If your investor clients are nervous about purchasing multifamily properties in 2020, they’re not alone. In the 2020 National Multifamily Index released this week by Marcus & Millichap, a commercial brokerage and advisory firm based in California, executives addressed some of the main causes for concern on the very first page.

Outlook for Chicagoland in Marcus & Millichap’s 2020 National Multifamily Index

“Many unknowns await investors in the coming year as the presidential election, risks of a resurgent trade war with China and an impending Brexit loom on the horizon,” read the opening letter from John Sebree and John Change, both senior vice presidents and directors for Marcus & Millichap. Still, they noted that bright sides remain for the sector. “But the strength of the employment market and positive demographic drivers that reinforce apartment housing demand will favor multifamily real estate.”

The concerns about overbuilding that dominated discussions over the status of the multifamily market in the past year or two seem to have dissipated. “Despite the significant inventory gains, developers have been effective in aligning new supply with job creation and population growth, keeping most markets in the U.S. in balance,” the report said. At the national level, the researchers identified workforce housing as an “anchor” for multifamily, and also pointed to secondary and tertiary markets as those with the greatest potential.

Chicago moved down nine spots in the rankings this year, coming in at No. 37 on the 50-city index. Researchers blamed slower employment growth, high taxes and financial uncertainty for the lower placing.

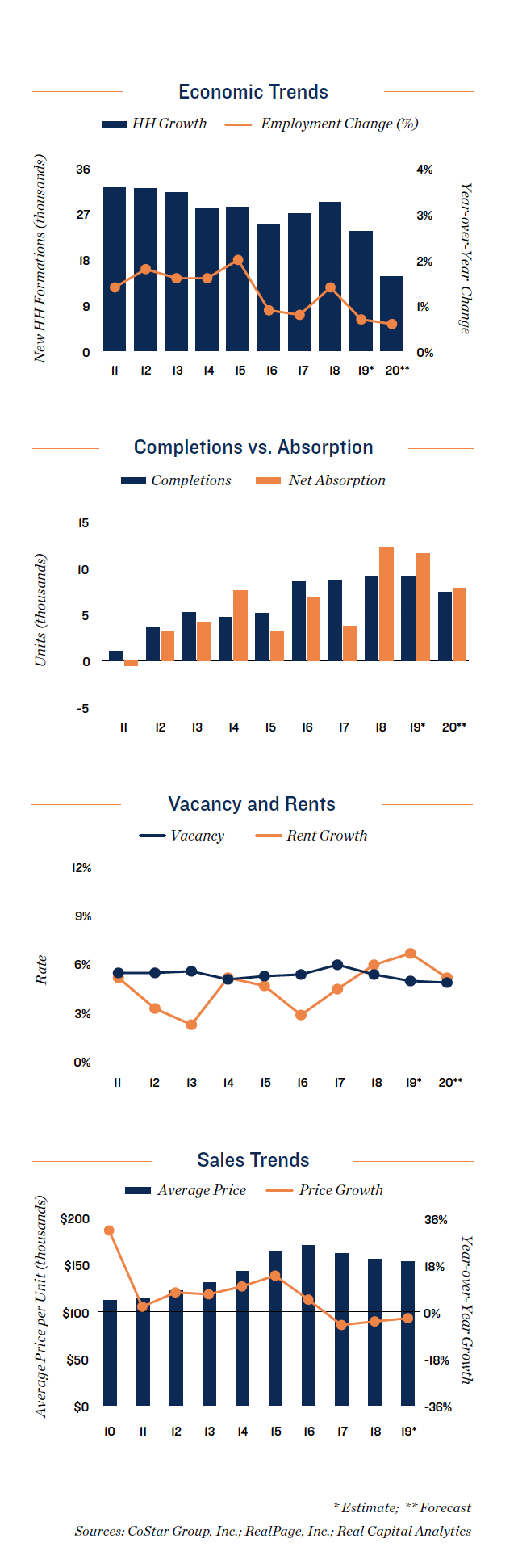

However, the report did note a few bright spots. Researchers predicted average effective rent will rise 5.1 percent to $1,663 per month. This continued rent growth will be driven by the urban core, particularly thanks to employment growth fueled by the technology sector. Marcus & Millichap expect suburban rents to remain even with what they are today, with vacancy under the 4 percent mark. Researchers called out Chicagoland areas along major transit arteries, especially in Aurora and Naperville, as being particularly attractive to buyers.

The report predicted construction in 2020 will be at 7,400 units for the metro area, a decrease from the 9,100 delivered last year. Perhaps unsurprisingly, much of the construction activity in 2020 is projected to remain in the West Loop and Near North Side, but other neighborhoods (Logan Square, Ukrainian Village, Uptown, Wicker Park and areas around Lincoln Yards) are expected to see new supply as well.

It’s well known that investors hate uncertainty, which is why Cook County Assessor Fritz Kaegi’s property tax reassessment weighs heavily on the firm’s outlook. “The assessor still has at least a year before the entire county has been reassessed, but increases witnessed in suburban submarkets offer insight into what could be in store for county apartment owners,” researchers noted.

Another uncertainty mentioned in the report is the fact that Illinois is one of the handful of states where legislators are considering rent control. The report made note of the fact that, while cities such as New York, San Francisco and Washington, D.C., have had rent control in place for decades and still have a robust apartment investment market, the three states — California, New York state and Oregon — that enacted rent control last year saw a decline in this type of activity. They added that areas that are not considering rent control could benefit from the legislation elsewhere, as multifamily investors seek new markets to avoid the uncertainty of those that have these new laws to contend with.