According to the Summer 2012 Merrill Edge Report, many Americans in the mass affluent category are willing to make short-term sacrifices in order to get their finances in better shape. The report, released in April by Bank of America, explores the financial concerns and priorities of mass affluent consumers, or, Americans with $50,000 to $250,000 in investable assets.

This group, which consists of approximately 28 million households in the United States, has also shown, over the last six months, a rising concern over a number of financial issues, such as the cost of healthcare and being able to afford the lifestyle they want in retirement.

Key findings about lifestyle sacrifices this group is willing to make include:

• Seventy percent of mass affluent Americans say they took on home improvement projects in the last year, such as plumbing, painting and home cleaning, that they would normally hire someone else to do.

• Younger members of the mass affluent segment were more likely to embark on these home improvement projects than their older counterparts.

• Eighty-four precent of 18- to 34-year-olds took on a project compared to 77 percent of 35- to 50-year-olds and 60 percent of those aged 65 and older.

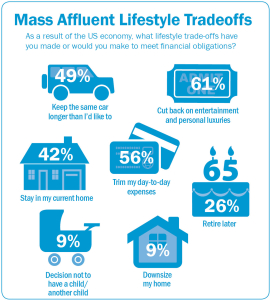

Other methods this group will utilize in order to meet financial obligations, according to the report, include cutting back on entertainment and personal luxuries (61 percent), trimming day-to-day expenses (56 percent), and keeping the same car longer than they’d like to (49 percent).

Other methods this group will utilize in order to meet financial obligations, according to the report, include cutting back on entertainment and personal luxuries (61 percent), trimming day-to-day expenses (56 percent), and keeping the same car longer than they’d like to (49 percent).

“It is important for affluent Chicagoland residents who may be thinking about purchasing higher-end properties to know that there are loan options available for them,” says Bill Schwers, a Bank of America regional sales executive who oversees the Illinois region. “I always recommend talking with an experienced lender early on in your client’s home search to go through the numbers and see what their best option is. We originate jumbo loans to Chicagoland residents every day, and have done so even through the economic downturn. Now, we’re beginning to see some positive movement in the number of large home sales in the Chicago area.”

Schwers adds the Merrill Edge Report findings can help agents get into the luxury market and work better with luxury clients and the mass affluent group.

“It’s important for agents to get into the mindset of the mass affluent segment,” he says. “This segment of consumers lead very busy lifestyles, and, while purchasing a home is a top personal priority, they need their agents to go that extra mile. Agents focused on the mass affluent and luxury clients need to be extra flexible and have an ability to cater to busy schedules — be sure you are always available by phone and that you can meet clients in the location of their choice when they want to talk face to face.”

Merrill Edge Report Methodology

Ketchum Global Research and Analytics and Braun Research conducted the Bank of America Merrill Edge Report survey by phone between Feb. 13 and Feb. 29, 2012 on behalf of Bank of America. Braun contacted a nationally representative sample of 1,000 Americans in the United States with investable assets between $50,000 and $249,999, and oversampled 300 mass affluent in San Francisco and Los Angeles. The margin of error is +/- 3.1 percent for the national sample and +/- 5.7 percent for the oversample markets, with both reported at a 95 percent confidence level.

To help inform the Merrill Edge Report, Communispace conducted a series of qualitative studies including interactive conversations, surveys, and other dynamic and exploratory activities with its proprietary online community of 300 mass affluent consumers.

Bill Schwers is the Regional Sales Executive, Sr. V.P. for Bank of America Home Loans in the Chicago, IL/IN/KY/WV market areas. Bill joined Bank of America in November of 2004 where he held the position of Area Sales Manager, Senior Vice President. Bill is responsible for all mortgage lending activities in one of the fastest growing markets in the country. With the addition of LaSalle Bank and Countrywide, Bank of America Home Loans is now one of the largest residential lenders in the greater Chicagoland market.