![]()

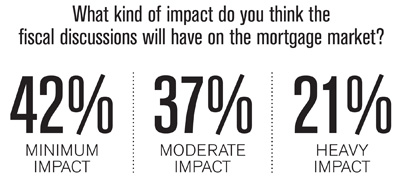

If bonds become less advantageous as our credit rating deteriorates, then interest rates could rise significantly, and much sooner than anticipated, which in turn will cause the housing market to collapse. A compromise will be reached, even if it is short of the ultimate goal, and there will be a significant reduction in spending and the so-called ‘entitlements,’ which in turn will keep interest rates low and the housing market will improve. All ‘experts’ seem to think these things are necessary for our economy to fully recover.”

Jim Haley

U.S. Lending & Finance, Ltd.

Mortgage rates will increase with a knee-jerk reaction after the fiscal cliff issue is resolved – although that should be followed by a market correction. Mortgage rate volatility in 2013 will be more dependent on inflation and the unemployment rate.”

Ron Haddad

Key Mortgage Services