The recovery in housing is still heavily concentrated in higher price points, according to new NAR research.

On the surface, it seems like just another report on housing – earlier this week, the National Association of Realtors reported that existing-home sales lost momentum in August, falling 1.8 percent from July and 5.3 percent from August 2013, and reversing four consecutive months of home sale increases.

As with all matters concerning the housing recovery, though, digging beneath the surface reveals considerable details about the nature of those numbers, and how though housing continues to soldier on, it’s doing so in a manner that is still, six years removed from the collapse, completely out of whack with its fundamentals.

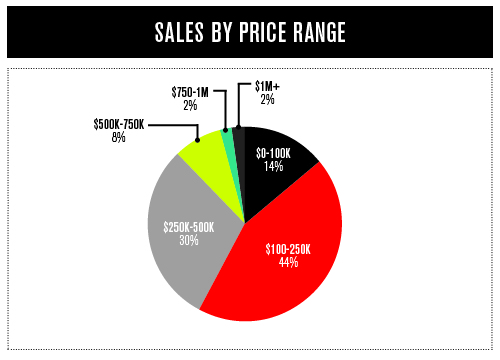

All one has to do is view a couple of charts (courtesy of NAR data) to see why. First, here is the breakdown of August’s existing-home sales by price range:

As you can see, between homes priced $100,000 to $250,000 and homes priced $250,00 to $500,000, we’re dealing with nearly three quarters of the total market for existing-home sales; meanwhile, homes priced $1 million and above make up just 2 percent of the marketplace.

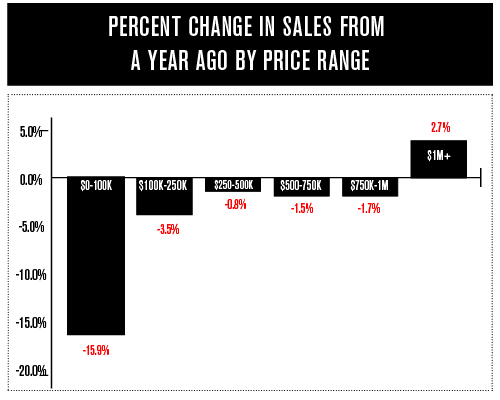

Things get awfully cloudy, though, when we look at the year-over-year change in sales for those price brackets:

See what’s happening? Every single price range – with the sole exception of million-dollar listings – saw home sales decline in August compared to last year, with entry-level homes showing the biggest declines of all. So though homes priced $1 million-plus account for a smidgen of all home sales, they’re the only homes seeing higher sales volume than a year ago.

We’ve written a number of stories on this trend, as of late, and it merits repeating – housing, between sales and home construction, has trended upward, and the resulting marketplace is not an ideal one for middle class consumers and first-time homebuyers.