While the existing-home sales data out today was mixed at best, contract activity points to a brighter autumn season. Examining data out this week from the Mainstreet Organization of Realtors, it’s clear that the market began getting back on the move in June. Last month, 45.4% more detached single-family homes went under contract in Chicagoland than in the same month last year. While the market for condos and townhomes wasn’t as hot, attached homes also went under contract at a significantly greater clip than in 2019, marking a 28.9% increase over last year.

Image: Illinois Realtors

The suburbs that saw the biggest change in year-over-year contract activity were Chicago Heights (with a 138.1% increase in the number of homes under contract), La Grange (133.3%), Hainesville-Grayslake (117.8%) and Wheeling (114.3%). The interactive map embedded below shows more detail across the suburban region.

Looking at the full Chicagoland picture, the MORe data was underscored by information released yesterday in Midwest Real Estate Data’s weekly report. Its market snapshot, which looks at all of MRED’s coverage area, including the city, showed an increase over the previous week, with a 3% gain in contracts, and a major boost when looking at year-over-year data. Contract signings were up an impressive 59% for the week ending July 20, when compared to this same time last year.

MRED reported that the median home price was up 6.5% for the week, while MORe’s year-over-year pricing data was a bit lower in terms of gains. The association found the median sale price in the suburbs was up only slightly to $287,000 for attached homes in June, compared to $286,900 at this time in 2019. Prices for detached properties rose 1.7%, from $175,000 in June 2019 to $178,000 last month.

While having homes under contract certainly isn’t the same thing as closed sales, it does bode well for the future. “We expect to see many of these contracts from May and June convert to finalized sales in July and August,” MORe CEO John Gormley said in a press release. “The time it takes for a house to go from contract to closing has remained relatively stable, because our industry was quick to introduce virtual closings and other workarounds to allow business to continue safely during the pandemic.”

The association noted that this expectation will likely hold even if the state has to roll back to Phase 3 of its opening plan. “We understand the virus a little bit better now and have policies and procedures in place to protect buyers, sellers and Realtors,” MORe Board of Directors President Brian Kwilosz said. “We expect to see homes continue to go on the market and sell throughout the summer.”

Still, Kwilosz suggested buyer’s agents may have to prepare their clients to work a little harder to get to the closing table than usual. “If you’re serious about purchasing a home, ask your Realtor to connect you to a mortgage lender so you can get preapproved for a mortgage now and make an offer as soon as you see the home you want,” he said.

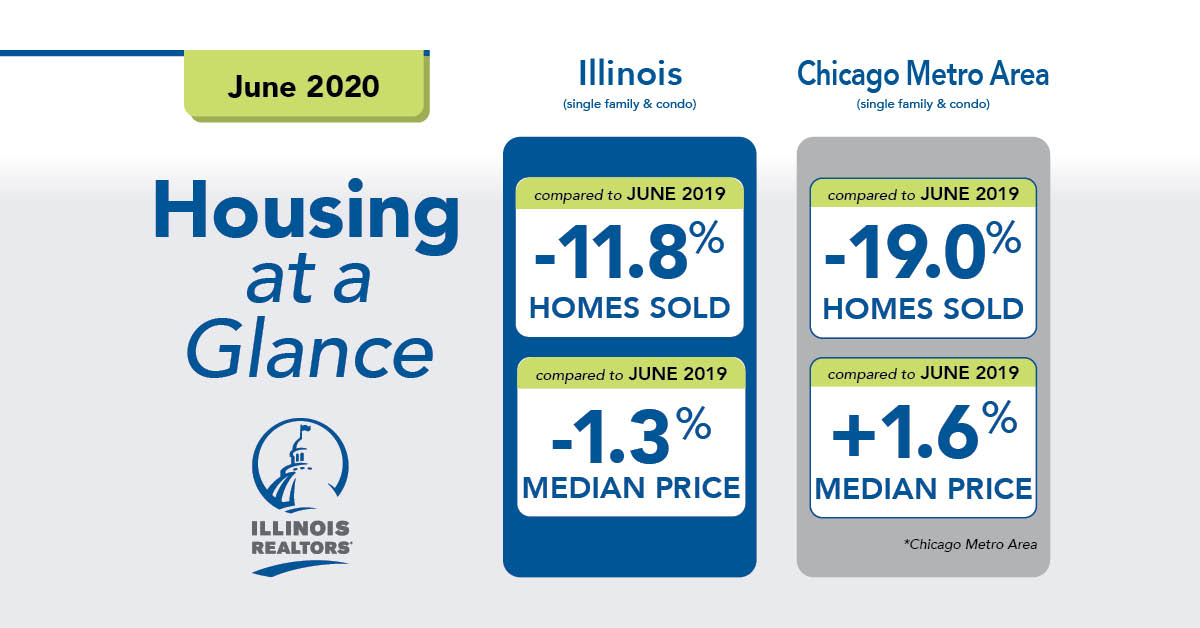

Shifting to actual sales, Illinois Realtors reported today that, while June’s numbers are lower than last year, they’re still up from last month. Statewide sales of single-family homes and condominiums were down 11.8% from June 2019. The slide in Chicagoland was even steeper; sales in the nine-county Chicago Metro Area were down 19% year over year in June and 29.1% in the city of Chicago. Statewide, month-over-month gains were 28.8% in June, while in the metro area and city they were 27.1% and 19.1%, respectively.

“It was a big improvement from May, and prices continue to hold steady,” said Maurice Hampton, president of the Chicago Association of Realtors. “The 20.2% decline in inventory definitely plays into these sales declines, as more options lead to more opportunities for homebuyers.”

Homes available for sale in June declined 30.6% year over year and it took 22.2% longer to sell a home in June this year compared to last.