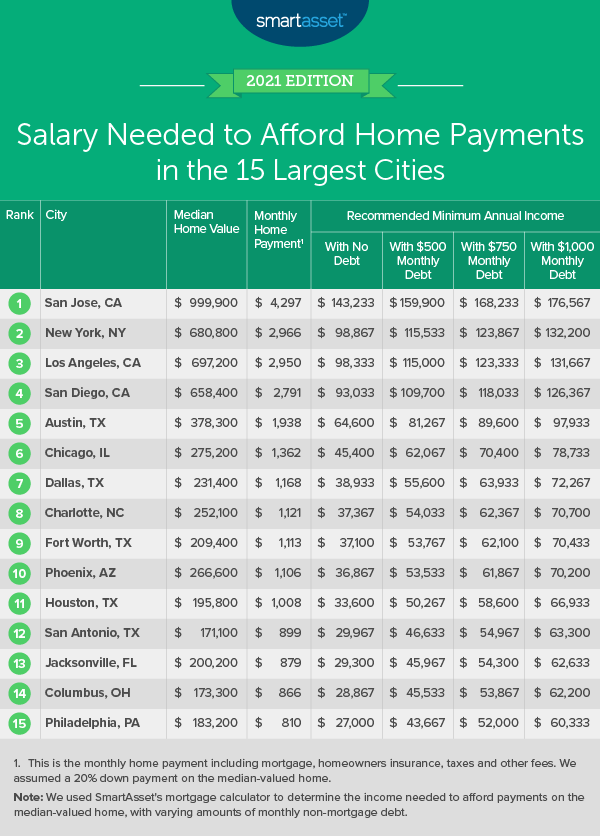

Out of the 15 largest municipalities in the country, Chicago has been ranked No. 6 in terms of how much a homeowner must earn in order to keep up with their monthly mortgage payments, according to a study by personal finance website SmartAsset.

The website, which notes that housing costs take up about one third of average spending for households, configured data by assessing the median home value and mortgage payment to show the minimum level of income necessary. SmartAsset recommends homeowners not exceed a 36% debt-to-income ratio.

In Chicago, the median home price is $275,200 and the median monthly payment $1,362. The recommended annual income with no debt was $45,400. If one owes more than $1,000 in debt, then they will need to make about $78,733 a year to afford home payments.