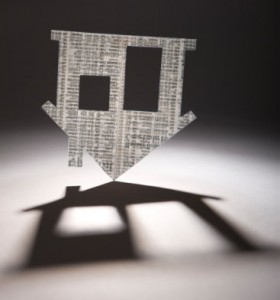

The shadow inventory, which may be as large as seven million homes, poses a threat to long-term housing stability.

There may be more than 3 million homes officially for sale nationwide, but a recent Miami Herald investigation has shown that millions of additional properties lay dormant in housing’s “shadow inventory,” many of them tucked away on bank’s balance sheets or going through foreclosure proceedings.

“The housing market’s ballooning shadow inventory — buoyed by a yearlong foreclosure slowdown — stands as its most menacing problem, threatening to stifle recovery for several years,” states the piece, which was exhaustively researched and written by Tolus Olorunnipa.

Officially listed at 3.5 million, the national inventory of homes is roughly nine months’ worth of properties. But as Olorunnipa found, once shadow inventories are factored in, that supply more than doubles to at least 7.5 million. A healthy housing market typically has about six months’ worth of properties on sale, or 2.4 million.

Jack McCabe, the CEO of McCabe Research & Consulting in Deerfield Beach, said the shadow inventory is an issue that has received far too little attention.

“A lot of people don’t understand how much inventory is set to come online in the next 18 to 24 months,” McCabe said in Olorunnipa’s piece. “When you compare what the Realtors show is inventory to what’s out there, you realize we have a long way to go.”

How long, exactly? Here are some of the stats Olorunnipa mentions:

- There are roughly 2.2 million homes stuck in the foreclosure process, many of the cases completely stalled.

- On top of that, 2.5 million homeowners are 30 to 60 days behind on payments, a sign of further foreclosure proceedings to come.

- In South Florida alone, which was the main focus of Olorunnipa’s research, 40,000 houses are owned by lenders but not yet for sale, 124,000 units have received initial foreclosure notices and 37,000 properties are 90 days or more behind on their payments.

- In all, estimates of the size of the shadow inventory range from 1.6 million to seven million homes.

Aside from the sheer volume of shadow properties, another complicating factor is how long properties often sit through the foreclosure process. Dennis Donet, a Miami foreclosure defense attorney, said his office is plagued by such cases.

“I’ve got dozens of foreclosure cases in my office that started in 2008 and are still open, with lenders doing absolutely nothing to move these cases forward,” Donet said.

And as Olorunnipa pinpoints on several occasions in her piece, all those factors threaten the long-term stability of housing, even when existing home sales, housing starts and construction have just started posting positive gains.