The Draw of Economic Stability

International clients also turn to residential real estate as a sound investment that they can pay off quickly. They can continue to rent out for years to come, particularly in a high-demand rental market such as Chicago’s.

“Rents are going up so much in Chicago and studios are so easy to rent, they will close and have a renter lined up already,” says Kristine Frost, an agent with Related Realty. “Buyers from Hong Kong might sign the purchase contract in the morning, and in the evening, they sign the lease and the renter moves in the next day.”

Clients also seek properties in the U.S. because of the nation’s political and economic stability. Sears recently worked with a client from Jordan and helped her secure a condo that she plans to use as an investment property.

“We still manage it for her,” Sears said. “She comes over now and then, but not to stay there. She’s using it as an investment to make some money. When I asked her why she wanted to buy, she had two reasons. One was she went to school here at the University of Illinois, and feels comfortable here. Her other comment was ‘I’d like to own something that, when I get ready to sell it, there’s not a possibility the government’s going to nationalize it or it’s going to have bullet holes in it.’ ”

Chinese investors see Chicago’s housing market as a prime place to generate income, according to Carmen Chong, the chairwoman for the Asian Real Estate Association of America. “Chinese investors see the U.S. as a bargain following the worst foreclosure crisis since the Great Depression,” Chong said. “In the last year there’s been the corruption crackdown in China and a lot of people have seen their wealth evaporate over there because of that.” Chinese president Xi Jinping’s current and ongoing campaign against corruption has generally left the private sector alone, instead targeting government officials and leaders in state-owned enterprises (SOEs). Still, many Chinese investors and business leaders are nervous about its effects on the economy, which has fluctuated wildly in recent months.

But politics and economical concerns are not Chinese buyers’ only motivations for seeking real estate overseas. Like other groups, education is a big draw. “A lot of Chinese kids go to college here because the Chicago area has some of the best colleges in the U.S.,” says Frost. “Each year a greater proportion of Chinese are coming. Either they graduate and buy the house themselves, or they rent from their parents or their parents buy it for them while they are in school. They’re in school here, they know Chicago, they’ve seen the city and the lake. It’s different from what they heard when they were in China, that it’s a gangster city. They love it here.”

Cash and the Delicate Nature of International Transactions

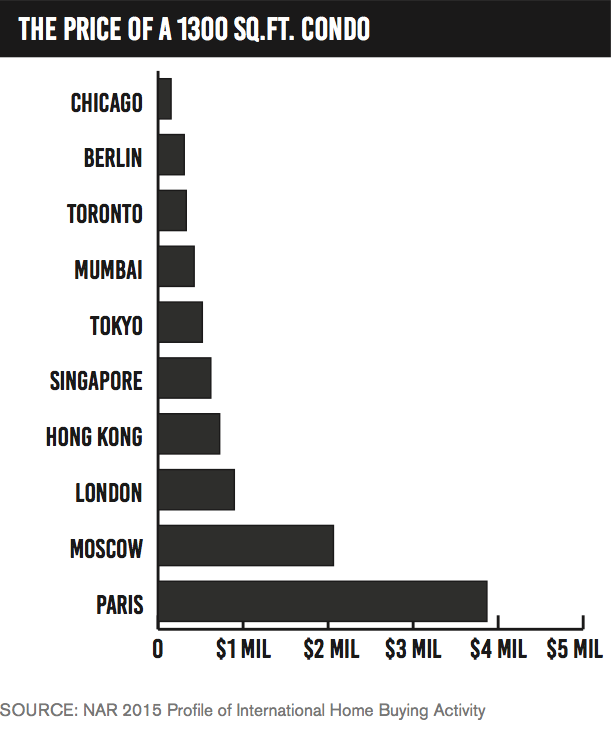

Despite the hurdles associated with buying a home in the United States from beyond its borders, in many cases it’s more affordable to purchase property in the U.S. than in the client’s home country. A foreign buyer may seek out properties that fill a specialized niche, such as homes where multiple generations of a family can live together. Some buyers are motivated by a desire to purchase a home in the U.S. as a display of their affluence, in which case properties that can establish and signal an individual’s status within the community are highly desirable. For example, a 1300-square-foot condo in the Chicago-Naperville-Joliet area costs an average of $163,800. In Hong Kong, apartment prices average $776,280, in London the average cost is $960,840 and in Moscow a condo goes for $2,209,800.

For buyers seeking properties that will help them generate an income, the U.S. offers a better return on investment than many other countries. NAR cited figures indicating that home prices in the United States are more likely to be undervalued relative to income than in other cities. In Great Britain, homes are 27 percent overvalued, and they are 35 percent overvalued in Canada, compared to 11 percent undervalued in the U.S.

Acquiring property in the United States is a long and exacting process for many international homebuyers. Apart from geographic difference and the culture shock that may come with their first visits to the U.S., they also deal with regulations governing money transfers and cash transactions, as well as bank policies regarding down payments.

Mortgage financing is a substantial hurdle for many foreign homebuyers, because their financial profiles often differ from what lenders are used to seeing for resident applicants. As a result, about 55 percent of all international buyers paid for their home in cash. These transactions carry with them an entirely different set of complications.

“In China, there is a rule that each person can exchange only $50,000 per year,” Frost said. “That’s nothing. Most properties I help them buy are $300,000 to $400,000 or more, so they have to come up with ideas for getting money here. If they already have someone living here who has a bank account, it’s easier because they can just transfer money into that account little by little. If they don’t, they have to decide how much they want to spend. Then I have the attorney set up an account for them with the money in escrow that we can use in closing.”