As population demographics continue to change, so too does the fate — and face — of the average American homebuyer.

Accounting for nearly 17 percent of the U.S. population, the typical homeowner is more likely than ever to be young and Hispanic, according to the 2016 State of Hispanic Homeownership Report.

Published in May of this year, the study was a joint effort of the Hispanic Wealth Project and the National Association of Hispanic Real Estate Professionals (NAHREP), and suggests that the amount of Hispanic households in the U.S. has grown by nearly 6.7 million since 2000.

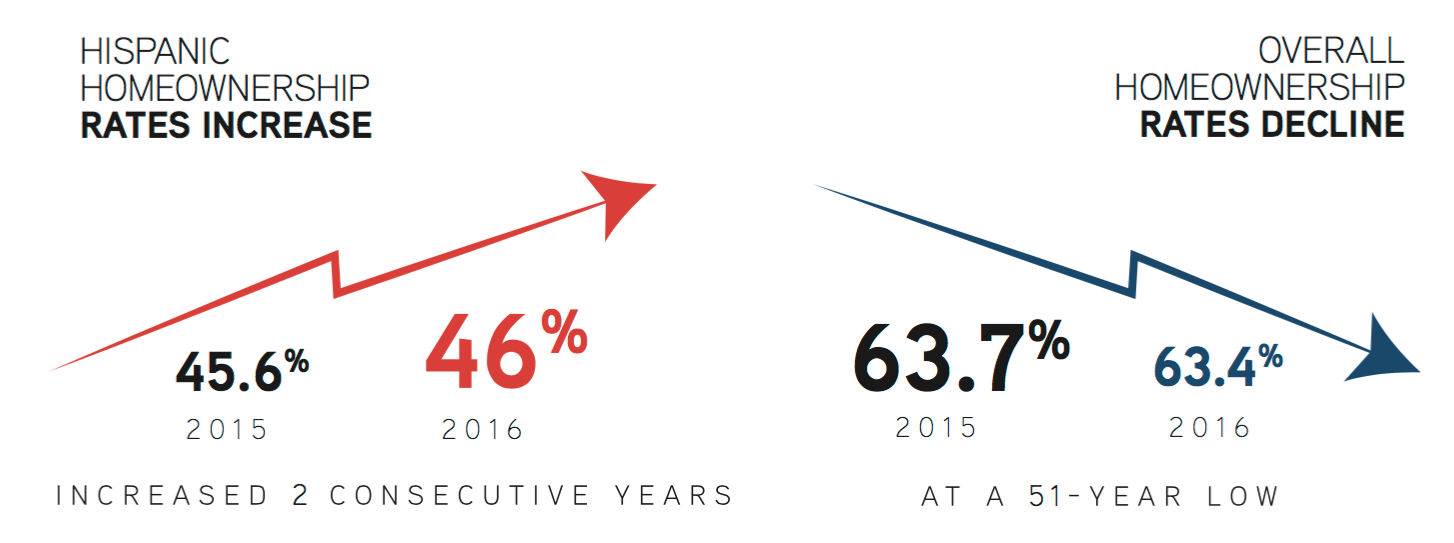

Based on these numbers, Latinos now account for 42.5 percent of household growth nationwide and are anticipated to make up to 52 percent of new purchasers by 2030.

Source: 2016 State of Hispanic Homeownership Report

These demographics become even more impressive when one considers the drop in homeownership rate over the past few years. In conjunction with inventory shortages and high rates of loan-refusal among the Hispanic community, it would suggest that Hispanic homebuyers are more determined than ever to become owners.

“With credit remaining tight and limited housing inventory in several markets, these numbers are extremely encouraging and a testament to the economic resilience of the Hispanic community,” said 2016 NAHREP President Joseph Nery.

And yet, despite contributing so fervently to the housing market, potential Latino buyers are often met with stringent obstacles additional to those normally associated with purchasing.

A 2011 report by the New York Times found that the net worth of the average Hispanic household was merely $8,348. For the median white household, the number was over $100,000. What’s more, the industry is on the cusp of an affordability crisis — and in the midst of a skilled labor shortage — that often disproportionately affect Hispanic Americans over their white counterparts.

This kind of disparity is also subject to changes in immigration policy — such as Congress’s pending decision on DACA — and a myriad of other issues including underwhelming access to Spanish-speaking agents and fair lending practices.

As rates of Hispanic homeownership continue to outpace those of the country in total, a strong, Hispanic housing market is increasingly more important to the health of the market overall. As such, agents should seriously consider taking the steps to both market too and work with more Hispanic buyers on the path to ownership.