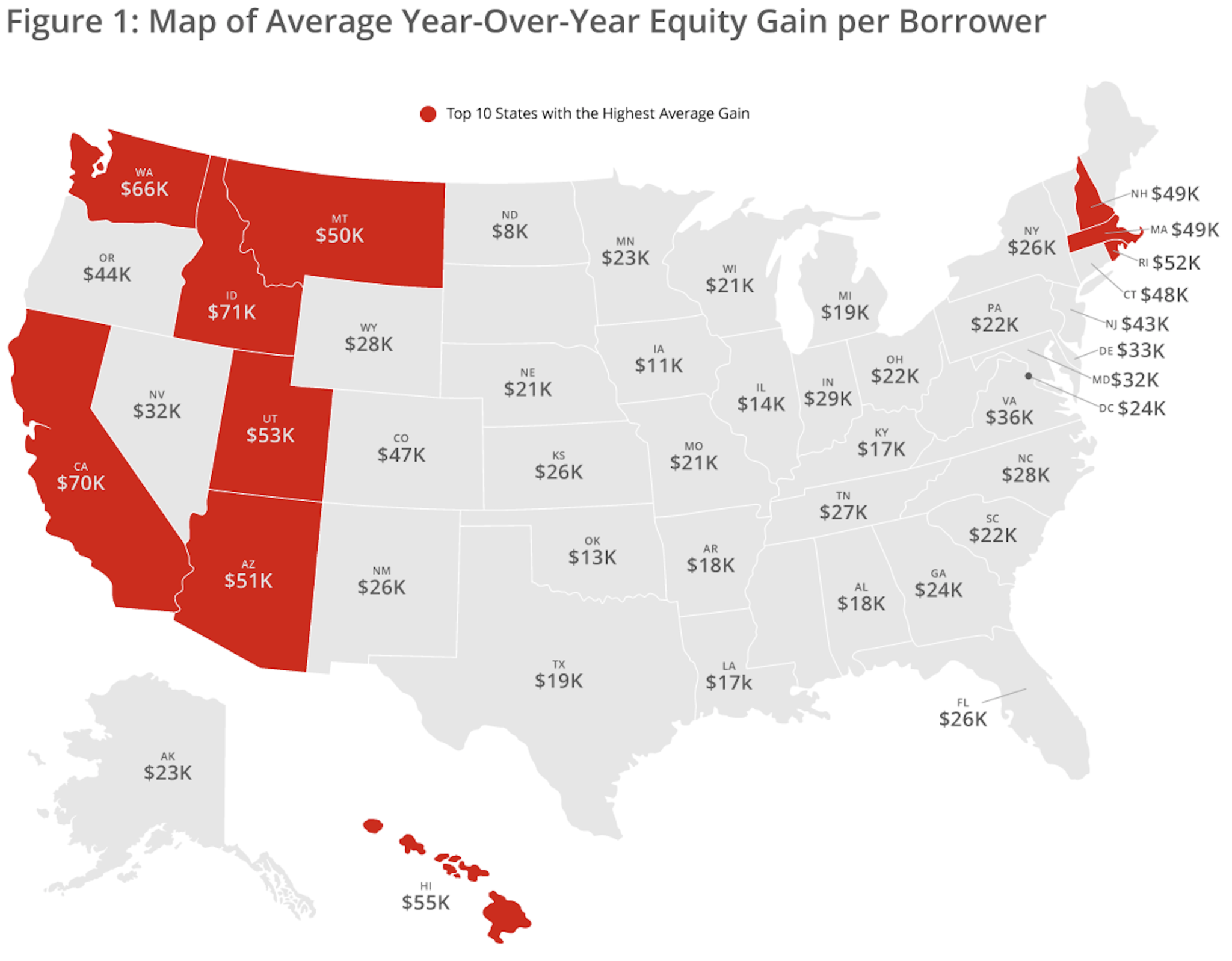

Map courtesy CoreLogic

The average U.S. homeowner has seen the equity in their home increase by nearly 20% year over year for the first quarter of 2021, according to CoreLogic’s Homeowner Equity Report.

That 19.6% increase represents a combined increase of $1.9 trillion or about $33,400 per borrower, the report noted.

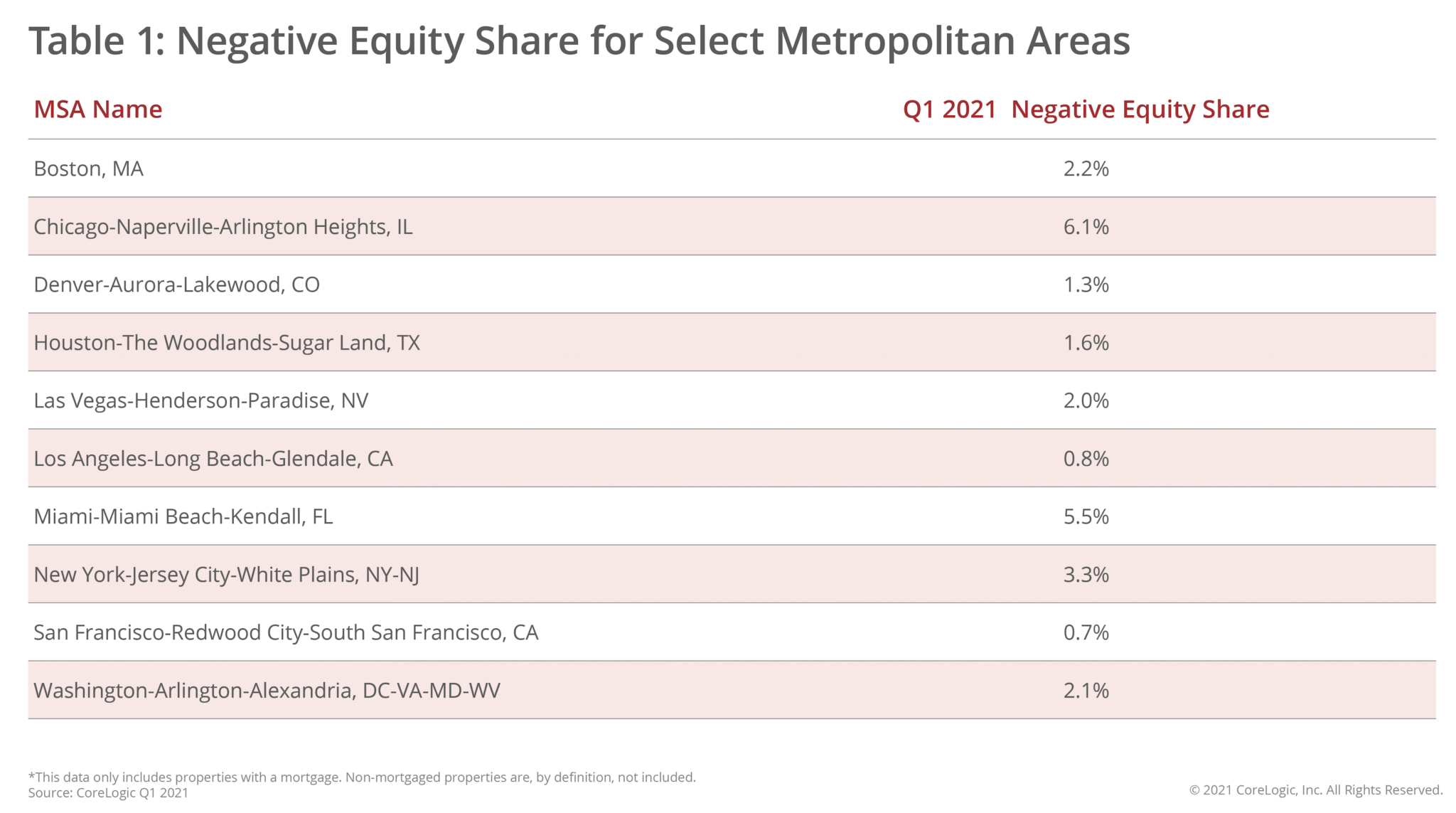

CoreLogic says the boost in equity will help stave off foreclosures, but the share of homes underwater in the metro Chicago area was at 6.1% at the end of the first quarter of 2021, outpacing the national rate of 2.6%.

Nearly three-quarters of survey respondents (74%) said they are not concerned that they’ll owe more than the house is worth over the next five years.

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic,” CoreLogic President and CEO Frank Martell said in a press release. “These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who’ve experienced years of price appreciation.”

Courtesy CoreLogic

Dr. Frank Nothaft, chief economist for CoreLogic, said the CoreLogic Home Price Index experienced an increase of 11.4% over the past year, resulting in pushing the average level of equity up to $216,000.

“This reduces the likelihood for a large numbers of distressed sales of homeowners to emerge from forbearance later in the year,” Nothaft said.

The report added that in the first quarter of 2021, the number of underwater homes dropped by 7% to 1.4 million. That makes up 2.6% of all properties with a mortgage.

Looking forward, a 5% increase in home prices would mean 195,000 homes would regain equity, while a 5% decrease would result in another 260,000 sliding underwater.