Hispanic homeowners are narrowing the home value gap with white homeowners both nationally and in Chicago, according to a new report.

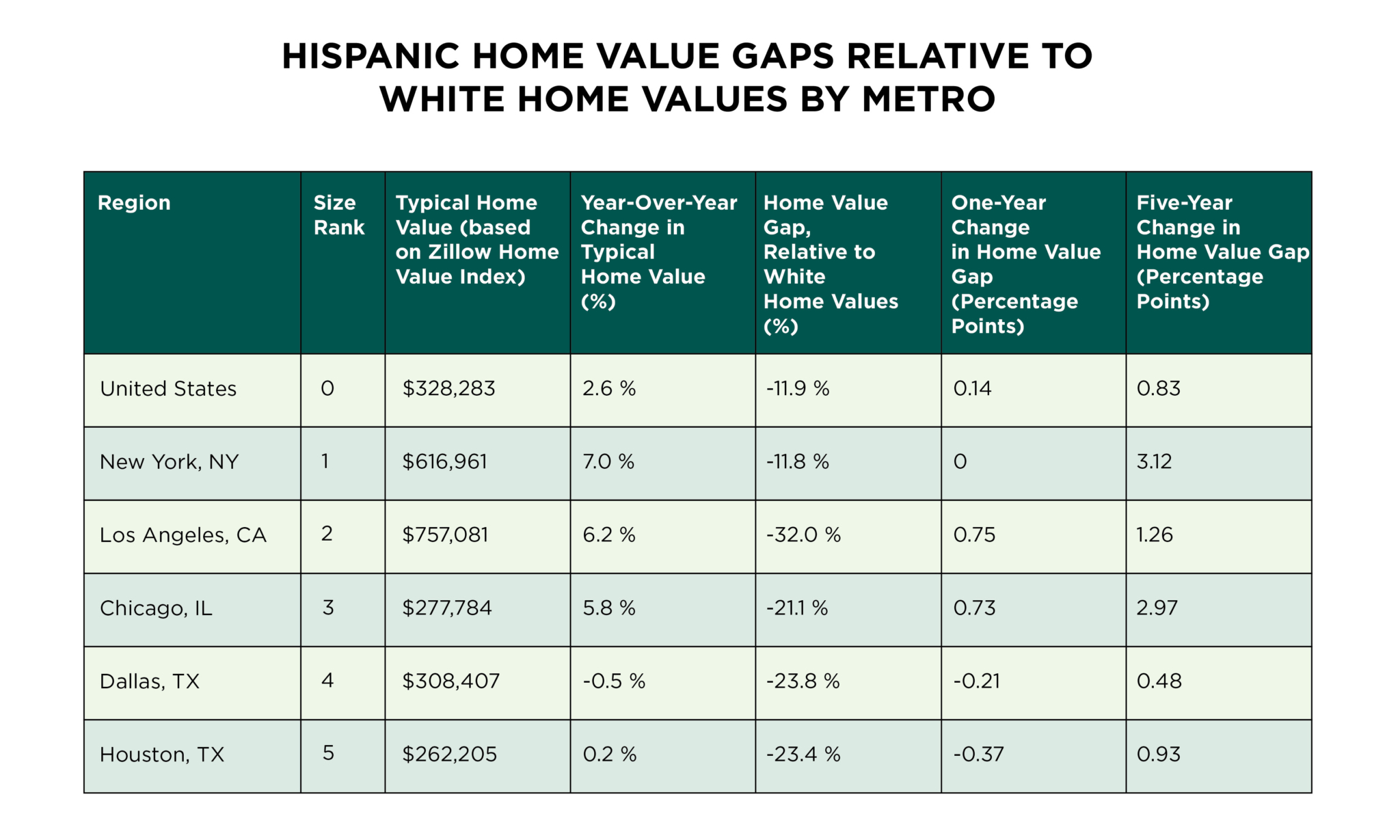

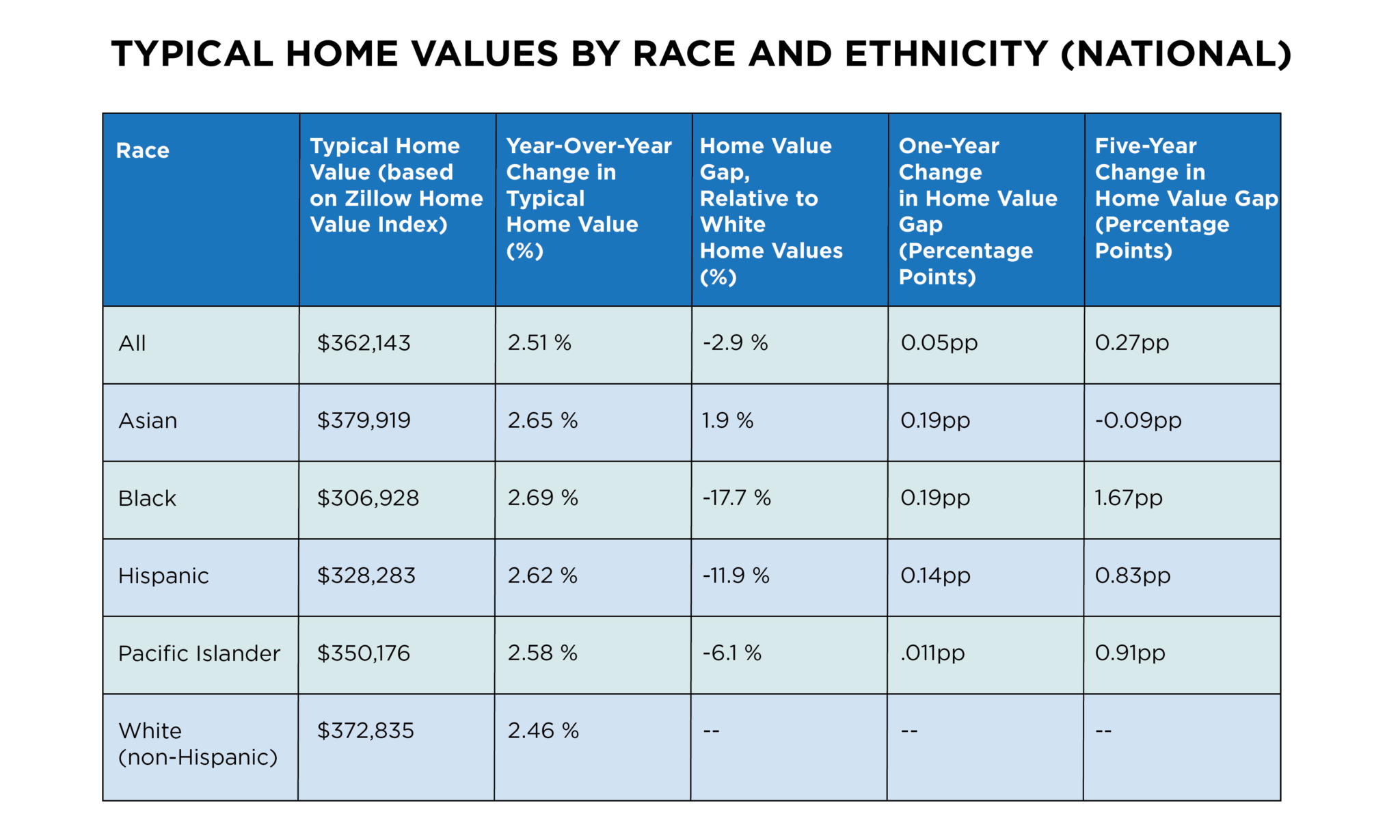

A Zillow analysis found that Hispanic-owned homes in the U.S. are worth 11.9% less than homes owned by non-Hispanic white households, the smallest percentage gap on record. That’s down from 12.1% last year and 12.4% in December 2021.

“Homeownership stands as a cornerstone for building wealth, yet systemic barriers have unfairly hindered many people of color from acquiring homes valued comparably to those of their white counterparts,” said Treh Manhertz, Zillow senior economic research scientist. “Efforts to improve access to down payment assistance, credit-building programs, zoning reforms and affordable housing construction and preservation in desirable areas are key initiatives to help this progress continue.”

The national home value gap is smaller than it is in Chicago, where the value difference between Hispanic-owned homes and white-owned homes in Chicago is 21.1%. That percentage gap ties Chicago with Detroit for 10th largest among the 100 cities measured by Zillow. Los Angeles has the largest gap, at 32%.

The national home value gap is smaller than it is in Chicago, where the value difference between Hispanic-owned homes and white-owned homes in Chicago is 21.1%. That percentage gap ties Chicago with Detroit for 10th largest among the 100 cities measured by Zillow. Los Angeles has the largest gap, at 32%.

There is evidence that the gap is narrowing in Chicago faster than in many other communities, though. The 21.1% gap is down 0.73% from last year and 2.97% compared to five years ago. Both percentage drops were among the 20 largest among cities in the analysis.

Zillow also found that the value gap among Black-owned homes has narrowed compared to that among whites, to 17.7% from 17.9% the previous year. That 17.7% gap is higher than it was in 2022, when it was 17.2%. And the gap was smaller still in 2007, at 16.3%, shortly before the Great Recession.

The value gap between homes owned by Pacific Islanders and those owned by whites is 6.9%. Asian-owned homes are valued 1.9% higher than white-owned homes, Zillow found.

“The jump into homeownership remains a significant hurdle for Hispanics,” the Zillow report said. “Hispanics represent 18% of prospective buyers but 13% of successful purchasers. Data from the Home Mortgage Disclosure Act shows that Hispanics face higher fees when purchasing a home, averaging $2,812 compared to the national average of $2,072. Mortgage denial rates are also notably higher for Hispanic borrowers, with 18.8% experiencing denials compared to 10% for non-Hispanic whites, often due to elevated debt-to-income ratios, which account for 38% of denials.”

Zillow’s findings of a narrowing home value gap align with the conclusions in the 2024 State of Hispanic Wealth Report published by the National Association of Hispanic Real Estate Professionals (NAHREP).

The NAHREP wealth report dispelled the myth that Hispanics purchase homes primarily in moderate- to low-income neighborhoods. In fact, 71% of home purchases made by Hispanics in the U.S. in 2023 were in middle- to upper-income areas, the report found. Only 4% of home purchases by Hispanics were made in low-income census tracts.

One of the goals of NAHREP and a factor in finding balance and equity for Hispanics in the real estate market is increasing the number of Hispanic and Latino Realtors. The NAHREP report noted that while 19.1% of the country is Hispanic or Latino, only 10% of Realtors are Hispanic or Latino. That is a slight increase from 9% in 2018, but there is more progress to be made, according to the report.

“Fortunately, the industry is diversifying: among REALTORS® with 16 or more years of experience, only 7% are Latino, whereas among those with two years of experience or less, 19% are Hispanic or Latino,” the report said.

Other long-term real-estate-related goals by NAHREP include increasing the rate of Hispanic homeownership to 50%. It was 49.5% in 2023.

The association also aims to increase the rate of Hispanic-owned investment properties. In 2013, 3.8% of U.S. Hispanics owned an investment property, while more than 7% of the rest of the population did. Today, the investment property ownership among non-Hispanics has dropped to 5.8%, while the Hispanic investment property ownership rate remains the same, at 3.8%.