Government housing policy since 2008 has been a mixed bag, but the International Monetary Fund is suggesting that more government action, rather than less, may be the answer to the U.S.’ housing woes.

In its latest World Economic Outlook report, which was released Tuesday and covered by the Wall Street Journal, the IMF included a section on the world’s housing markets and advocated “bold” policies to reduce mortgage debt as home values fall.

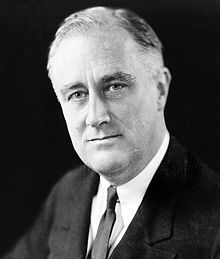

As examples of aggressive policies that worked, the IMF cited the United States during the 1930s, when the government-launched Home Owners’ Loan Corporation (HOLC) to restructured homeowner debt and prevented foreclosures, and Iceland, which has enacted similarly proactive policies in the wake of its own housing crisis.

“HOLC was established in 1933 because a series of earlier initiatives designed to stop the rising number of foreclosures had achieved little, and social pressure for large-scale intervention was high,” the IMF said in its report.

Though the program initially underestimated the scope of the era’s housing crisis and was marred by mismanagement (mostly because of the “lack of precedent” when considering the Great Depression), the IMF said that once HOLC was refined, it came to exemplify “a bold and broadly successful government-supported household debt restructuring program designed to prevent foreclosures.”

As the Journal noted, the earlier mishaps of HOLC are remarkably consistent with the problems that have plagued the Obama administration’s efforts to curb the present day housing crisis. Its programs, which are many, have failed to gain traction with both political parties, the Journal reported, and as a result, 2.4 million homes were still in foreclosure at the end of 2011, and only 951,000 mortgages have been permanently modified, which is less than 2 percent of all mortgages (and far beyond the administration’s original goals, as we’ve covered extensively).

The solution, according to the IMF, is a more drastic effort from Washington – at least one on the scale of HOLC, which purchased one million troubled mortgages, or, a fifth of all mortgages at that time, from lenders and negotiated new terms with the borrowers. Though the government did face about 200,000 foreclosures after the negotiation period, the IMF was clear that the efforts of HOLC did aid the overall economy.

“By making mortgage payments more affordable, it effectively transferred funds to households with distressed mortgages that had a higher marginal propensity to consume and away from lenders with (presumably) a lower marginal propensity to consume,” the study said.

HOLC also wrote off the principal on some mortgages, and principal reductions, as many of our readers know, has been a constant issue in housing policy. Would it not seem, though, that the principal reduction program lukewarmly supported yesterday by FHFA Acting Director Ed DeMarco is more of the same, and not the broad, aggressive program that the IMF called for?