Existing-home sales rose in February, as buyers slowly returned to the market to take advantage of more inventory and variety and despite elevated interest rates, the National Association of REALTORS® (NAR) said.

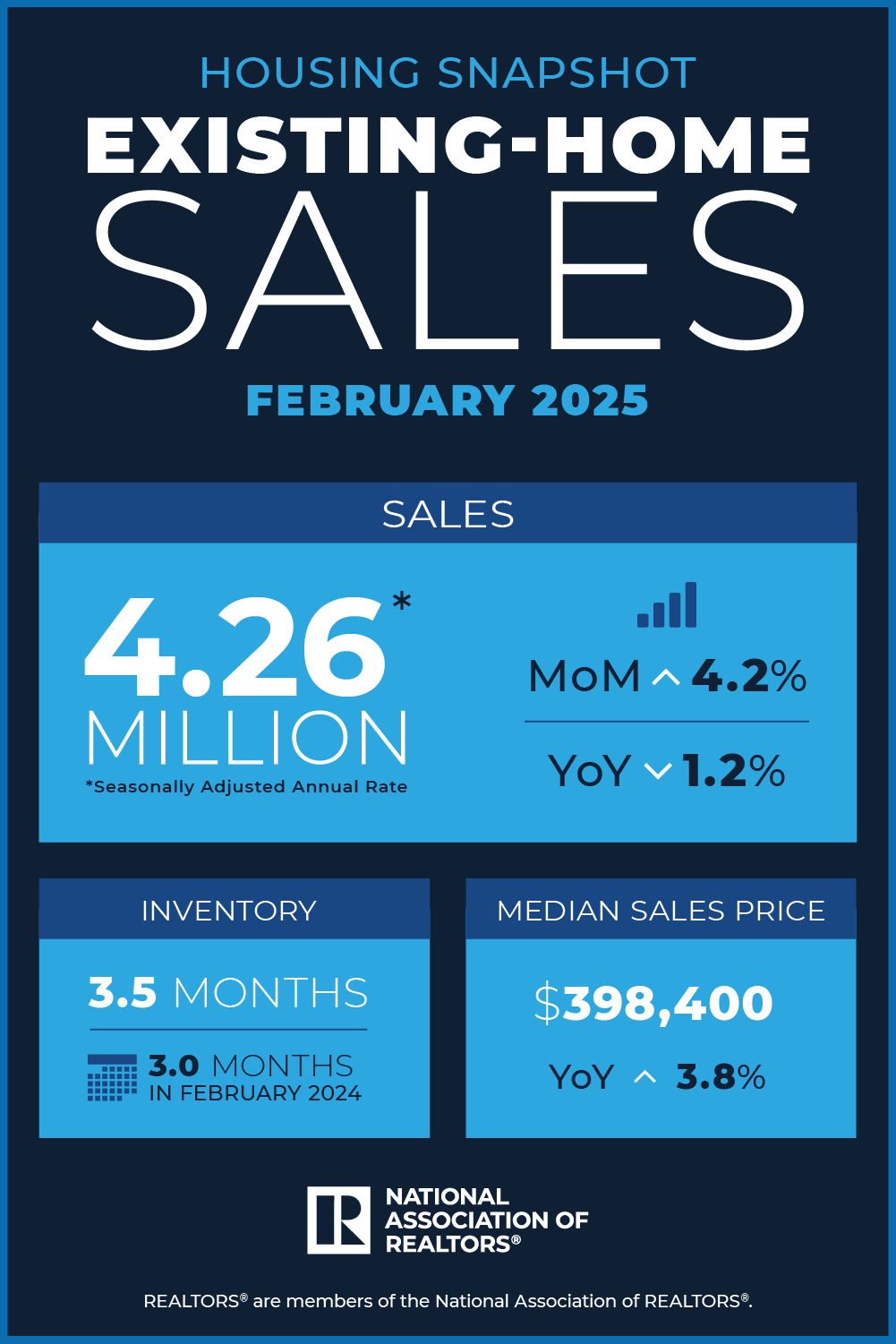

Specifically, sales rose 4.2% from January to a seasonally adjusted annual rate of 4.26 million. Year over year, sales were down 1.2% from 4.33 million in February 2024.

On a non-seasonally adjusted basis, February sales were down 5.2% year over year, NAR Chief Economist Lawrence Yun noted, but added that February 2024 had an extra day of business due to being in a leap year.

“After adjusting for this effect, combined with the winter seasonal factors, the momentum for home sales is flashing encouraging signs,” Yun said.

The 30-year, fixed-rate mortgage averaged 6.65% as of March 13, according to Freddie Mac. That’s up from 6.63% a week before but down from 6.74% a year earlier.

The median existing-home price for all housing types in February was $398,400, up 3.8% from its year-ago level of $383,800.

“Each one percentage-point gain in home price translates into an approximately $350 billion increase in housing equity for American property owners,” Yun said. “That means a gain of nearly $1.3 trillion in home value appreciation at a time when the current stock market is undergoing a correction. Moreover, the ongoing housing shortage, coupled with historically low mortgage default rates, implies a solid foundation for home values.”

By property type, single-family home sales jumped 5.7% month over month but slid 0.3% year over year to a seasonally adjusted annual rate of 3.89 million. The median existing single-family home price was $402,500, up 3.7% on a year-over-year basis.

Existing-condominium and co-op sales fell 9.8% from January to an annual rate of 370,000. The median existing condo price was $355,100, up 3.5% from February 2024.

Homes typically remained on the market for 42 days in February, up from 41 days in January and 38 days in February 2024.