An International Marketplace

NAR’s survey distinguished between two types of international buyers. The first is resident foreigners who are recent immigrants to the United States and plan to spend more than six months in the country for work or education. The second is non-resident foreigners who have permanent addresses outside the U.S. and who spend less than six months out of each year stateside. They typically purchase homes as investment properties or vacation homes. Non-resident foreigners accounted for about $54.4 billion of the total dollar amount of international transactions, while $49.4 billion were attributed to resident foreigners.

Whether they are business executives or frequent travelers looking for a place to live during trips to the U.S., the parents of college students or savvy investors capitalizing on the city’s tight rental market, international buyers rely on local agents to help them find Chicagoland property.

“Some are coming because they already have connections here,” said Ronald Sears, a Century 21 S.G.R. agent who works with many international clients. “Some are coming because their children will be going to school here and they want to purchase a house or an apartment for them to stay in, rather than pay the high dorm fees. It’s economically feasible.”

Whether residents or non-residents, international homebuyers tended to purchase higher-end homes. The amount paid by foreign homebuyers has fluctuated in recent years, while trending sharply upward. In the year ending in March 2014, international buyers paid an average of $396,200 for a home in the U.S.

Chinese and Indian Buyers Flock to Chicago

Nationally, buyers from five countries accounted for 51 percent of overseas home purchases: Canada, China, India, Mexico and the United Kingdom. Nationally, China led all other nations in terms of the number of international buyers. Between Spring 2014 and Spring 2015, Chinese buyers purchased more units than all other nations for the first time, spending a collective $28.6 billion. Canadian buyers followed at $11.2 billion, then Indian buyers at $7.9 billion, clients from Mexico at $4.9 billion and those from the U.K. coming in at $3.8 billion.

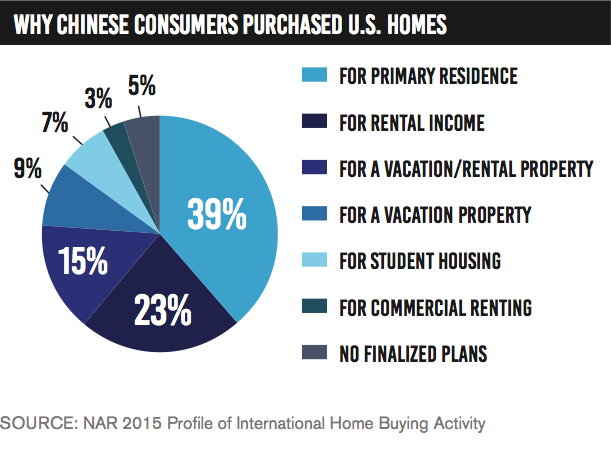

While the largest share of Chinese buyers (about 35 percent) favored California, Illinois tied Texas as the fifth most popular state to buy real estate in, attracting 4 percent of Chinese buyers, according to NAR. They purchased homes valued at an average of just over $831,000, the highest among international buyers. About 69 percent of those purchases were cash transactions. Most Chinese buyers – 39 percent – said their newly purchased home would be their primary residence; 23 percent said they would rent it out; 15 percent would be used for vacation and rental; 9 percent for vacation; 7 percent as housing for a student attending school in the U.S.; and 3 percent would be used for commercial rental. The remaining 5 percent had not finalized their plans.

Buyers from India also showed a high level of interest in Illinois, and 5 percent of Indian buyers chose a home in the state. Seventy-nine percent of buyers from India elected to use their homes as a primary residence.

The number of people who come to Illinois on a non-permanent basis – think college students and upper echelon business personnel – is growing. Last October, the NAR published a report titled “Business Data for Engaging in International Real Estate Transactions in Illinois.” It showed that the number of nonimmigrant individuals coming into the state from other countries rose from 1,021,476 to 1,197,625 in 2012, an increase from the 783,554 visitors recorded in 2009. Most of those visitors – 1,033,809 of them – are business travelers. Students and exchange visitors make up the second-largest group at 68,999, rising from 62,227 the previous year and from 49,924 in 2009. Temporary workers, diplomatic personnel and others made up the remainder.

NAR lists several factors that contribute to an international client’s decision to buy in a particular city. Proximity to one’s native country is a major consideration – clients from Mexico and Latin America tend to buy in Texas, Arizona, California and Florida. The presence of an established community of immigrants from the home country will also influence the decision to buy in a particular market, and the presence of relatives and friends is a particularly strong draw.

In the Chicago area, many international buyers purchase a house or condo to use during business trips. The city’s infrastructure, its burgeoning technology hub and the manufacturing facilities available in the city and suburbs draw tech companies seeking a foothold in North America. Chicago’s location in the Midwest, and its affordable prices relative to New York and Los Angeles, also make it a desirable market for international executives to consider.

Work and education are obvious motivations, particularly for management personnel who may need to stay in a U.S. city for months at a time, or for parents hoping to send their children to a top-flight urban university. A 2014 study by the Brookings Institution titled “The Geography of Foreign Students in Higher Education: Origins and Destinations” illustrates the importance of colleges and universities in drawing international buyers to Chicago. The Chicago-Joliet-Naperville region was home to 35,204 international students between 2008 and 2012. The area currently ranks sixth among U.S. metro areas with at least 1,500 international students, falling between Washington, D.C. and its suburbs in Northern Virginia and just ahead of the Dallas-Fort Worth area.

Data gathered for U.S. News & World Report’s annual college rankings for the 2014-15 school year shows that 30 percent of students at the Illinois Institute of Technology come from other countries, trailing only the Florida Institute of Technology and the New School in New York City among national universities. The University of Chicago, Northwestern University, Loyola University Chicago, DePaul University and the University of Illinois-Chicago also cracked the top 100.