Real estate investors re-entered the housing market in a big way in the second quarter of 2021, and Chicago is at the top of the list for investor purchases, according to a new report.

The study by online brokerage Redfin shows that investor home sales surged in the second quarter, jumping 208.8% from the previous year. While that percentage is somewhat of a statistical anomaly due to pandemic lockdowns in 2020, Chicago has still experienced the second-highest spike in investor purchases of the 41 large metro areas Redfin studied.

Chicago was No. 6 in the nation in terms of total houses sold to investors in the second quarter, with investors buying a total 2,680 homes. That represents 10.3% of the total market, at a value of $871.8 million, according to Redfin.

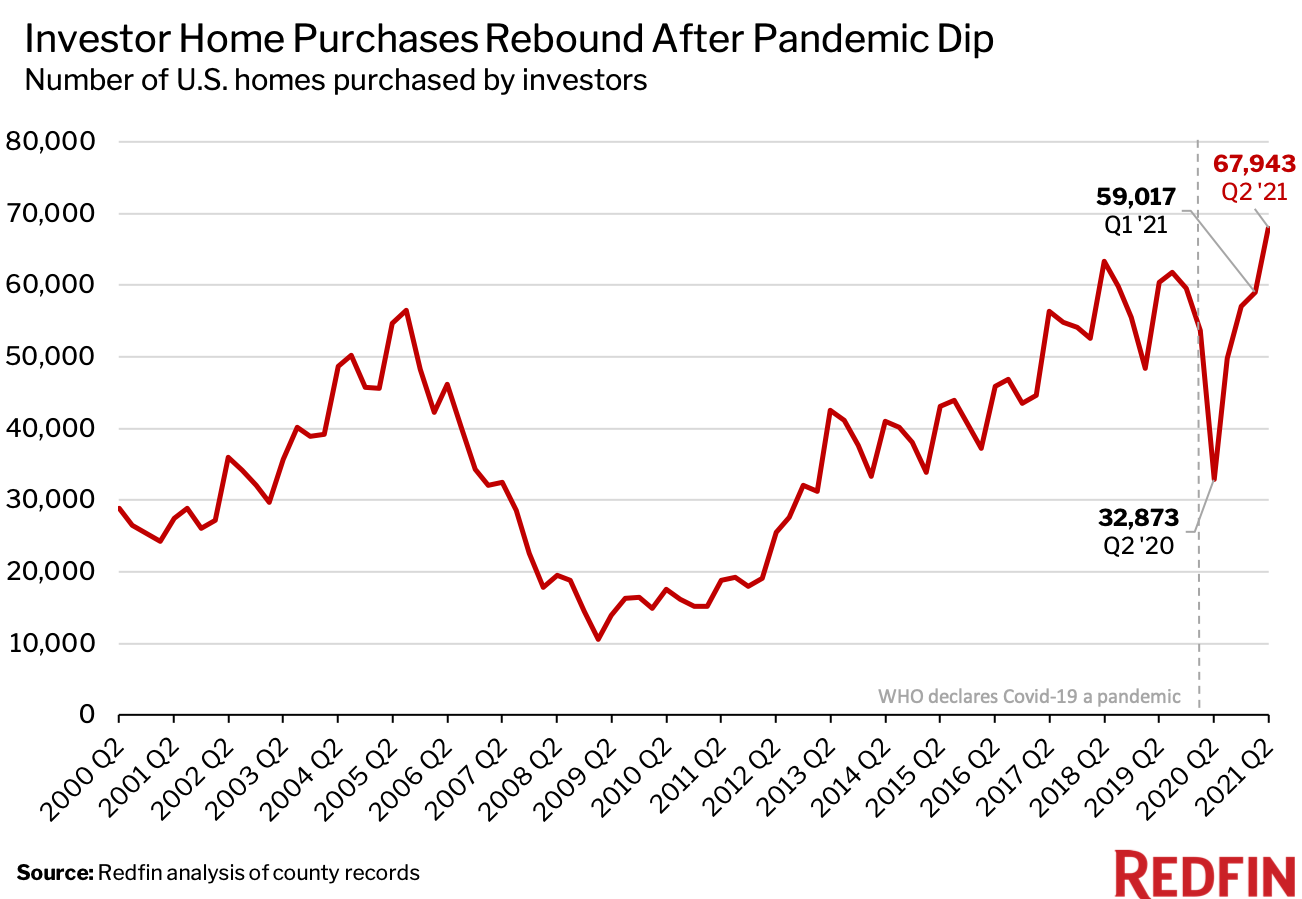

The study notes that Chicago is not alone — investment property purchases have spiked across the nation in the second quarter of 2021, climbing 15.1% from the previous quarter and jumping 106.7% from a year earlier.

Nationwide, investors are paying much more than they did a year ago, according to the report, which noted that the typical home was purchased for $439,600 in Q2 2021, up a staggering 23.7% from the previous year.

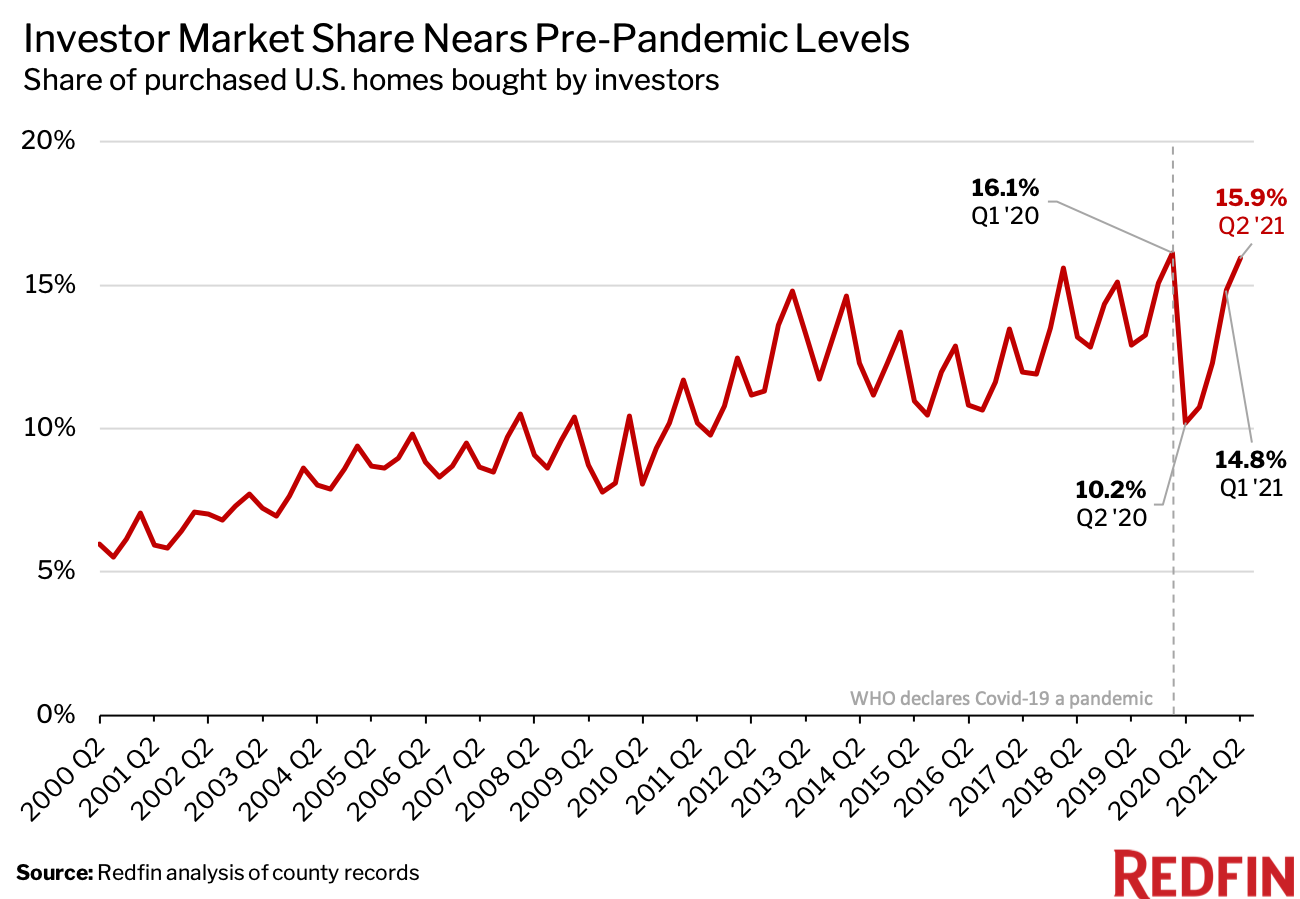

About one out of every six homes in the U.S. was purchased by real estate investors in the second quarter of 2021. It’s a return to levels seen prior to the pandemic, when investor purchases were at 16.1%.

Those soaring home prices are a big opportunity for investors, according to Redfin Senior Economist Sheharyar Bokhari. “With housing values consistently on the rise, solid returns are pretty much guaranteed — especially when you’re an investor who has access to extremely cheap debt,” she said in the report.

They’re also taking advantage of the fact that many first-time homebuyers are currently priced out of the market and forced to continue renting. “With so many Americans priced out of homeownership, investors can turn an easy profit by buying up properties and renting them out,” she said.

Bokhari added that investors’ return to the market poses challenges for first-time homebuyers in part because investors often bring cash to the table, which helps them win in multiple-offer situations. The report notes that nearly three quarters (74%) of investor home purchases in the second quarter were made with cash — that’s the highest level of cash offers since 2018.

That investor cash has increased the total percentage of homes purchased with cash, nationwide, in Q2, pushing the statistic to 30%, up from 25.3% in all of 2020.

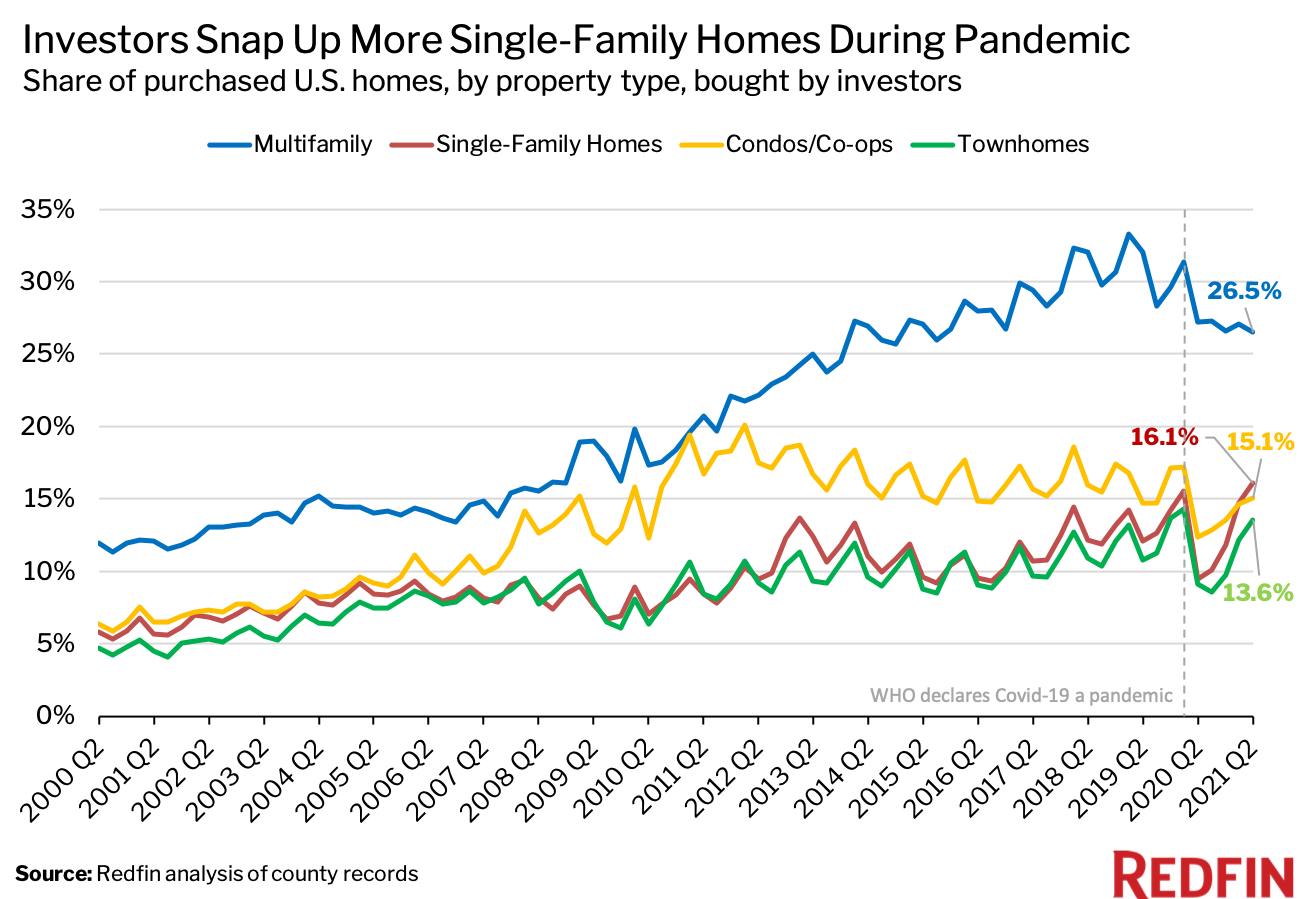

Investors purchased about 26.5% of all multifamily homes in Q2, down from a high of 33.3% in 2019. They also represent 16.1% of single-family home sales and 15.1% of condo sales for the quarter. That’s up from 9.4% and 12.4%, respectively, during the pandemic.

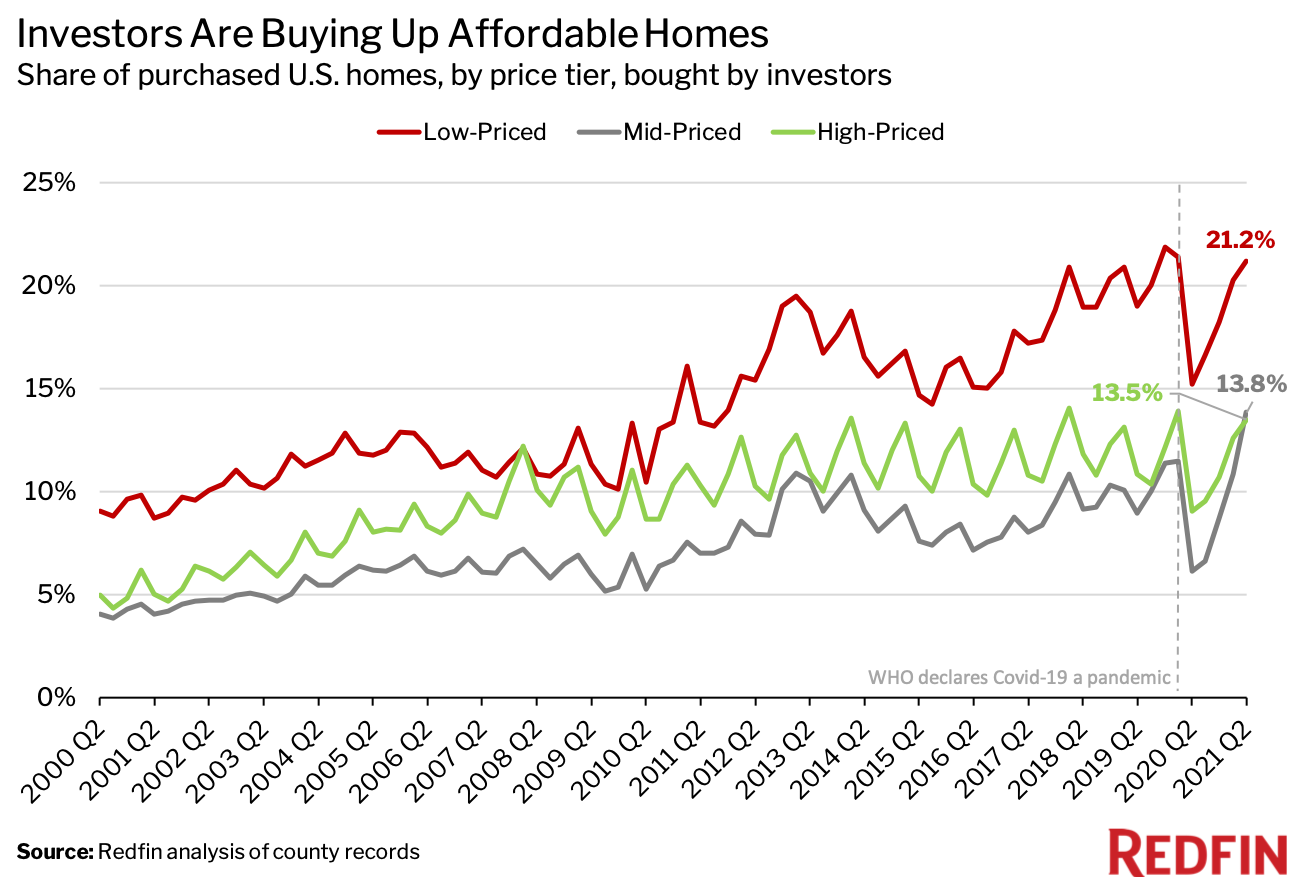

Low-priced homes have historically been, and continue to be, the preferred housing type for investors. They represented 21.2% of sales of low-priced housing in the second quarter, 13.8% of the mid-priced housing purchases and 13.5% of high-priced homes.

While Chicago has been a hot market for investment properties, Phoenix and Miami are the two biggest hot spots for investors, according to Redfin. Nearly a quarter of all home sales there in the second quarter were made by investors.

The study noted that the pandemic accelerated the trend of homeowners’ moving from large urban hubs to midsized cities, but many homebuyers, particularly first-time homebuyers, are being priced out of those markets.

“Home prices in Phoenix have been surging, which means a lot of longtime residents have been priced out of the market and need to rent. Investors are moving in, buying up homes and turning them into rentals,” said Kristi Penrod, a designated broker with Redfin in Phoenix. “Phoenix still feels relatively inexpensive to a lot of investors — especially those who have been doing business in pricier cities like San Francisco or New York.”