New home sales were down monthly and up yearly, but the story is so much deeper than that.

By now you’ve surely seen the headlines – though new home sales in July were up 12.3 percent from last year, they were down 2.4 percent from June to a seasonally adjusted annual rate of 412,000, according to a new report from the Census Bureau.

Of course, beyond those numbers, there is considerably more information to parse through if one is to get a truly 360-degree idea of the new construction marketplace. Here are four angles to consider:

1. Prices Continue Rising – In July, the median sales price of a new home was $269,800, while the average sales price was $339,100. Those numbers are up 4.9 and 5.0 percent, respectively, from last year, and further demonstrate that in the post-boom housing market, new construction has gone to an increasingly wealthy, exclusive clientele (more on that in a moment!).

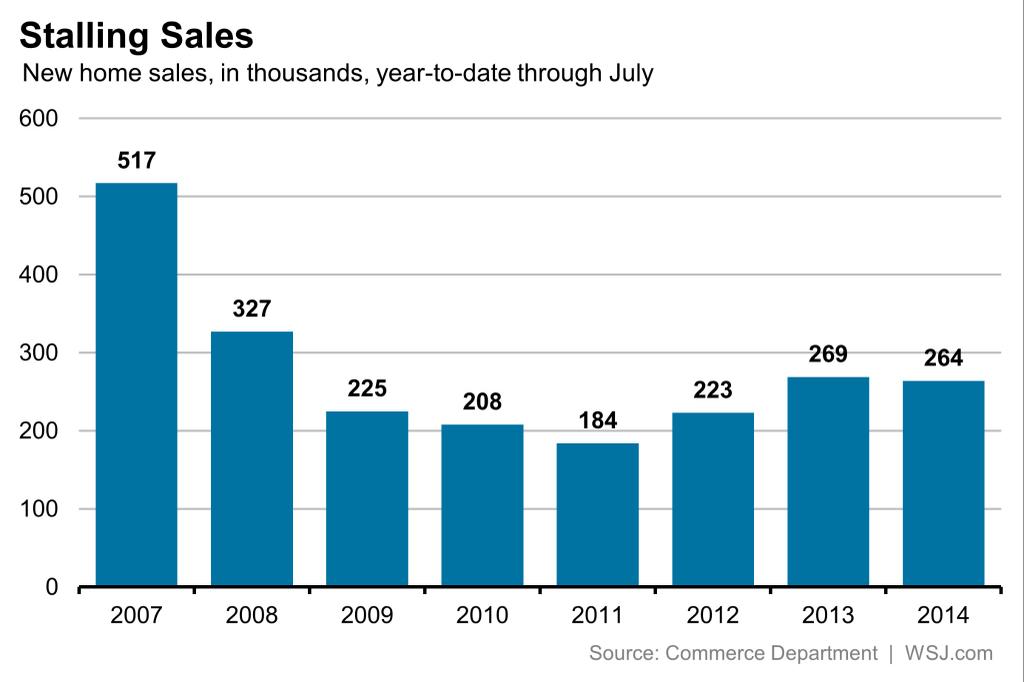

2. We’re Lagging Behind 2013 – Through July, new home sales are now running 2 percent below last year’s levels, further showing that 2014 will likely fall behind 2013’s exuberant performance. Here’s a great graph from The Wall Street Journal comparing the levels:

3. We’re Still WAY Out of Whack – Typically, there are six existing-home sales to every new home sale, meaning that the ratio of existing-to-new sales comes out to 6:1. Since the downturn, though, existing-home sales have made up a disproportionate share of the housing market, and in July, there were still 12.5 existing sales to every one new home sale, for a ratio of 12.5:1 – in other words, the market is still twice as lopsided as it should be.

4. The Inventory Question – Finally, new home inventory in July came out to 205,000, or a 6.0-month supply. Though that’s up 15 percent from a year ago, and though it’s the highest level of new home inventory in four years, and though it’s considered within a normal range by Bill McBride of Calculated Risk, some analysts are arguing that 2014’s low single-family housing starts are the reason for 2014’s low new home sales; because inventory remains historically low, the argument goes, sales remain depressed.

That is not quite accurate, though, and for one main reason – builders are only constructing new homes for consumers to can actually buy in the current market, aka wealthier, more exclusive clients who are fewer in number. As we reported last week, a shockingly high number of Americans cannot even cover a $400 emergency expense, so why would they be able to cover the downpayment on a new home? Thus, pending any wider economic growth, new home sales remain static.