The U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of the Treasury just released the Obama Administration’s Housing Scorecard for March, showing improvement in some areas from previous months.

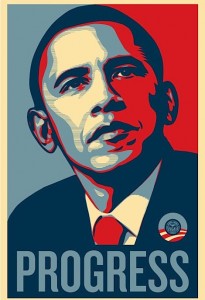

Raphael Bostic, an assistant secretary for HUD, said the scorecard shows progress for the administration’s housing proposals.

“The data this month show that we’re making important progress in providing relief to homeowners under the Obama Administration’s programs,” said. “With fewer borrowers falling behind on their mortgages and some 425,000 families taking advantage of our enhanced Home Affordable Refinance Program – standing to save on average $2,500 per year – it’s clear that the Administration’s efforts continue to provide significant positive benefits.”

The scorecard provides important information on the health of the housing market and the impact of the Administration’s foreclosure prevention programs, including: market data on home sales and mortgage delinquencies, which shows progress but continued fragility overall; mortgage delinquency rates, which continued a downward trend and are substantially below year ago levels; and foreclosure completions, which ticked downward last month, though increased activity is expected in the coming months as firms lift processing delays following the landmark mortgage servicing settlement reached with the five largest banks in early February.

The Administration’s recovery efforts, which are meant to help millions of families deal with the worst economic crisis since the Great Depression, continue to encourage improved standards and processes in the industry, with HOPE Now lenders offering families and individuals nearly 2.8 million proprietary mortgage modifications through January.

As of February, more than 970,000 homeowners received a permanent HAMP modification, saving more than $530 on their mortgage payments each month. Homeowners in HAMP permanent modifications have saved an estimated $11.6 billion to date.

Administration’s Housing Scorecard also featured the housing market strength in Chicago and the surrounding communities. The Chicago metro area was one of the hardest hit areas in the nation following the housing market downturn and an area where the Administration’s broad approach to stabilizing the housing market has been very active.

The report shows that home sales in Chicago remain at low levels, and new home sales have been declining since 2005, but leveled off by 2009. Bank-owned properties and short sales remain high at 35 percent of existing home sales in the Chicago market compared to 29 percent nationally, which contributes to continued weakness in Chicago home prices.