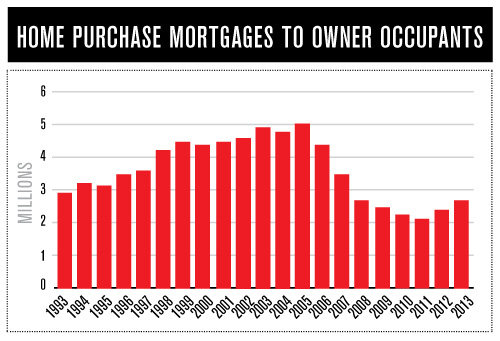

A few weeks ago, the Federal Reserve released a bevy of mortgage data from 2013, and it came with a screaming good headline – the number of mortgages made to purchase homes in 2013 was 2.68 million, a six-year high that is also up 13 percent from 2012 and 29.5 percent from 2011’s historic low.

However, there were quite a few qualifiers behind that impressive six-year high number, and we’ve highlighted the most notable below:

1. How Much is 2.68 Million? – As impressive as that 2.68 million number seems, the graph below from The Wall Street Journal demonstrates that the number of mortgages is still falling below historical averages, and even with 2013’s gain, lending is still below where it was…in 1993.

2. FHA Who? – Also, the FHA continues to see its market share decline. After increasing the fees it charges to shore up its shaky finances, the government agency’s share of the mortgage markets fell to 38 percent in 2013; that’s still far above historical averages, but is down from 45 percent in 2012 and 54 percent in 2009.

3. Mortgage Applications Are Down – Mortgage applications decreased 0.2 percent from one week earlier, for the week ending September 26, 2014, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey. In addition, the refinance share of mortgage activity remained unchanged at 56 percent of total applications from the previous week.

4. In Denial About Denial Rates – Denial rates, with 14.5 percent of purchase loans being denied in 2013, were consistent from 2012, but that does not necessarily denote a healthier mortgage climate. After all, denial rates rose while lending standards eased in 2005 and 2006, so the steady rate in 2012 and 2013 may be more the result of consumers staying out of the mortgage game than anything else.

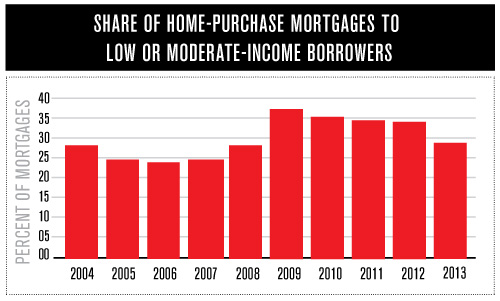

5. Inequality in Lending – Finally, as with so many other dimensions of the current housing market, lending is heavily geared towards a more affluent consumer. From 2011 to 2013, for instance, loans to high-income borrowers grew by 42 and 50 percent, respectively, while loans to low/moderate-income borrowers grew by just 12 and 7 percent.

Furthermore, as the graph below shows, low/moderate-income borrowers accounted for just 28 percent of purchase loans in 2013, down from 33 percent in 2012.