BMO Harris Bank recently released its Bank Housing Confidence Report with results proving heightened certainty in today’s housing market. The study reported that 53 percent of Illinois residents plan to purchase a home in the next five years and in Chicago, that number rises to 61 percent.

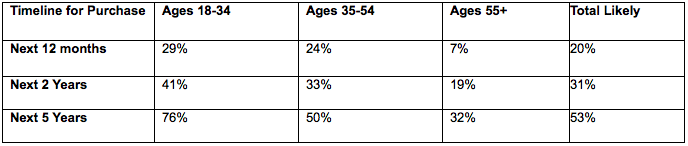

Likelihood to purchase, however, is highest amongst millenials, aged 18-34, jumping the number that plan to purchase a home in the next five years up to 76 percent. The probability to purchase drops as the age of potential buyers rises. Only 50 percent of those aged 35-54, plan to purchase in the next half decade and just 32 percent of people aged 55 and older have homebuying on their radar. Even more significant, nearly one third of millenials said they would be purchasing a home in the next 12 months and 41 percent in the next two years, compared to the 24 percent of people in the 35-54 year old age range and the 7 percent of people aged 55 and older planning to buy in the next year. As seen in the table below, the likelihood to purchase is higher with a larger window of purchasing time.

Nationally, those numbers pair up almost identically with 74 percent of millenials planning to purchase in the next five years, 45 percent in the next 24 months and 32 percent in the next year.

Student Loan Debt To Affect Homebuying:

Despite the rising optimism and eagerness amongst millenials in the housing market, there is a slight problem that may affect their purchasing power. While the housing market is on the upswing, so is the amount of student debt carried by young Americans, which is at a record high. In a report by The Project on Student Debt, last year, 71 percent of college seniors that graduated from a public four-year institution or private non-profit four-year institution had an average student loan debt of $29,400 per borrower. In Illinois, that number trails behind just barely at $28,028 with 64 percent of students in debt. Since 2008, the level of debt at graduation has progressively increased six percent each year.

Head of U.S. Economics, BMO Capital Markets, Michael Gregory said, “Student debt levels have more than doubled in the last seven years to $1.1 trillion. The financial burden means renters are delaying entering the purchasing market, which has a trickle-down effect on the overall housing recovery.”

Plus, tuition prices are nowhere close to a decline, as they have steadily increased since 1983. As reported by College Board, Trends in College Pricing, the current average published in-state tuition for four-year institutions is $8,893, which rose 27 percent since the 2008-2009 academic year. For four-year non-profit private institutions, the average tuition cost is $30,094 per year, 14 percent higher than 5 years prior. Statistic Brain found using data from the Department of Education that 13.7 percent of students attend college out-of-state. In addition, College Board noted the average cost of out-of-state tuition at a public four-year institution for the 2013-2014 academic year at $22,203, marking a 3.1 percent increase since the previous academic year.

Tuition is not the only rising cost, however; according to BMO Economics, home prices are still on the rise. As reported in the latest Case-Shiller Home Prices Indices, home prices in Chicago and neighboring areas increased 2 percent since March and 10.7 percent from one-year prior, in April 2013.

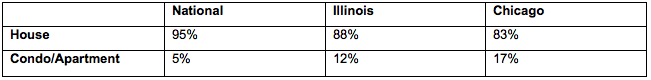

According to the study, 75 percent of Illinois residents own property and one-quarter rent. Of the 53 percent of residents in Illinois who reported a plan to purchase in the next five years, 14 percent would be first-time homebuyers. BMO Harris also showed ownership according to the type of property—condo, apartment or home, which can be seen in the table below.

According to results of the survey, the top reason why people choose to buy is to have a place to call their own and the second reason, chosen by 64 percent of homebuyers, is for long-term investment purposes. In addition, 62 percent of homeowners prefer not to rent for stability and certainty. In contrast, Illinois residents who choose to rent versus buy noted their reasons as financial instability, flexibility and freedom and having to deal with less upkeep and maintenance. Just more than a tenth of renters reported that they never plan to purchase.

Despite the potential risks involved for millenials in homebuying, including the possibility of student debt and increased home prices, there remains optimism from future homeowners and industry experts alike. “We had a strong start to the homebuying season, and that momentum has carried through for a few months now,” said Joe Tunk, Director of Mortgage Sales—Illinois, BMO Harris Bank. “We see this confidence and propensity for activity reflected in the survey numbers, which show that the next few years look like they will be busy for potential homebuyers. For those looking at a nearer-term purchase, we encourage them to get pre-approved to make the purchase experience that much smoother.”

*Results cited from the survey can be attributed to Pollara survey, used by BMO Harris Bank, which is comprised of interviews with online samples of 2,500 Americans (250 from Illinois) from April 1 to April 7, 2014.