After remaining flat for years, federal interest rates could be increased nine times by 2020, according to the Congressional Budget Office’s 2017 Budget and Economic Outlook.

The Federal Reserve’s policy committee met last week and determined that no federal interest rate hike would take place in May, but the agency is on track to raise the rate in June, according to reports. That would be the first of nine hikes set to be rolled out by 2020, if the Congressional Budget Office’s newly released predictions come through.

Interest rates went unchanged for nine years as the Fed attempted to jumpstart an ailing economy, but two quarter-percentage rate hikes have gone into effect since December, bringing the rate to 1 percent, according to USA Today. Those modest rate hikes were enough to rile the housing market, as some experts believe that homebuying’s strong start to 2017 was in part buoyed by buyers looking to get ahead of any future rate hikes.

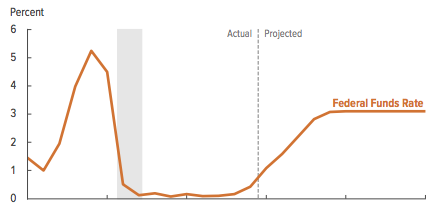

And there certainly will be future rate hikes. According to the Congressional Budget Office, the Fed will likely average three rate hikes of 25 basis points per year. That would bring the federal funds rate – which influences everything from mortgages, auto and other consumer loans – to 2.8 percent by 2020.

Chart showing the Federal Funds Rate from 2002-2027. The dotted line marks 2017. Source: CBO

Effect on economy

The rate hikes are actually pared down from previous predictions of the Fed’s future action. That’s because economic activity, including job creation and growth, has failed to meet expectations, according to the Congressional Budget Office.

“The slower projected increase of short-term interest rates partly reflects the fact that CBO now projects a slower pace of Federal Reserve rate hikes, in light of recent data that point to slower domestic and foreign economic growth than was expected in August,” the CBO’s report reads. “Long-term rates are also expected to be lower over the next five years—partly reflecting the expected slower increase in short-term rates and partly reflecting CBO’s expectation that the factors suppressing the term premium will dissipate more slowly than previously thought.”

Investors and economics experts are watching closely to see what the hikes will mean for the housing industry. Some believe the prospects of future rate hikes has propelled people to buy homes now, but others believe the increase will only make homes more unaffordable than they currently are.