A new study by Redfin indicates that despite rising mortgage rates, soon-to-be buyers are still in the market, even if it means making some compromises.

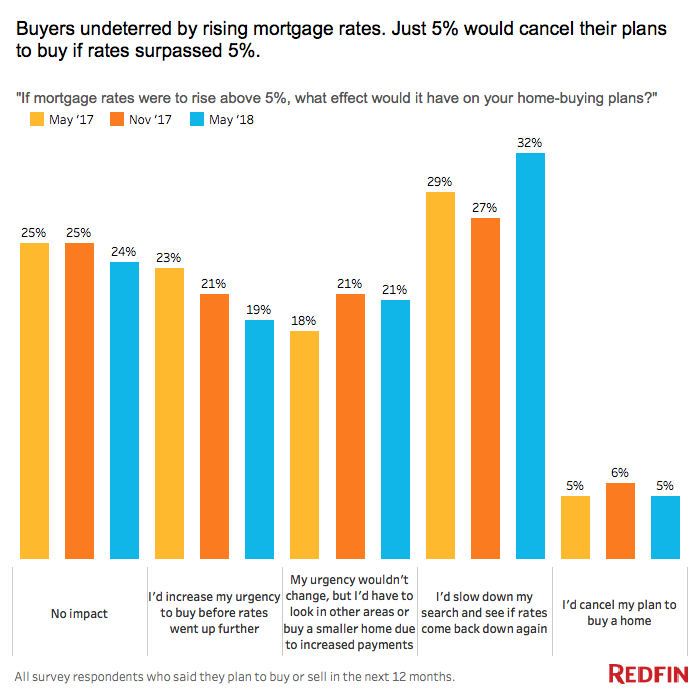

Last month, Redfin conducted a survey of more than 4,000 people who bought or sold a home in the last year, attempted to, or planned to do so soon. Of those people, 1,300 planned to buy a home within the next year. Only 5 percent of them said that they would halt their search for a home if mortgage rates rose higher than 5 percent. On the other hand, 24 percent of potential buyers said that the increase would not change their mind and have no impact on their search for a home.

“Homebuyers are well aware that higher mortgage rates means higher monthly payments, but mortgage rates remain very low, historically, and buyers will make compromises,” said Taylor Marr, senior economist at Redfin. “Most of the pressure buyers are feeling is from competition for a very limited number of homes for sale. The fact that such a small share of buyers will scrap their plans to buy a home if rates surpass 5 percent reflects their determination to be a part of the housing market.”

While only 5 percent of buyers reported they would stop searching for a home if mortgage rates rose north of 5 percent, 32 percent of people said that they would not stop, but slow down and wait to see if rates came back down again, up from the 29 percent of people who would do so in May 2017. Similarly, 21 percent of buyers said that an increase of 5 percent would cause them to look in other areas or find a smaller home, which is consistent with the percent of people doing so last year. A surprising 19 percent of people noted that a 5 percent increase would urge them to buy before rates increased any further, down from the 23 percent of people who would do so a year ago.