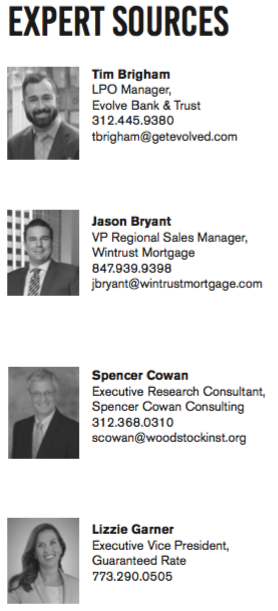

That includes Jason Bryant, a vice president of regional sales with Wintrust Mortgage, NMLS# 755918, EHL, who recognizes the potential benefits of a private Fannie and Freddie but acknowledges that such a transition would need to be handled with finesse.

“Privatization is certainly warranted, but it needs to be done in a way that serves the interests of the taxpayers rather that those of well-connected hedge fund investors,” Bryant says. “And while there are several opinions out there for how to achieve this, I have yet to come across a truly concrete plan. From my vantage point, any attempt to move forward to privatization is at a minimum two to three years away.”

Almost every professional we spoke to voiced concern for the borrower – which is not surprising, as it is the borrower who will bear the brunt of either outcome.

“I would hesitate to say Fannie and Freddie would be better or worse if privatized,” Garner says. “What I would say is that even if they’re privatized, they should still be held accountable to make sure they’re not overreaching in the market, and that they are still providing value and meeting demand.”

Chicago Agent magazine reached out to both Fannie Mae and Freddie Mac to get their perspective on the matter. Both institutions declined to comment, though a representative from Fannie Mae did say, “We are committed to working with FHFA, the new Congress, and the new Administration to continue to strengthen the housing finance system.”

I’ve heard enough. Just put it back the. Way it was. When something bad. Happens the. Uncle Sam. Will help. .every other 2008 bailout was. Returned. To. Businesses as usual.. So be it for FANMA

I have worked on/written about these matters in the Congress, at federal regulatory agencies, and for more than 20 years as Fannie’s chief lobbyist, before retiring in 2004.

For the past nine years, I’ve written a financial services and GSE blog.

My single greatest piece of advice to the Realtors who read about these issues is to kick in the butt your NAR execs in DC, who have tried to placate the Obama Admin and opposed resurrection of the GSEs. It’s that frustratingly simple.

Look at its record, not what they say to you in you conferences or breakout sessions.

The NAR is powerful but seems to want to play footsie with the big banks–and Senate baddies like Bob Corker (R-Tenn.)– and others who have their eye on the GSEs revenue not what best for mortgagors or homebuyers.

They will be utilities under the HERA statute of 2008, operating safely with more capital and a federal backstop to keep rates lower. The old GSEs are gone already, and no one wants the Big Banks to take over this marketplace.

Ideally, Congress would pass a small bill with some tweaks, though this is not necessary. What IS necessary is to keep Big Banks from taking over and harming consumers, Realtors, small lenders, and inner-city neighborhoods.