A study conducted by the Federal Reserve Bank of New York says homebuyers with student loans are less likely to take out mortgages than their counterparts.

Student loan debt is big; in fact, it would be more accurate to label student loan debt as massive, or better yet, gargantuan. At a whopping $966 billion, according to the latest numbers from the FRBNY Consumer Credit Panel, student loan debt is now the second-highest form of debt in the U.S., with only mortgage debt being higher. That’s right – student loan debt now exceeds credit card card debt!

In some ways, that is hardly surprising. After all, the cost of college has risen exponentially in recent years, so it’d make sense that student borrowing to cover the costs would rise in tune; however, a new study by the Federal Reserve Bank of New York has uncovered some troubling indicators on how student loan debt influences consumer behaviors – specifically, how it shapes homebuying decisions among young professionals.

Student Loan Debt and Homeownership

The NY Fed followed a straightforward methodology in its research. Looking at consumers aged 30 (the median age of first-time homebuyers, according to research by NAR), the Fed compared homeownership rates between 30-year-olds with student det and without student debt from 2003 to the present day. Here’s what they found:

- From 2003 to late 2011, 30-year-olds with student debt had a higher homeownership rate than those without debt.

- The reasons for this are simple: those with student debt are generally better educated, and thus, privy to higher income jobs.

- However, that divide has undergone a radical change in the last two years. Though both groups cut back on homeownership dramatically after the economy collapsed in 2008, student debt holders cut back on owning homes at twice the rate of non-debt holders, and by 2012, the homeownership rate for debt holders was 2 percentage powers lower than that of non-debt holders.

“Now, for the first time in at least ten years, thirty-year-olds with no history of student loans are more likely to have home-secured debt than those with a history of student loans,” wrote Meta Brown and Sydnee Caldwell for the Fed.

The Credit Score Crunch

So what can account for this enormous change in consumer behavior? Brown and Caldwell highlighted two possibilities, one obvious and another more insidious. First, they wrote that the Great Recession, and the damages it inflicted on the job market, caused consumers to cut back on their purchases and debt levels, so student debt holders, in that regard, were following common sense amidst economic uncertainty.

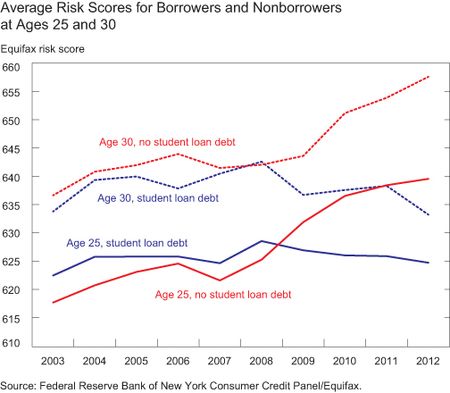

The second reason, though, is admittedly more troubling – that access to credit has dried up for student debt holders. Everyone knows that lending standards rose by quite a bit following 2008, but the Fed’s research shows that they rose in particular for student debt holders, to the point that credit is now tougher to attain for them, than non-debt holders (see the chart below).

Millennials, as we’ve written before, are crucial to the long-term health of the housing market, so we’ll have to track these numbers and see how they develop in the coming months as the economy continues to improve.