Independent contractor? Employee? It’s a slippery slope for brokers across the United States, as more and more questions arise about the appropriate status for real estate salespersons.

It’s a real pickle. Brokers are required to supervise their associates. Adequate supervision can only happen if agents attend trainings and learn policies and procedures associated with risk management, contracts and closings. If agents are to be successful, earn for themselves and for the brokerage, and not act as a liability, then it would seem to reason that there must be certain requirements that brokerages can place on their agents.

Current Cases Question Agent Status

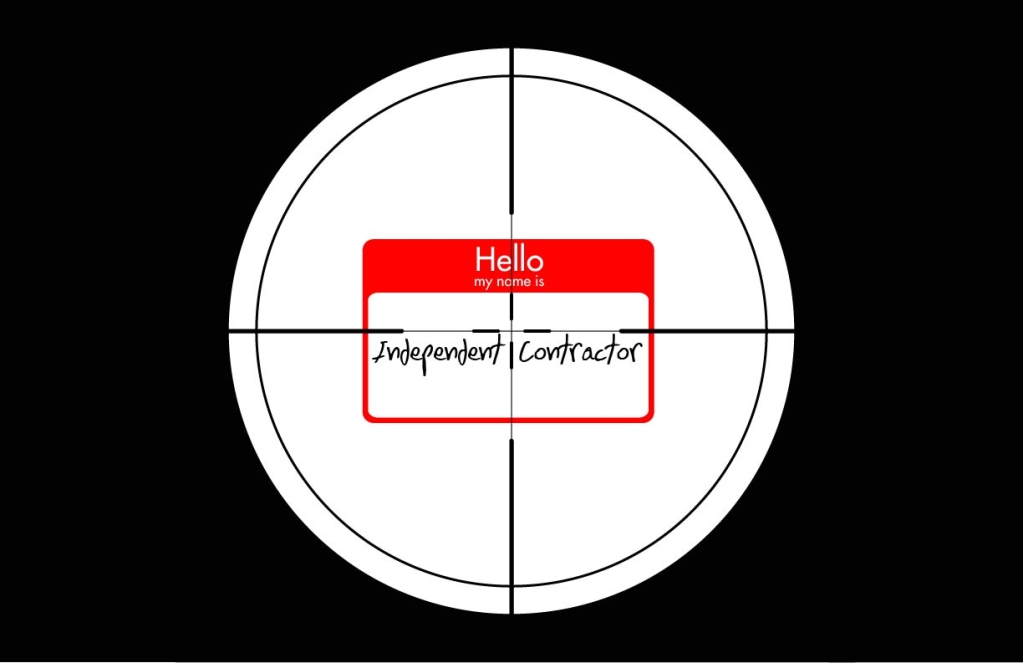

Yet, the independent contractor status of real estate agents has been “caught in the crosshairs,” according to the National Association of Realtors.

Recently, several lawsuits have arisen surrounding this very issue. Cruz v. Redfin Corp. in Alameda County Superior Court and Bararsani v. Coldwell Banker Residential Brokerage in Los Angeles Superior Court are two California cases that have not yet gone to trial. In both of those cases, accusations have been made that certain independent contractors were, in fact, employees and should have been taxed as such.

Realty Times reports that according to federal law (26 U.S.C. §3508 (b)), for federal tax purposes, real estate agents will not be treated as employees if three requirements are met:

- The agent must be licensed

- Substantially all payment is made on the basis of sales or output, but not on hours worked

- There must be a written contract between agent and company providing that, for federal tax purposes, the agent will not be treated as an employee

Yet, the Internal Revenue Service has a different evaluation system; it’s a 20-factor test (not a three-part test) that determines whether the status of an individual worker is that of an employee or independent contractor.

The Future for Real Estate Agents

The ramifications of altering the status of real estate agents on a national level could be vast. According to Lesley Walker, associate counsel at the National Association of Realtors, “Having an employer-employee relationship for a broker could be more expensive, more burdensome and more time-consuming.”

If the lawsuits determine that real estate salespersons are to be employees and not independent contractors, this could have devastating consequences on the real estate industry. Brokers could owe hundreds of thousands of dollars in back pay, income and payroll taxes, which could bankrupt even the most successful of brokerages.

Many brokerages offer all sorts of ongoing trainings. Many are recorded and can be watched on the agent’s own time, while others are live training sessions. While the agent is not required to attend the live trainings, there is a direct correlation between an agent’s income and his or her participation in professional development activities.

If brokerages cannot require that agents attend training, how can they protect their licenses from loose cannons or rogue agents? Believe it or not, brokerages may not be able to terminate independent contractors, as the 20-factor IRS test states that “the right to discharge a worker is a factor indicating that the worker is an employee.”

Real estate brokers appear to be in a bind regarding this subject, and it will be interesting to see how this will play out in the industry.

COPYRIGHT 2014 REALUOSO

REPRINTED WITH PERMISSION

If an agent is required to attend training, monthly meetings, etc s/he might be an employee in IRS’ eyes – http://art.mt.gov/artists/IRS_20pt_Checklist_%20Independent_Contractor.pdf