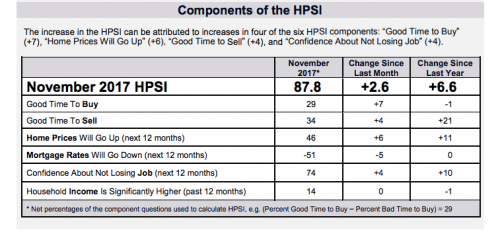

The Fannie Mae Home Purchase Sentiment Index (HPSI) grew to 87.8 in November, a 2.6 point increase from October, nearing September’s all-time high and marking a year-over-year increase of 6.6 points. Four of the six HPSI components increased.

The net share of respondents who reported that now is good time to buy a home is up 7 percentage points from October but still down 1 percentage point from this time a year ago. However, the net share who said now is a good time to sell a home is now up 21 percentage points year over year and 4 percentage points from the previous month.

A main driver of the increase in housing sentiment is a greater sense of job security among respondents, with 74 percent say they are not concerned about losing their job. There also was a rise in the net share who said home prices will increase in next 12 months by 6 percentage points to 46 percent.

The net share of consumers who reported that their income is significantly higher than it was 12 months ago remained unchanged in November at 14 percent, according to the index. Of the six HPSI components, the only decrease in sentiment was the net share who say mortgage rates will go down over the next 12 months, which fell 5 percentage points to negative 51 percent.

“In November, the HPSI rebounded to near its all-time high, returning the index to its gradual upward trend and suggesting fairly stable consumer home-buying attitudes,” said Fannie Mae senior vice president and chief economist Doug Duncan. “These results are consistent with our expectation that the housing market will continue its modest expansion going forward. Next month’s survey should offer the public a first look at the influence that potential tax reform may have on consumers’ views toward housing and the broader economy.”